Johannes Becker and Joachim Englisch*

After the international political agreement to introduce an effective country-by-country minimum tax on multinational firm profits, there are still some open questions on the design and implementation of the tax[1]. Among other elements, the OECD/G20 Inclusive Framework Statement of 8 October 2021 envisages a “formulaic substance carve-out” for deemed routine profits generated through real investments and a local workforce. Profits up to 5 % of the carrying value of tangible assets and payroll will be excluded from the scope of the minimum tax; higher percentages will apply during a transition period. However, the Statement is silent on how the carve-out affects the rules on calculating the local effective tax rate (ETR). Depending on the design, the carve-out will have different effects on the amount of top-up tax in case of a local ETR below the minimum rate. Three models on the interaction between the ETR formula and the carve-out are conceivable, two of which are equivalent with respect to the incentive structure (see Devereux et al. 2021[2] for a discussion). We therefore discuss only two diverging concepts. The analysis follows, in large parts, the one in Devereux et al. (2021).

Model A defines the local ETR as the ratio of covered taxes T over local excess profit, i.e. the difference between the GloBE Income P (quintessentially, financial profit) and the carve-out C:

In what follows, we assume that the local excess profit is strictly positive, i.e. P > C.

In Model B, the local ETR is measured as the ratio of covered taxes and GloBE income:

In both models, the top-up tax percentage equals the difference between 15 percent and the local ETR and applies only to the excess profit.

From the above follows that, for any local tax burden above zero, Model B results in a lower local ETR than Model A. The reason is that Model A ‘assumes’ that the tax on the carved-out “routine profits” C is always zero and therefore calculates the country-specific ETR as a fraction of local excess profit (P-C).

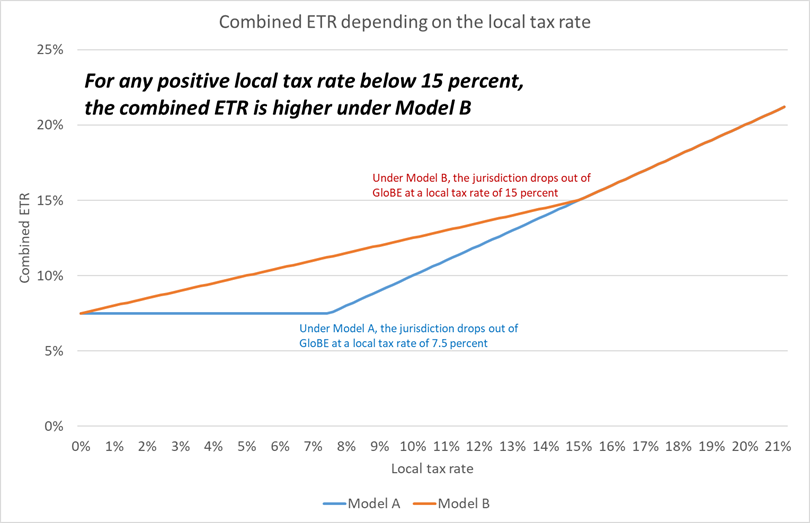

This implies a lower top-up tax for firms with excess profits under Model A. With the firm’s local ETR being tP/(P – C) with Model A and tP/P with Model B, the top-up tax is (0.15 – tP/(P-C))*(P-C) with Model A, as compared to (0.15 – t)*(P – C) with Model B – if the firm is subject to GloBE under both models. Since a local ETR of 15 % is reached at a lower local tax burden under Model A than under Model B, the firm drops out of GloBE at lower local tax rates. Then, the top-up tax under Model A is zero.

Under the GloBE regime, total tax payments (covered taxes tP plus the top-up tax) as a fraction of total local income will be labelled the combined ETR of the firm in a particular jurisdiction under each of the two models. Under model A, the combined ETR is![]()

Under Model B, it is![]() After dropping out of GloBE, the combined ETR is simply t.

After dropping out of GloBE, the combined ETR is simply t.

The combined ETR is thus higher under Model B whenever the local tax rate is between 0 and 15 percent. In other words, under Model B, the government can only offer the same – low – combined ETR as under Model A, if the local tax rate is cut to zero. This, however, implies that the government foregoes all local tax revenue. At a local tax rate higher than zero, the combined ETR with Model B will thus always be less attractive from the multinational firm’s perspective than it would be under Model A.

The below diagram shows how the combined ETR depends on local tax rates for both models. For the example in the diagram, we assume that local income P is twice as large as the carve-out, i.e. P = 2C. The following statement, however, applies to all levels of local income larger than the carve-out: For any positive local tax rate below 15 percent, the combined ETR is higher under Model B. This suggests that Model B is better suited to curb international tax competition than Model A.

