Luisa Scarcella (DigiTax Centre at University of Antwerp; Member of the Working Party on Tax & Legal Matters)

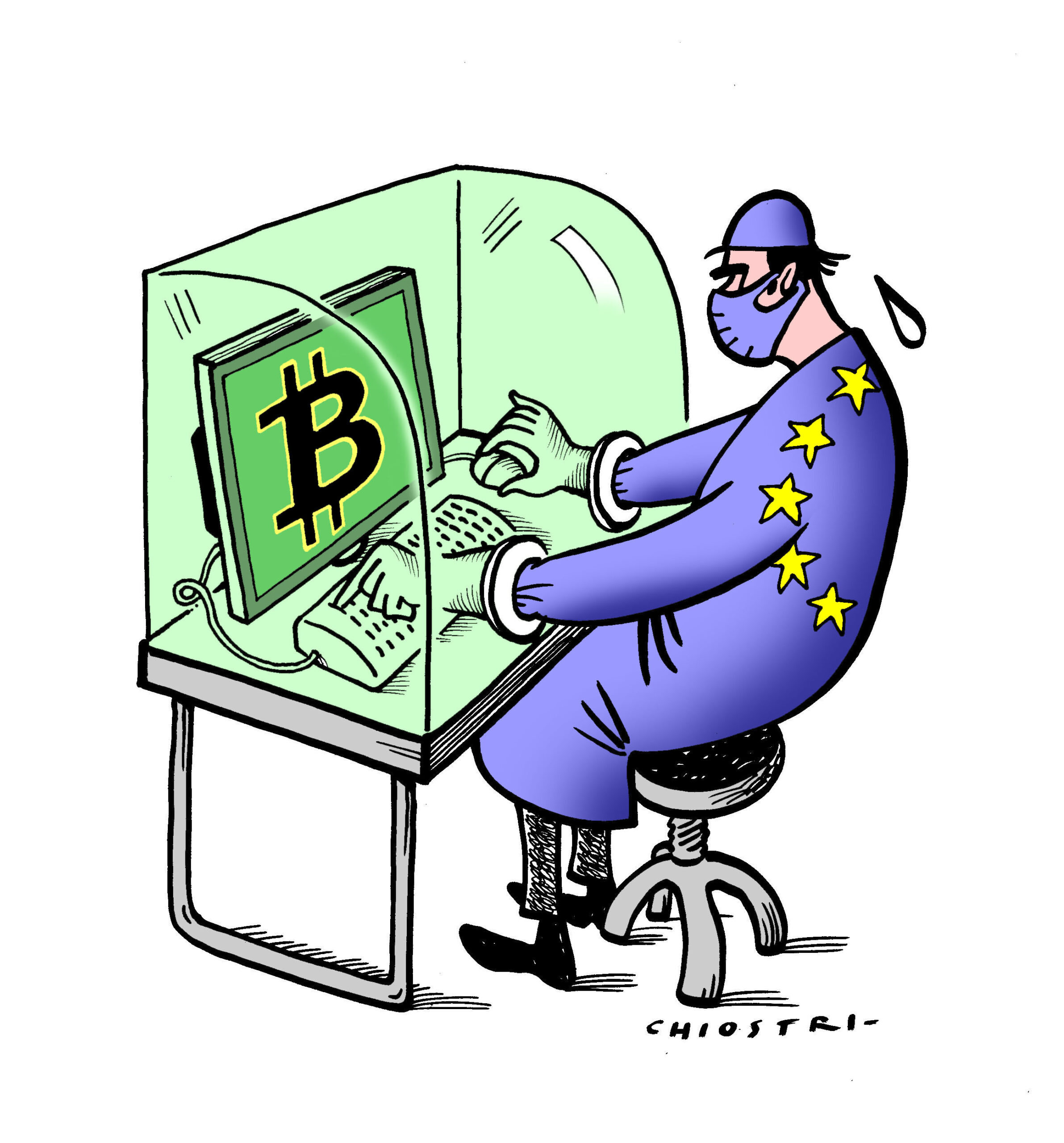

The recent rise in the price of Bitcoin and other cryptocurrencies and crypto-assets accompanied by the rapid growth of crypto-assets providers has caught the attention of the EU regulator once again. Due to the heterogeneity in the rules that the Member States are applying and the features of many crypto-assets such as pseudo-anonymity, valuation difficulties, and global reach, there might be the risk of under-reporting or no reporting of taxable income, leading to revenue losses. Worried about this concern, besides the possible distortion in terms of competition with traditional financial instruments and the possible use of crypto-assets as a vehicle for the shadow economy, the EU Commission decided to take action.

Consequently, on 10 March 2021, the EU Commission has launched a public consultation to strengthen rules on administrative cooperation and expand the exchange of information in the area of e-money and crypto-assets. This public consultation is part of the process that will lead to the proposal for a new update (i.e., the Eighth) of the Directive on Administrative Cooperation (DAC), which is planned to be adopted by the Commission by the third quarter of 2021.

Indeed, given the global scale of the crypto-assets phenomenon, an international and EU effort in the area of tax cooperation seems to be the only way forward.

Previous Measures and Recent Proposals at the International and EU Level in the Area of Cryptocurrencies and Crypto-Assets

At both the international and EU level, a first attempt to monitor transactions involving cryptocurrencies and crypto-assets has been made in the area of anti-money laundering (AML). At the international level, the Financial Action Task Force (FATF) first in 2015 and then in 2019 updated its “Guidance for a risk-based approach to virtual assets (Vas) and virtual assets service providers (VASPs) by amending its Recommendation no. 15 and by introducing the definition of VASP and VAs in its glossary. In this guidance, the FATF recommended adopting to VAs a similar approach to the one adopted to traditional finance, such as the application of mandating KYC/AML laws. However, in March 2021, the FATF has published a draft for a new update to the FATF guidance in relation to crypto-assets, which is open to comment until 20 April 2020. Differently, at the EU level, the fifth anti-money laundering Directive (AMLD5) of 30 May 2018 does not refer to virtual-assets but only to virtual currencies adopting a narrower definition as it focuses only on one possible type of so-called crypto-assets.

