1. Introduction

The Pillar Two Report[1] (the “Report”) which contains the Global Minimal Tax (the “GloBE tax”) proposal has recently been on the top of discussions both in the academic and practice world. While the proposals objective is debatable[2], the blueprint contains dozens of new rules, exceptions and mechanisms which may possibly complicate life not only of MNE’s tax advisors and accountants but also of tax administrations. For example, adopting a jurisdictional blending approach coupled with a formulaic substance based carve out will increase the complexity of the proposal as well as the associated compliance costs[3].

However, at the core, the rules are not something new but are built on existing anti-abuse rules that are found in the national law or treaty policy of several countries. Accordingly, this blog attempts to give its readers an idea of how the GloBE rules work through a case study.

To reiterate, the most important rule of the GloBE proposal is the Income Inclusion Rule (the “IIR”) together with the Undertaxed Payment Rule (the “UTPR”) that acts as a backstop. Quite similar to CFC rules and the US GILTI, the IIR triggers the inclusion of low taxed income at the level of the shareholder where the income of a controlled foreign entity / permanent establishment is taxed at below the minimum tax rate. The IIR mechanism also contains a Switch-over rule (the “SoR”) which eliminates treaty obstacles to apply the IIR in respect to branch structures whose no- or low-taxed income is exempt from taxation in the jurisdiction of the head office under a relevant tax treaty.[4] The UTPR is a secondary rule which is applied in the payor jurisdiction when the parent is not subject to the IIR.[5] Finally, the Subject-to-tax rule (the “STTR”) complements these GloBE rules. It is based on the denial of treaty benefits for certain deductible intra-group payments made to jurisdictions where those payments are subject to no or low rates of nominal taxation.[6]

2. Case study

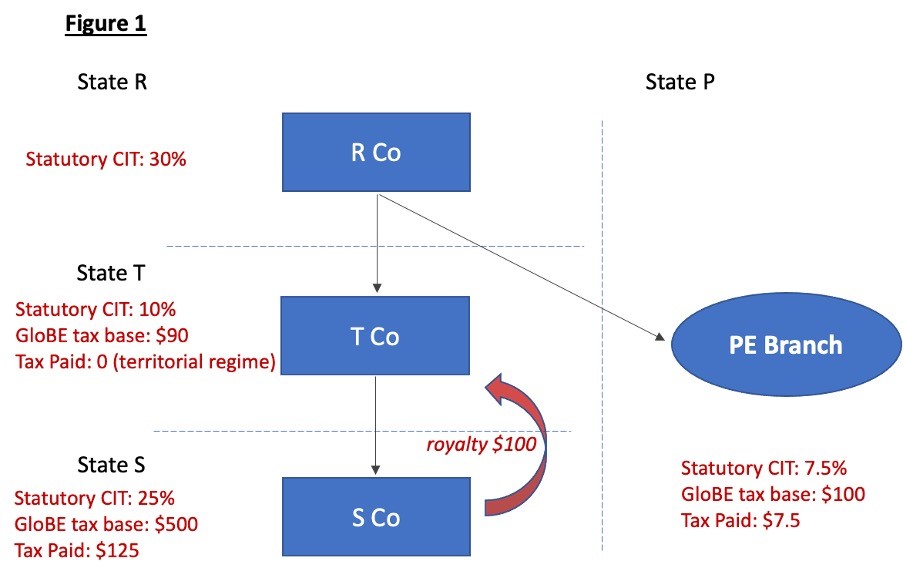

In order to present how the GloBE mechanism works, a series of assumptions for the case study is made (see Figure 1).

-

- First, R Co is a tax resident in State R and it is the Ultimate Parent Entity (the “UPE”)[7] of the multinational group (the “MNE Group R”). It has crossed the Group consolidated revenue threshold, that is, Euro 750 Million for the application of these rules [8]. The Group is subject to the IIR in State R. The statutory corporate income tax (CIT) rate in State R is 30%.

