Much controversial research released by the World Health Organization (WHO) at the end of March 2021 has concluded that the inception of the COVID-19 disease is likely due to a crossover of the SARS-CoV-2 virus from animals to humans. Although not unprecedented as an accident, the chances of viruses crossing over from other species to human beings increase significantly if the parties in question are in close contact with one another. Allegedly, such an encroachment somehow occurred around the Chinese city of Wuhan in late 2019.

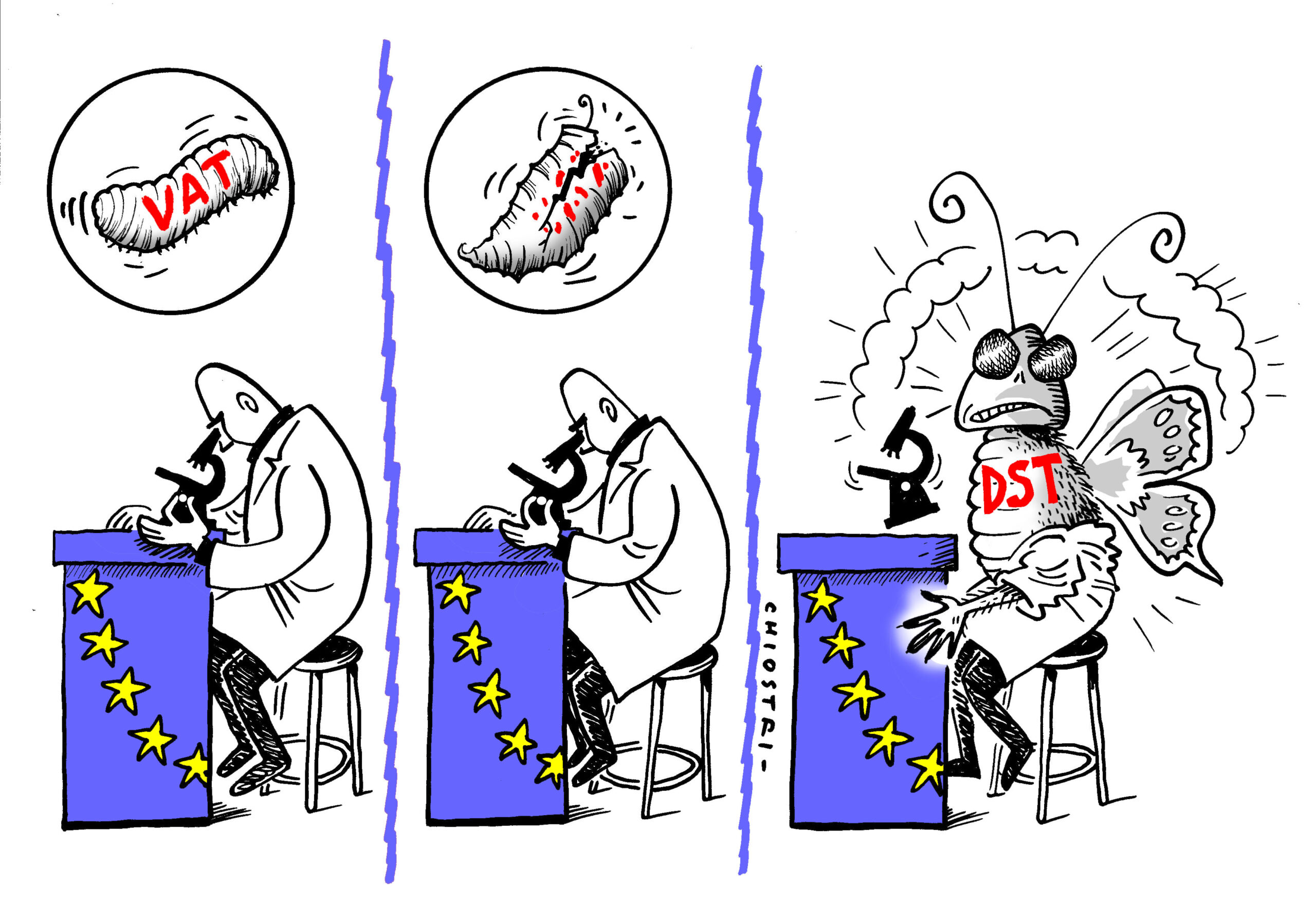

Perhaps a similar crossover has occurred in the field of taxation lately. The parties involved in such an event happen to be taxes belonging to two different ‘species’, i.e. the (old) value added tax (VAT) and the (new) digital services tax (DST). VAT is a tax that, at least in the European Union (EU), can boast more than 50 years of ‘honourable service’. On the contrary, DST is the last-born in the realm of taxation, as the EU Commission has tabled it in a proposal only within the framework of the ‘Fair Taxation of the Digital Economy’ reform package unveiled in March 2018 [1]. Moreover, VAT is a consumption tax levied on all goods and services. Instead, DST is a levy imposed on digital businesses’ turnover as a short-term solution against the current deficit of taxation on profits made by large companies having a digital footprint in the EU [2].

