Back in 2000, computer gaming was revolutionized. Instead of sports games, ego shooters or other genres, people caught an interest in ‘virtual living’. Games offered an extensive life simulation. To an – at that time – unprecedented degree, people could live their lives virtually. Disregarding the why behind what drives players, it is undeniable that the game became a huge success. Over the years, further games popped up, with an ever further advanced possibility of living virtually. A few years later, an online virtual world in which people could live a second life had its release. For some, steering a virtual person through a virtual copy of the world became an absorbing pastime.

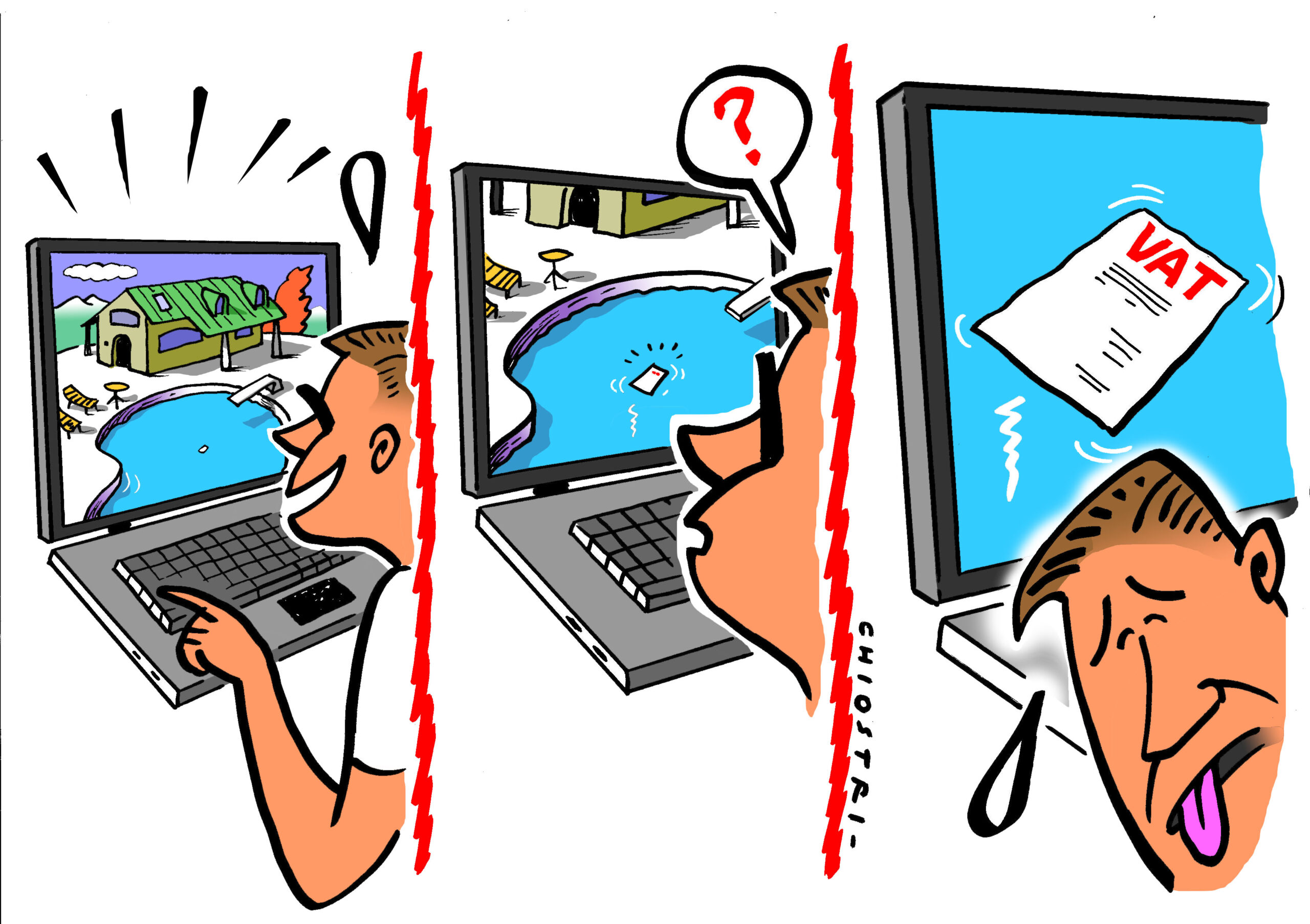

Interesting, one might think. To make it even more interesting, you could enrich your imagination with a tax angle. Would it be a taxable transaction if two avatars decided to contract with each other for consideration? At least in the real world, in most jurisdictions, concepts of a sales or a value added tax exist and enjoy quite some popularity. Why not in a virtual world? Do ‘normal’ tax rules apply? Do we need special taxes for virtual worlds?

So, what would happen in such a situation? What could such a situation look like? In Germany, a German taxpayer generated revenue by renting out virtual land. In exchange for the virtual land, the taxpayer – or rather his avatar – received virtual currency. The taxpayer then had this virtual currency exchanged for real fiat money. How to tax this receipt was to be considered by a German Regional Fiscal Court, namely the Fiscal Court of Cologne.

How did the parties concerned classify the facts? Unsurprisingly, the tax authorities saw the transactions as taxable supplies in the spirit of applicable German VAT law. The plaintiff saw them outside the national VAT law due to a missing exchange of services. He underpinned this argument by the perception that there was no contractual obligation between him and the receivers of his services. In his view, both he and the service recipient did have contractual relationships with the operator of the virtual world, but not with each other.