- Second, R Co has a financing branch (PE) in State P wherein the statutory CIT rate is 7.5%. The branch has an income of $250 and expenses of $150. The expenses include $30 on payroll costs and $20 on tangible components (eg. depreciation). The Globe tax base of the branch based on financial statements is $100 (before adjustments for a formulaic substance based carve-out). The branch pays $7.5 as corporate income taxes in State P. The tax treaty between State R and P, which follows the exemption method, contains the SoR rule.

- Third, R Co owns T Co. T Co is resident for tax purposes in State T wherein the statutory CIT rate is 10%. T Co’s only source of income are royalties paid by a related company viz., S Co. T Co has an income of $100 and expenses of $10. The expenses include $5 of payroll costs and $5 on tangible components (eg. depreciation). The GloBE tax base of T Co based on financial statements is $90 (before adjustments for a formulaic substance based carve-out). It is also assumed that State T has a territorial regime wherein all offshore income is exempt from taxation. Thus, T Co pays $0 as corporate income taxes in Country T.

- Fourth, T Co owns S Co. S Co is a resident of Country S wherein the statutory CIT is 25%. S Co earns $1500 as income and its costs amount to $1000 (including an arm’s length royalty payment of $100 to T Co). The GloBE tax base of S Co based on financial statements is $500 and it pays $125 as taxes in Country T. Moreover, State S has introduced the UTPR rule and State T and State S have a tax treaty (based on the OECD Model) that contains the STTR.

- Finally, as a result of the formulaic substance carve-out, the share of payroll and tangible asset components deductible from the GloBE tax base is set at 10% on such costs.[9] Moreover, the minimal tax rate under the IIR accounts for 12.5% and 7.5% for the STTR.

3. Solution

3.1. Rule order

The STTR applies first[10] (assuming it is mandatory) and it has priority over of the IIR. As indicated, it is a treaty-based rule which applies to intragroup payments that take advantage of low nominal tax rates of taxation in the other contracting state (that of the payee). It allows for the source state to impose additional taxation on certain covered payments up to the agreed minimum rate.[11]

It should be highlighted that the STTR is applied on a nominal rather than effective tax rate (the “ETR”) basis[12], which means that it is triggered where a covered payment is subject to a nominal tax rate in the payee jurisdiction that is below an agreed minimum rate. However, the nominal tax rate is applied on an adjusted basis meaning that it takes into consideration publicly available preferential rates, preferential exemptions or exclusions etc. For example, if the statutory CIT rate in a country is 15% and 80% of offshore income paid to that jurisdiction is exempt from taxes then the nominal adjusted rate in that country is 3%. In other words, the rate is derived by multiplying the actual tax rate on the payment by the proportion of the payment that is subject to tax in the payee jurisdiction.[13]

The tax paid under the STTR is taken into account while determining the ETR under the other rules.[14]

Second, the IIR is applied. The IIR operates in a way that is similar to a CFC rule in that it allows the State of the UPE (or another parent) to tax the foreign income of any controlled (directly or indirectly) subsidiary.[15] In other words, the UPE has to tax the profits of a subsidiary that are subject to the ETR below the minimum GloBE rate.[16]

In order to apply the IIR to profits of a PE, whose income is exempt from tax under the provisions of double tax treaties, the SoR is introduced into to tax treaties. The purpose of the rule is to remove treaty obstacles from the application of the IIR to PEs and it applies where the treaty otherwise obligates the contracting state wherein the head office is located to use the exemption method.[17] Put differently, the SoR allows a state of a parent’s residence to tax the income of the PE up to the minimum GloBE rate as provided for under the IIR.[18]

Lastly, the UTPR is applied if IIR is not applicable. The UTPR acts as a backstop to the IIR by way of limiting the deduction of intra-group payments or through an equivalent incremental adjustment (possibly a reverse CFC rule).[19] It requires a UTPR taxpayer[20] which is a member of a MNE Group to make an adjustment in respect of any top-up tax that is allocated to that taxpayer from a low-tax entity of the same group.[21] The UTPR only applies to the income of a low-tax subsidiary when it is not subject to the IIR.