Despite their different background and scope, VAT and DST are in close contact with one another, indeed even closer than they might appear at first glance [3]. First and foremost, VAT and DST are both regarded as indirect taxes (although not undisputedly) [4]. This shared classification further implies that the two taxes have the same EU legal basis [5]. Another common feature relates to both taxes stepping outside the scope of double tax conventions (DTCs) on income and capital [6]. A fourth commonality concerns their administration. In early experience, the DST application largely builds upon the same administrative apparatus (e.g., for declaration, payment, refunds and penalties) used by national authorities for VAT purposes [7].

There is, however, another crossover area between VAT and DST. This relates to place of taxation rules, i.e. the rules for determining where the tax should be levied and allocating taxing rights among different countries.

Place of taxation under VAT and DST

Under VAT, place of taxation (under EU VAT, rectius ‘place of supply’) rules set forth the territorial scope of the tax. Place of taxation rules are contained, separately for the supply of goods and services, in Title V of Directive 2006/112/CE (the VAT Directive) [8]. The place of supply rules aim to allocate taxing rights between two or more jurisdictions. As such, they function as distributive rules. Their functioning relies on proxies, i.e. a series of legal predictions meant to approximate the place of actual consumption of a particular good or service. Proxies indeed vary to a great extent, based on the type of good or service concerned, and may equally refer to the place of establishment of the supplier or customer, the residence of those persons, the place of performance of a specific activity, as well as the location of one or more elements somehow related to the transaction subject to VAT (e.g., an immovable property).

Under the EU Commission’s DST proposal, ‘place of taxation’ is dealt with under Article 5. For linking taxable revenue obtained by a digital business to the territory of a Member State, this provision refers, at the first paragraph, to the location of users of a digital service subject to the DST. The actual rules for determining user location differ based on the specifics of the digital service in question, i.e. whether it concerns the online placement of advertising, facilitation of users’ interaction by digital platforms, or sale of collected user data. However, for all the digital services subject to the DST, paragraph 5 of Article 5 prescribes that ‘the Member State where a user’s device is used shall be determined by reference to the Internet Protocol (IP) address of the device or, if more accurate, any other method of geolocation’. In this regard, the Explanatory Memorandum attached to the (original) DST proposal stipulates that, by and large, ‘[t]he IP address is a simple and effective proxy for determining the user location’. Nonetheless, ‘if the taxable person is aware by other means of geolocation that the user is not located in the Member State where the IP address indicates, that taxable person would still be able to rely on that other means of geolocation to determine the place of taxation’ (p. 12).

Use and enjoyment rule under VAT

Under the VAT Directive, however, a provision exists that gives the EU Member States the option to derogate from the ordinary place of taxation rules for certain services, by relocating the place of supply of those services to their territory. Notably, Article 59a(b) grants the Member States, ‘[i]n order to prevent double taxation, non-taxation or distortion of competition’, the possibility to consider the place of supply of certain services (e.g., telecommunications, broadcasting and electronic services), if situated outside the EU, as being located within their territory ‘if the effective use enjoyment of the services takes place within their territory’ [9].

Regrettably, no definition of the expression ‘effective use and enjoyment’ is provided under EU VAT law. Not surprisingly, the lack of a statutory definition in this regard leads the Member States to potentially have a different understanding of the ‘effective use and enjoyment’ override provision [10]. As Terra & Kajus put it, ‘[p]rovisions may become meaningless when questions may be raised such as where were the services actually consumed, or effectively used or enjoyed and what was the purpose behind the purchase of service, and which establishment benefited the most, etc.’ [11].

Difficulties associated with a ‘muddled’ interpretation of the expression ‘effective use and enjoyment’ came to the fore also in the recent judgment SK Telecom (Case C-593/19), rendered by the Court of Justice of the European Union (CJEU) last week, on 15 April 2021. The case concerned the application of the rule on effective use and enjoyment by Austria, with regard to the VAT treatment of roaming services provided by a South Korean company to users residing in South Korea but staying temporally in Austria.

I reserve any insightful discussion of this CJEU’s case to a comment to appear in a forthcoming issue of Highlights and Insights on European Taxation (H&I). For this article’s purposes, I would only draw a few considerations on the potential inconsistencies due to reliance on an expression as much as volatile as ‘effective use and enjoyment’.