The court’s judgment

The Fiscal Court of Cologne ruled the renting of virtual land to be a Vatable transaction. Normal German VAT rules apply, with no general reservations regarding jurisdictional issues or extraterritorial problems.

The plaintiff did not use the gaming platform primarily as such, but rather used it through the parcelling of virtual land and its subsequent renting to gather virtual currency and then, as a result, to convert it into money.

Economic activity

Interestingly and surprisingly, the plaintiff did not try to defend his position with the argument that his activity did not qualify as an economic activity, as stipulated by Art. 9 (2) VAT Directive. This sort of thinking could be supported by, for example, the Bastova case in which the European Court of Justice (CJEU) ruled that participation in a horse racing competition is not a service provided for consideration, due to the lack of a direct link. However, the possible argument that jackpot money is not taxable for VAT purposes would not apply in the case. Such thinking is flawed as the virtual world, in this case, does not share any characteristics with a game in which money can be won through luck, skill or any other ability. Just as renting out of the land in the real world is not comparable to a classic poker game, its virtual equivalent is also not comparable. Hence, it is hard to find credible arguments to see the plaintiff’s actions not as economic activity.

For the court, a direct link is established; although, in its judgment, no specific focus is set on the flow of the money. The rent, which is paid in the virtual currency of the virtual world, must be converted into real fiat money. This fact opens up room for a tiny defence line. The virtual world’s operator had himself reserved the right to change the framework of the virtual currency at any time; it even had the right to terminate the virtual currency without any compensation. And on top of that – what would the plaintiff do if the operator of the virtual world simply declared insolvency? Such situations also apply to fiat money in the real world, although, presumably, there is far less regulation and safety involved in the virtual space. However, on second thoughts, again, no fundamental differences to a real-world transaction remain.

Legal relationship

The court did not follow the plaintiff’s argumentation that no legal relationship between him and his virtual tenants was present. In this vein, the court drew a comparison to a market in the real world. Just as in the real world, an organizer can enable access to a market for a fee so that visitors to the market can trade with each other, in the virtual world, the operator enables users to interact with each other via avatars and to buy/sell or rent/lease items. Furthermore, the anonymity of the avatars does not destroy the legal relationship. If necessary, at least the IP address used can be traced. This was enough, in the eyes of the judges to create a legal relationship.

Place of supply

While the taxpayer as a human being is intuitively found in a place, the place of supply might be the deal-breaker for the taxation in the virtual world. In order to find this place, the character of the service must be identified. The tax office saw the services as an electronic service, according to Art. 58 VAT Directive. The court rejected this view with the argument that human participation constituted the performance process.

While the court did not finally rule on the question of which kind of service the service in question constituted, it opened the discussion for two other categorizations. First, the service could constitute service in the form of granting, transferring and exercising patents, copyrights, trademark rights and similar rights (licensing services). Second, the service could constitute a general supply.

While so far, the real world has also been mirrored from a tax angle, now an indisputable difference takes place. The court did not take into consideration the service to be the renting of immovable property. This is convincing, as ‘immovable property’ is defined in Art. 13 Implementing Regulation of the VAT Directive. The definition leaves no room to include virtual land under one of the criteria, being “any specific part of the earth, on or below its surface, over which title and possession can be created”. Hence, the court did not spend any time considering this angle.

While the correct categorization of the service matters from a legal perspective, the court decided not to decide on this issue. Without the options of an electronic service or the renting of immovable property, only the options of a licensing service or a general service are left.

The place of supply for these two services differs only where non-taxable persons are recipients of the supply. If both services are supplied to a taxable person, the place of supply is deemed to be the place of business of the recipient.

For a general service, the place of supply to a non-taxable person resident in Germany is at the place of business of the supplying taxable person. In this case, the plaintiff’s home. In the case of licensing services, the place of supply would be deemed to be at the place the residence of the non-taxable person if that is outside the European Union.

In summary, slight differences exist in the deemed place of supply dependent on the categorization of the service. As the true identities of the recipients of the service were never unveiled, the tax authorities had to come up with an estimate. Also, the court remarked that the share of customers of the plaintiff whose domicile or registered office is not in Germany was to be estimated. The tax authorities came up with an estimation of 70 per cent taxable supplies in Germany. The court accepted this estimate as plausible. Two pillars of the estimation, which was not set out at length, were the assumption that the recipients of the service were mostly non-taxable persons, due to the character of a game. And second, that the plaintiff’s web presence in the German language led to it mostly having German customers.

The court admitted revision. The case was appealed and is now to be decided by the Federal Fiscal Court. It will be interesting to see if the appellate court sees the need to characterize the service.

Implications

In summary, even such an initially quite unique case is captured by the VAT framework. In other words, there is not much room to escape the VAT system. – even if transactions take place in a way that was surely not anticipated by the creators of the VAT system!

While some people may desire a second and virtual world to achieve their dreams, the VAT system does not need a virtual counterpart. The normal VAT rules are sufficient to tax almost fully virtual transactions. Little discrepancies in the categorization of these services are still to be resolved, though.

Time will show whether the higher court will decide on the categorization of the service or whether it will not be necessary in this case. In the medium to long term, a definitive answer as to how services in a virtual world should be characterized is needed.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.