3.2. Calculation of the GloBE tax

3.2.1. Step 1: application of the STTR

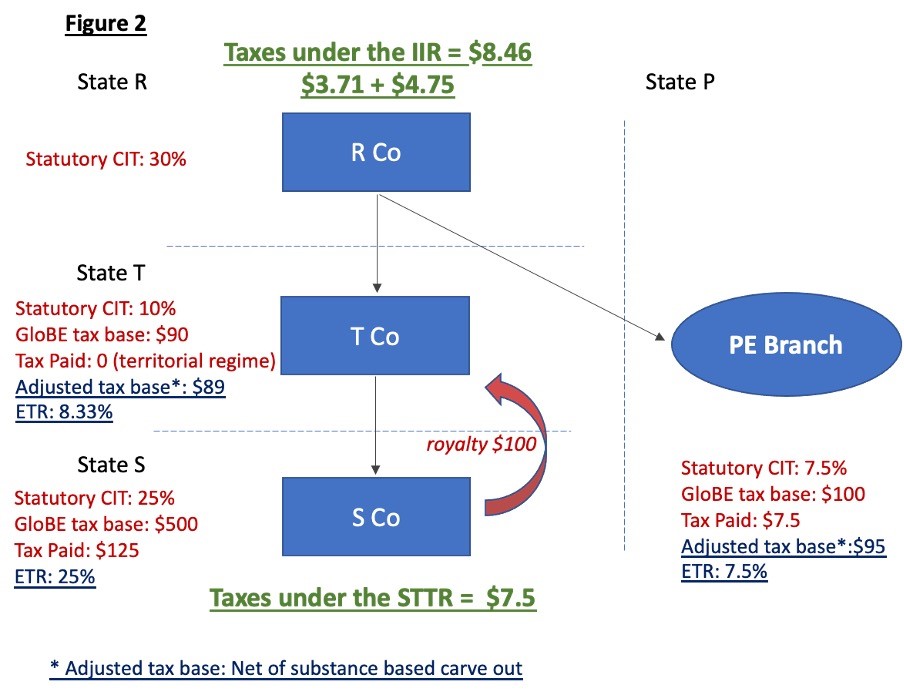

As pointed out above, the STTR has a priority over the IIR and it applies first. The STTR allows State S to tax the gross amount of royalty paid to T Co up to an agreed minimal rate, i.e. 7.5% even though the tax treaty allocates exclusive taxing rights over royalties to the State of residence of the recipient. State S is therefore authorized to impose additional tax on royalty at the rate equal to the difference between the minimum rate under the STTR, i.e. 7.5%, and adjusted nominal tax rate of 0% (as offshore income is exempt) applicable to the royalty in the payee’s jurisdiction, i.e. State T. Consequently, the top-up tax rate for the STTR amounts to 7.5% which is applied to gross royalty of $100. Thus, State S can withhold $7.5 of taxes. [22]

3.2.2. Step 2: application of the IIR

The IIR is applied to subsidiaries as well as branches. As a consequence, if the profits of T Co, S Co and the branch are taxed below the GloBE rate then they should be taxed in the hands of R Co. In order to verify which profits are taxed below the minimal rate for the IIR, the ETR in State T, State S and State P must be calculated.

ETR in State S: In this case, as the ETR in State S accounts for 25% ($125 of taxes paid by S Co in State S divided by $500 of its GloBE tax base), which is above the minimal 12.5% tax, the IIR is not applied to this subsidiary.

ETR in State T: The ETR in State T is equal to the amount of taxes paid by T Co as divided by the amount of the profits (GloBE tax base).[23] As T Co paid $7.5 of WHT in State S under the STTR[24] and its GloBE tax base is $90, the ETR in State T amounts to 8.33% which is below 12.5% and, therefore, the profits of T Co are covered by the scope of the IIR.

Subsequently, the rate of top-up tax must be determined. The top-up tax rate equals to the excess of the minimal tax rate for the IIR, which is 12.5%, over the ETR as calculated above.[25] Therefore, the top-up tax rate applied in State T accounts for 4.17%, which is the excess of 12.5% over 8.33% ETR.

The top-up tax is equal to the amount of GloBE tax base of T Co, reduced by the share of payroll and tangible carve-out, multiplied by the top-up tax rate.[26] The amount of carve-out is equal to $1 (10% of $5 payroll costs and $5 tangible asset component). The top up tax accounts for the amount of $90 profit reduced by $1 of carve-out and multiplied by 4.17% top-up tax rate. Therefore, the top-up tax to be paid by R Co in State R under the IIR is $3.71.