Indeed, the location of a service within the territory of a Member State as a result of the application of the rule on effective use and enjoyment may vary significantly based on the type of service concerned [12]. Thus, as regards roaming services dealt with in SK Telecom (Case C-593/19), the Advocate General (AG) pointed out that ‘roaming services are intended solely for the use of a mobile telephone network located in the Member State concerned by users temporarily staying in that Member State’ (para. 78).

However, going further in his analysis, the AG listed a series of different (and, thus, potentially conflicting) criteria for locating these services, namely:

- the location of the mobile telephone network used;

- the physical location of the users accessing the mobile telephone network;

- the territorial coverage of the mobile telephone network used;

- the mode of access to the mobile telephone network, which was similar for both Austrian and Korean (but temporally staying in Austria) residents.

By lucky accident, in the case at hand, all these criteria were pointing to the territory of the same Member State, i.e. Austria (one may maliciously think that this was precisely the reason for the AG adopting these criteria, after all). However, it cannot be excluded that different criteria (if any) might be adopted with respect to different types of services. For instance, in Athesia Duck (Case C-1/08), the CJEU located the effective use and enjoyment of advertisement services within the territory of the Member State where the advertising material was disseminated. The rule on effective use and enjoyment does not preclude those kinds of inconsistencies, despite, as the EU Commission itself acknowledged, ‘systematically defining the place of consumption as the place of taxation could lead to some serious practical problems’ (p. 2).

Geolocation methods under DST

Provisions capable of overriding the normal functioning of the place of taxation rules also exist under the DST proposal. As recalled above, Article 5 of the EU Commission’s proposal for a DST establishes the IP address of the user’s device as a single proxy for determining the user location. At the same time, however, the DST proposal enables linking a digital service to the territory of a Member State by relying on ‘any other method of geolocation’, provided this method is ‘more accurate’.

Use of other geolocation methods by one or more Member States equates to overriding the determination of the place of taxation of digital services based on the single proxy used under the DST proposal, i.e. the IP address of the user’s device. Similarly to the ‘effective use and enjoyment’ provision under VAT, no definition of the expression ‘any other method of geolocation’ is provided under the DST proposal. The lack of a statutory definition might thus lead the Member States to have a different understanding of the expression ‘any other method of geolocation’. Moreover, taxable persons under the DST proposal are at liberty to resort to different geolocation methods, also depending on the type of digital services concerned.

The Italian DST (‘Imposta sui Servizi Digitali’ or ‘ISD’), born as a national version of the DST proposed by the EU Commission in March 2018, offers a useful comparison in this regard. In view of the first tax payments due in May 2021 (the first year of application of the Italian DST is, in fact, 2020), the Italian Revenue Agency has issued, in late March 2021, a Circular Letter laying down meaningful details for the application of the Italian DST. Notably, as regards the rules for allocating revenue from digital services to Italy, the Italian DST refers to the user’s location. As under the DST proposed by the EU Commission, the user’s location is determined by relying on the device’s IP address of the user. However, the Italian DST enables digital businesses to establish a user’s location based on other geolocation methods. Presumably taking inspiration from the revenue sourcing rules laid down in the OECD Report on Pillar One of October 2020 (pp. 70-97), the Circular Letter lists various methods of geolocation as different as:

- a GPS receiver;

- a base station system such as a GSM modem or an application programming interface (API);

- a Wi-Fi network connection;

- a wireless beacon signal using BluetoothLow Energy (BLE) protocol.

Under the Italian DST, the taxable person can determine the user’s location not only based on means of geolocation other than the IP address, but even by relying on any other ‘inductive method’. In this regard, the Circular Letter explains that the user’s location can be determined based on the user’s personal information available to the taxable person concerned. Notably, these are the information collected by a digital provider during a user’s onboarding (e.g., when the user creates an online account), or derived from the monitoring activities performed automatically by the company through software tools (e.g., through user activity trackers such as cookies). However, available methodologies do not stop here. Notably, as an additional inductive method, the taxable person can refer to the postal address where a good or service must be delivered, on the assumption that this place would correspond to the user’s location. In the Circular Letter, the Italian Revenue Agency openly admits that the digital business may locate the user on the basis of one or more of the methodologies described above, eventually also using various criteria for different digital services. Only, the digital business must have a due diligence process in place, to ensure appropriate tracking as regards the methodologies used.

A steamroller to crack nuts

The geolocation methods described above lay down just another set of proxies for establishing the user’s location and thus the place of taxation for DST purposes. Usage of different geolocation methods by the Member States and taxable persons may lead to an inconsistent application of the DST’s place of taxation rules, with a lack of harmonization resulting in double (non-)taxation. Perhaps this is also why the proposed compromise for a DST reached under the EU Council in 2018-19 has limited the location of users to the use of their devices’ IP addresses, thereby excluding ‘any other method of geolocation’.