Surprisingly, Devereux et al. (2021) come to the opposite conclusion. According to these authors, Model A may “reasonably be expected to “put an end to the race to the bottom on corporate taxation”” (p. 2), whereas Model B may not. Devereux et al. (2021) observe that, for any local tax rate small enough to trigger GloBE under Model A, i.e. for any t < 0.15(P-C)/P, the local government does not have any incentive to lower its tax burden further under this model. The combined ETR is fixed at 0.15(P-C)/P, and a reduction of the local tax rate only reduces local tax revenue. In contrast, under Model B, a cut in the tax rate reduces the firm’s ETR and may, thus, foster investment.

This comparison is, however, misleading since it refers to the incentives of cutting the tax rate when Models A and B yield different levels of combined ETRs. As mentioned above, for any positive local tax rate below the minimum rate of 15 percent, the combined ETR is higher under Model B. So, Devereux et al. (2021) argue that Model A provides less incentives to engage in tax competition because its combined ETR of local tax and a top-up tax is fixed at the lowest level that can possibly be attained under Model B. This, however, is akin to stating that levying zero corporate tax rates is a superior move in the tax competition game because, at this level, the competitive pressure to reduce tax rates further is eliminated. Put differently, we can obviously end the race to the bottom by moving all competitors to the bottom – i.e. suicide for fear of death.

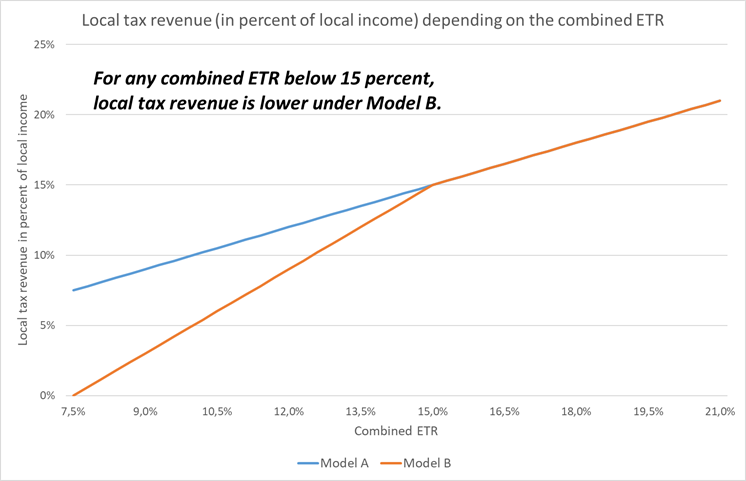

In fact, the comparison made by Devereux et al. (2021) is not suited to show that tax competition is fiercer under Model B. Tax competition aims at attracting investment and tax base, so the relevant indicator is the amount of tax that firms have to pay in total. Consequently, the degree of tax competition is best measured by the level of combined ETRs. For any local tax rate below the minimum rate, the latter are consistently higher under Model B (except for the case in which the local government sets a tax rate of zero; in this case, the combined ETRs are equal).

A relevant test would instead compare the two models at the same (combined) ETRs. The only situation in which ETRs are the same is when the local tax rate is zero for the government under Model B. Then, both combined ETRs are 0.15(P-C)/P – equal to 7.5 percent in the example shown in the diagram. The combined effective tax rate cannot get below this level, therefore we need to consider an increase in the ETR.

An increase in the firm’s combined ETRs by a small amount Z has the following effect on local tax revenue (for simplicity ignoring behavioral adjustments by the firm): Under Model A, increasing the combined ETR implies dropping out of the minimum tax regime; then, an increase of the firm’s combined ETR by Z yields additional revenue of ZP. Under Model B, increasing the combined ETR by Z requires an increase of the local tax rate by Z*(P/C) and thus provides the government with additional revenue of Z*(P/C)*P, i.e. more than under model A. That is, starting from identical combined ETRs, the local government has stronger incentives to increase the combined ETR under Model B. Thus, competing in combined ETRs is costlier under model B.

To sum up, the GloBE proposal is about stabilizing the tax payments made by multinational firms, i.e. introducing a lower bound to the firm’s total ETRs. Thus, in effect, its very purpose is to reduce the effectiveness of local tax rate cuts. Therefore, evaluating different models of ETR calculation with regard to their incentives to change local tax rates is of little relevance. Appropriately evaluated, Model B provides the local government with stronger incentives to increase the firm’s combined ETR. In contrast, Model A implies lower combined ETRs almost everywhere and, thus, allows for more aggressive tax competition.

* Prof. Dr Johannes Becker is Director of the Institute of Public Economics at Muenster University, Germany; Prof. Dr Joachim Englisch holds is Director of the Institute of Tax Law at Muenster University, Germany.

[1] See also Becker/Englisch, Implementing an international effective minimum tax in the EU, 2021, accessible at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3892160.

[2] Devereux/Simmler/Vella/Wardell-Burrus, What is the Substance-Based Carve-Out under Pillar 2? And How Will It Affect Tax Competition? EconPol Policy Brief 39/2021.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.