ETR in state P: As regards the PE in State P, its profits are taxed with the ETR of 7.5% ($7.5 of CIT paid in State P divided by 100$ of GloBE tax base). Since the ETR is below 12.5%, the IIR is applied. Although PE’s profits are generally exempted from tax in State R under a double tax treaty between State R and State P, the SoR introduced thereto allows switching from the exemption to the IIR and to tax PE’s profit at the level of R Co.[27]

The top-up tax rate applied to PE’s profits accounts for 5% (excess of 12.5% minimal rate over 7.5% ETR in State P). The amount of carve-out accounts for $5 (10% from $30 payroll and $20 tangible components). The top-up-tax to be paid in State R is equal to $100 reduced by $5 carve-out and multiplied by 5% top-up tax rate, i.e. $4.75.

Taking into account that R Co subject to the IIR, the UTPR is not applied. This analysis is depicted in Figure 2.

3.2.3. Alternate possibility: Application of the UTPR

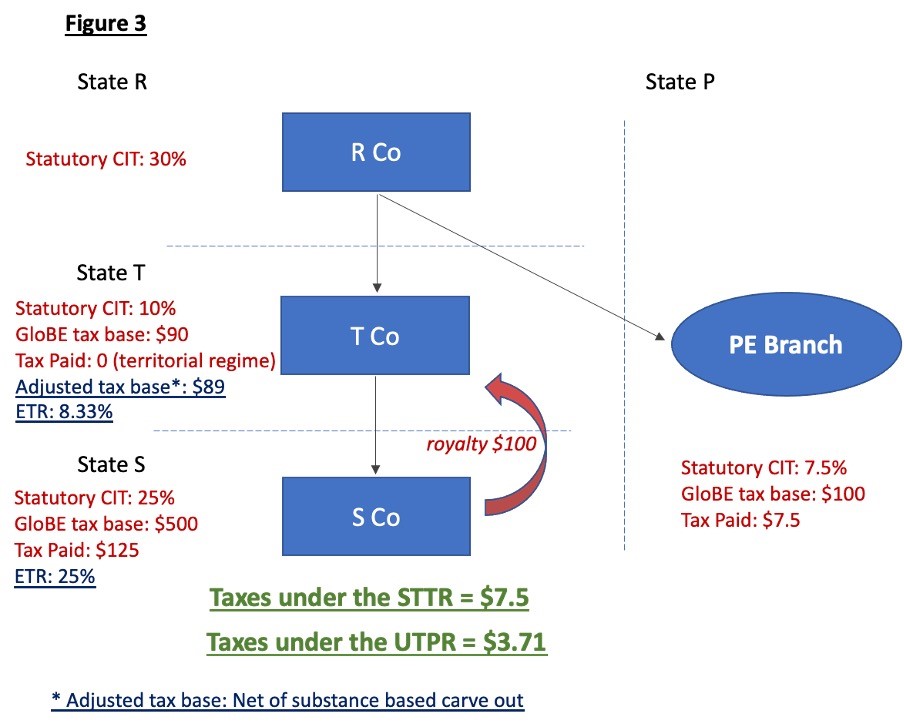

Assuming the opposite, i.e. that State R has not introduced the IIR and State S implemented the UTPR, the implications in the case of the STTR are similar to those described in the section 3.2.1. Therefore, it results in the obligation of the State S to withheld of $7.5 of top-up tax.

The application of the UTPR requires also computation of the jurisdictional ETR in State T. The UTPR uses the same mechanics as the IIR for determining the MNE’s jurisdictional ETR, application of any substance based carve-out and the amount of top-up tax allocable under the rule.[28]

The ETR is determined by dividing the amount of taxes, which include WHT imposed by State S, by the amount of profits (GloBE tax base).

The ETR in State T accounts for 8.33% ($7.5 of WHT in State S divided by $90 of T Co GloBE tax base) and it is below the minimum rate of 12.5%.