Undoubtedly, what emerges from both interventions in the AML area is a set of obligations for intermediaries operating in the crypto-sphere, underlying the fundamental role that they can play in ensuring compliance with AML rules. Moreover, the link between financial regulation, AML, and tax provisions is crucial, and efforts in the past have been made to get AML policies and automatic exchange of information closer, as the data gathered in these areas can be fundamental for both AML and tax authorities. For instance, in the EU, the EU Directive 2016/2258 (so-called DAC5) prescribes that the Member States shall provide by law access by tax authorities to the mechanisms, procedures, documents, and information gathered for AML purposes by the competent authorities. Thus, how the AMLD changes also influences the types of information that tax authorities will have access to.

Even though the AMLD5 has a very limited application scope at the EU level since it is restricted to virtual currencies and the Directive does not contain a definition of crypto-assets, a new updated version of the AMLD will also be discussed in 2021. At the same time, the proposal for an EU Regulation on Markets in Crypto-assets (MICA) published at the end of September 2020, does already include a definition of crypto-assets which are described as ‘a digital representation of value or rights which may be transferred and stored electronically, using distributed ledger technology or similar technology’.

According to the MICA proposal, within the realm of crypto-assets, three types of tokens shall be distinguished:

- asset-referenced tokens: types of crypto-assets aimed at maintaining stable values by referring to the values of several fiat currencies that are legal tenders, one or several commodities or one or a number crypto-assets, or group of those assets;

- electronic money tokens or ‘e-money tokens’: which refer to types of crypto-assets whose primary aim is being used as a medium of exchanges and that aims at maintaining stable values by referring to the values of fiat currencies that are legal tenders;

- utility tokens: types of crypto-assets that are intended to provide digital access to goods or services, available on DLT, and are only accepted by the issuers of those tokens.