In the author’s opinion, a better solution would be to simply accept the limits of the geographical scope of tax rules, which in the case of the proposed EU DST relies on a single proxy such as the user’s IP address, even if this may result in hypothetical situations of non-taxation [13]. On the contrary, digital businesses’ obligation to keep track of the various geolocation (or even inductive) methods used, with tax authorities under a burdensome requirement to check it, is undesirable. In fact, it can create unpractical burdens like those faced by someone using ‘a steamroller to crack nuts’ [14].

Hopefully, the announced legislative proposal on an EU digital levy, whose consultation period on the draft has just expired and with the final version expected to be adopted by the EU Commission in the second quarter of 2021, will take the above considerations into account and prevent a potentially treacherous ‘tax crossover’ from occurring.

[1] On the current state of play of the EU DST proposal, see G. Kofler, Editorial: The Future of Digital Services Taxes, 30 EC Tax Review 2 (2021), pp. 50-54.

[2] According to the CJEU (Commission v Poland (Case C-562/19 P), para. 41), turnover is, the same as profits, ‘a relevant indicator of a person’s ability to pay’. Arguing that, by targeting digital companies with a high turnover, the EU DST might discriminate against US digital giants, R. Mason & L. Parada, The Legality of Digital Taxes in Europe, 40 Virginia Tax Review 1 (2020), pp. 175-217.

[3] Comparing VAT and DST, M. Lamensch, Digital Services Tax: A Critical Analysis and Comparison with the VAT System, 59 European Taxation 6 (2019). Against this background, it should be recalled that the DST does not meet the four essential characteristics of VAT and therefore its levying is not prohibited under Article 401 of the VAT Directive. Cf. CJEU’s decision in Vodafone Magyarország (Case C-75/18), paras 57-66.

[4] In the Impact Assessment (p. 20), the EU Commission presented the DST as an indirect tax: ‘[g]iven its (preferred) features, this tax would have more elements of an indirect tax, so it would need to be treated as an indirect tax other than turnover taxes and excise duties’.

[5] The legal basis of the EU DST proposal is Article 113 of the Treaty on the Functioning of the European Union (TFEU). For an analysis, see J. Nogueira, The Compatibility of the EU Digital Services Tax with EU and WTO Law: Requiem Aeternam Donate Nascenti Tributo, 2 International Tax Studies 1 (2019), at para. 4.4.

[6] In this regard, see D. Hohenwarter et al., Guest Editorial: Qualification of the Digital Services Tax Under Tax Treaties, 47 Intertax 2 (2019), pp. 140-147.

[7] Notably, the Italian DST (discussed later in the main text) relies on provisions largely modelled on those used for administering Italian VAT.

[8] Chapter 1 (Articles 31-39) of Title V of the VAT Directive contains the rules for place of supply of goods. Place of supply rules for services are instead laid down in Chapter 3 (Articles 43-59a).

[9] Noteworthy, the exercise of this option by Member States does not depend on the tax treatment that the services are subject to outside the EU. See VAT Committee, Guidelines resulting from the 89th Meeting of 30 September 2009, Document B – taxud.d.1(2010)176579 – 645.

[10] On the rule on effective use and enjoyment leading to ‘a more fragmented picture’ in the application of EU VAT place of supply rules, see A. van Doesum et al., The New Rules on the Place of Supply of Services in European VAT, 17 EC Tax Review 2 (2008), pp. 78-89. Criticizing the rule on effective use and enjoyment as not being ‘an efficient criterion for taxing services’, T. Ecker, Place of Effective Use and Enjoyment – EU History Repeats Itself, 23 International VAT Monitor 6 (2012).

[11] See B.J.M. Terra & J. Kajus, Introduction to European VAT (IBFD 2020), at para. 11.4.6.

[12] See VAT Committee, Working Paper no. 633, taxud.d.1(2009)211327, where the EU Commission discussed how to apply the rule on effective use and enjoyment in the context of different types of services (i.e., advertising services, telecommunications, broadcasting and electronic services, hiring of means of transports, transport of goods).

[13] However, the adoption of the user’s IP address as a single proxy can also be criticised. See D. Stevanato, A Critical Review of Italy’s Digital Services Tax, 74 Bulletin for International Taxation 7 (2020), at para. 6.1.; Office of the US Trade Representative Executive Office of the President, Section 301 Investigation Report on Italy’s Digital Services Tax (6 January 2021), p. 26.

[14] With regard to the EU VAT rule on effective use and enjoyment, B.J.M. Terra, European Proposal for New Rules regarding the Place of Supply of Services, in GST in Retrospect and Prospect (R. Krever & D. White eds, Thomson Brookers 2007), p. 383.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.