The top-tax rate applied to T Co is 4.17% (the excess of 12.5% over 8.33% ETR). The top up tax is equal to the amount of $90 profit reduced by $1 of carveout and multiplied by 4,17% top up tax rate. Therefore, the top up tax to be paid by S Co in State S under the UTPR is $3.71.

The key point of the UTPR is the computation of the amount of deduction, resulting from royalties paid out by S Co to T Co, to be denied in State S. It is achieved by dividing the amount of top-up tax allocated to S Co[29] by the CIT rate which it is subject to.[30] As S Co is subject to a CIT rate of 25%, therefore State S can deny the deduction of $14.84 ($3.71 of top-up tax divided by 25% CIT rate in State S). Another way, is to simply re-allocate the income computed with the IIR to S Co (sort of reverse CFC rule or better RFC rule – Related Foreign Company rule).

Although it is not clear in the blueprint, we will assume that the low-taxed profits of the PE are out of the scope of the UTPR. This is because the branch in State P has no connection with State S apart from them being a part of the same MNE Group. This analysis is depicted in Figure 3. On the other hand, if the branch is not taxed under the UTPR then the profits derived in a low tax country go untaxed.

4. Caveat

As a last point, the reader should note that the solution discussed in this blog represents our understanding of the proposal. As the proposal is complicated and several design parameters are yet to be confirmed, the solution could change depending on the exact details.

[1] OECD/G20 Base Erosion and Profit Shifting Project, Tax Challenges Arising from Digitalisation – Report on Pillar Two, October 2020, OECD. Online access: http://www.oecd.org/tax/beps/tax-challenges-arising-from-digitalisation-report-on-pillar-two-Ibidem.pdf

[2] See also: V. Chand, K. Romanovska, International Tax Competition in light of Pillar II of the OECD project on Digitalization, online: https://kluwertaxblog.com/2020/05/14/international-tax-competition-in-light-of-pillar-ii-of-the-oecd-project-on-digitalization/

[3] See also: V. Chand, K. Romanovska, Pillar II of the Digital Debate: Our View on the Approach Towards Blending and Substance Carve Outs to Determine Effective Tax Rates, https://kluwertaxblog.com/2020/09/18/pillar-ii-of-the-digital-debate-our-view-on-the-approach-towards-blending-and-substance-carve-outs-to-determine-effective-tax-rates/

[4] OECD/G20 Base Erosion and Profit Shifting Project, Tax Challenges Arising from Digitalisation – Report on Pillar Two, October 2020, OECD, p. 16.

[5] Ibidem, p. 15.

[6] Ibidem, p. 16.

[7] Ibidem, p. 24.

[8] Ibidem, p. 41.

[9] Ibidem, pp. 92-93.

[10] Ibidem, p. 169.

[11] Ibidem, p. 148.

[12] A nominal tax rate is a rate imposed by law on a taxable income which disregards deductions, exemptions, credits and preferential rates, whereas an effective tax rate (ETR) is a rate of tax actually paid on pre-tax profits (i.e. pre-tax profits divided by the tax actually paid).

[13] Ibidem, 161.

[14] Ibidem, p. 169.

[15] Ibidem, p. 110.

[16] Ibidem, pp. 170 – 171.

[17] Ibidem, p. 169.

[18] Ibidem, p. 170.

[19] Ibidem, pp. 121-122.

[20] Ibidem, a UTPR taxpayer is any Constituent Entity that is located in a jurisdiction that has implemented the UTPR in accordance with the GloBE rules.

[21] Ibidem. The two-step allocation mechanism is designed: 1. if a UTPR taxpayer makes any deductible payments to the low-tax entity the top-up tax of such entity is allocated to a UTPR taxpayer in proportion to the total of deductible payments made to that entity by all UTPR taxpayers. 2. if a UTPR taxpayer has net intra-group expenditure in proportion to the total amount of net intra-group expenditure incurred by all UTPR taxpayers.

[22] Ibidem, p. 163.

[23] Ibidem, p. 100-101.

[24] Ibidem, p. 169.

[25] Ibidem, p. 100.

[26] Ibidem, p. 101.

[27] Ibidem, p. 170.

[28] Ibidem, p. 124.

[29] Ibidem.

[30] Ibidem, p. 135.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.