This definition and types of tokens, which differ from the FATF definition and those that were given in the past by central banks and national financial supervisory authorities, might also be relevant for both a new version of the AMLD and the DAC8. As reforms are foreseen both in the area of AML and the exchange of information, the EU legislator should strive for the alignment of the definitions to be contained in the new AMLD and the DAC8.

Furthermore, the need to extend the exchange of information in the area of crypto-assets has not only emerged at the EU level but also within the OECD. A report published by the OECD in late 2020, offering an overview of the current tax treatments of virtual currencies worldwide, also highlighted the need for greater transparency in this area, especially when considering a crypto-asset. Indeed, given the global scales of the crypto-assets phenomenon, the wider the international cooperation, the better. In light of this need, the OECD is currently developing a technical proposal to obtain an adequate level of reporting and exchange of information in the area of crypto-assets. In 2020, the Committee on Fiscal Affairs (CFA) has approved a work plan to review the Standard for Automatic Exchange of Financial Account Information in Tax Matters and it plans to transmit to the Council an update to the Recommendation on the Standard for adoption by the end of 2021. This review is also expected to identify financial assets (such as e-money and crypto-assets), products and intermediaries that should be included in the scope of the Standard, or of automatic exchange of information generally, because they are potential alternatives to covered financial products, in particular for those seeking to avoid reporting under the Standard. The EU proposal to update the current directive on administrative cooperation, aiming to extend the scope of the exchange of information in the area of crypto-assets, is perfectly in line with the OECD plan to incorporate crypto-assets within the financial assets subject to the automatic exchange of information and the Common Reporting Standard (CSR). However, the design of the proposal, including the definitions and the obligations contained therein, will need to be constructed, taking into account that Member States’ applicable tax provisions differ.

The DAC 8 Public Consultation

Going into the details of the DAC8 public consultation, the DAC update aims to expand its scope to crypto-assets and e-money, and it is included among the actions to be undertaken under the new tax package of the EU Commission, adopted on 15 July 2020. The main reason for a new update of the DAC is to ensure that revenues stemming from investments in or payments with crypto-assets and e-money will be subject to the applicable tax provisions. However, regulating such a constantly changing environment requires mapping and understanding which stakeholders are involved, what kind of activities are carried out, and how the Member States are currently qualifying crypto-assets to apply the relevant tax provisions.

Thus, according to the Better Regulation principles, the Commissions decided to launch an open consultation on 10 March 2021 to gather views from the interested parties, an approach that was already used in 2020 for the EU MICA Regulation. The outcome of this public consultation is expected to help the Commission verify whether there is a need for an EU legislative measure aimed at targeting tax revenue losses due to the underreporting of income/revenue generated by crypto-assets and e-money.

The public consultation is divided into two parts that can also be answered partially, depending on the respondents’ interests and expertise. The second part of the public consultation is not specifically relevant for crypto-assets or e-money, but it generally seeks views on the necessity to strengthen the EU framework on the compliance measures in relation to the reporting obligations arising from the EU rules on administrative cooperation.

Differently, the first part of the consultation focuses on the crypto-sphere and aims at collecting important information concerning different aspects of the crypto-assets realm. This first part could be subdivided into subsections based on the types of questions and information aimed to be collected. The first two subsections include questions directed to crypto-assets users and crypto-assets providers. The purpose of the questions there contained is clearly to gain a complete overview of the phenomenon. The questions concern:

- the types of crypto-asset service providers used;

- the types of activities carried out by the crypto-asset service providers;

- where crypto-asset service providers are registered or licensed;

- the location of the tax residency of the crypto-assets service provider;

- the type of crypto-assets in which the respondent has invested;

- the amount of the investment;

- the features of the crypto-assets in which the respondent has invested;

- whether the crypto-assets in which the respondent has invested are backed by an asset (e.g., stable coins);

- whether they have a centralized or decentralized structure;

- which is the amount in Euro invested on a yearly average;

- which types of information about the customers and transactions are – accordingly to the respondents – readily available for different types of intermediaries; and

- Which types of information regarding crypto-assets investments in their Member State of residence or another Member States are at the disposal of crypto-assets providers.

More interestingly, the third subsection of this first part of the public consultation on DAC8 focuses on the reporting obligations on crypto-asset service providers. According to the current status quo, some EU countries have already imposed or are planning to impose reporting obligations on crypto-assets service providers. However, as correctly pointed out in the public consultation, different national approaches might lead to extra administrative burdens to crypto-assets/e-money service providers. Thus, the EU Commission has asked the interested parties whether they think that crypto-assets service providers shall be subject to reporting obligations, whether the same reporting obligations for tax purposes throughout the EU should be adopted, which would be the main challenges faced by the providers and whether all entities should be subject to the same set of reporting rules or whether some exemptions shall also be introduced. Indeed, concerning this last question, the goal is to limit the opening of new possibilities to take advantage of potential loopholes while at the same time avoiding potential harm to innovation by imposing on newly created or small businesses such as start-ups a too heavy burden in terms of compliance. Furthermore, the EU Commission poses a similar question in relation to the types of transactions involving crypto-assets and e-money that should be subject to reporting. Similarly, the risk of exempting some transactions could lead to potential loopholes. Considering alternatives in the way crypto-assets transactions take place, the last question of the first part of the public consultation asks whether peer-to-peer crypto-assets transactions through unhosted wallets should be reported to tax administrations from the legal perspective to guarantee a level playing field and, if yes, how.

What Does the Future Hold for the Exchange of Information on Crypto-Assets and E-Money?

Crypto-assets are a global phenomenon. As such, strengthening cooperation at both the international and EU level will be highly beneficial to avoid under-reporting and non-reporting of income. The DAC8 proposal will need to ensure a comprehensive and coordinated approach towards the involved actors, whose role in facilitating crypto-assets exchange has already been considered pivotal in the AMLD5 and the MICA Regulation proposals.

The use of public consultations both in the area of the DAC8 but also for the update of the FATF guidance on a risk-based approach to VAs and VAPs reveals the awareness by legislators and regulators of the necessity to engage with stakeholders when trying to regulate in this field. Indeed, the possibility of gathering information directly from the involved stakeholders will allow policymakers to understand better the eco-systems and the types of compliance obligations that need to be imposed. However, the public consultation’s success will certainly depend on the number of responses that will be collected from the different stakeholders involved in the crypto-sphere.

The data obtained by the EU Commission through the public consultation will not only be fundamental in the design of the new DAC8 proposal but will also be used to assess the correct application of the VAT legislation. Indeed, as crypto-assets start to be regulated in different Directives and Regulations at the EU level, the hope is that enough coordination among the legislative measures – at least from a definitory perspective – will be reached.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.

Cryptocurrencies and the blockchain tech is the biggest part of the future digital economy. These projects provide superfast (Solana for example = up to 100K transactions per second vs. 4k/5k TPS for Visa and MC) and secure transactions at the fraction of the cost that can rival established banks and financial institutions.

Just like the stock market of the 1980s had lots of bad and risky “scam” stocks, the crypto industry also had to deal with its share of scammy projects that failed and defrauded the investors. Therefore, as an investor you do your due diligence, research the project, the team + its IT members and verify their history within the overall tech industry. Still this is not risk proof, but just as you research ana analyze stocks, you have to utilize the same logic and analytical tools.

Fiat currency is more likely to be the Ponzi Scheme than crypto projects!

Crypto + Metaverse + Web3 = Future digital economy!