1. Purpose of the contribution

The purpose of this contribution is to address the impact of the Pillar I debate on principal structures or centralized business models. The tentative assessment will be made in light of the “ongoing work” of the OECD with respect to the digitalization of the economy[1].

2. Illustration of a typical centralized business model

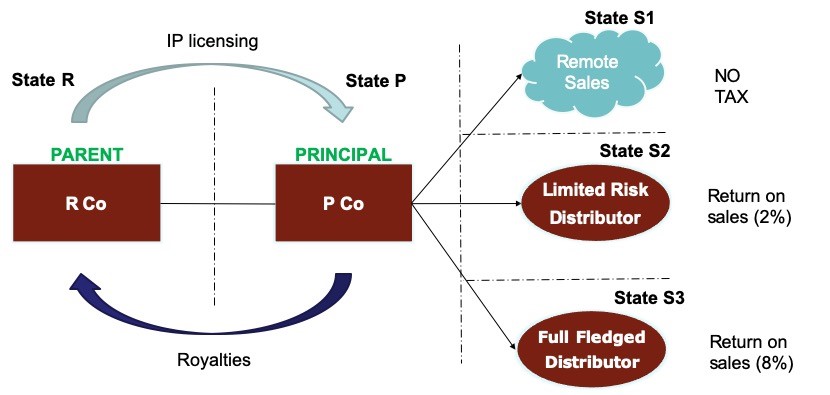

The concept of a principal structure or centralized business model has already been discussed by the author in another contribution. A typical structure that is used relates to a case where an MNE (MNE Group X hereafter), which has its parent in one jurisdiction, sets up a centralized business in another jurisdiction. For example, consider the situation of Company R in Country R that has developed all trade and marketing intangibles. Company R sells its products in the State R market. For its overseas operations (for instance, European operations) Company R establishes a centralized business model (Company P – a principal entity) in Country P. Company R licenses its intangibles (IP) to Company P. Company P employs the intangibles for its operations and derives business income. Company P then pays an arm’s length amount of royalties to Company R (other variants of such royalty arrangements are also possible)[2].

Further, assume that Company P, which makes use of toll manufacturers in other countries to process its goods, sells its finished products in three countries. In country S1, the products are sold on a remote basis. As a permanent establishment (PE) does not exist in that country (under the current nexus rules), Company P is not subject to corporate taxation therein. In country S2, the products are sold through a limited risk distributor (LRD). Assume that the arm’s length compensation of the LRD amounts to 2% on sales. In country S3, the products are sold through a full-fledged distributor (FFD). For the purposes of this example, assume that the FFD reports a taxable profit that amounts to 8% on local sales. This profit is at arm’s length. The structure is depicted in the diagram below.

3. Amount A of the Unified approach

The overall objective of the Pillar I debate is to allocate additional taxing rights to market countries. In our example, this would be Country R, S1, S2 and S3. This said, the sales made in Country R will not be analyzed in this contribution. In order to do so, three amounts are proposed in the unified approach viz, Amount A, Amount B and Amount C.

Amount A, which is an add on to the existing nexus and profit allocation system, seeks to re-allocate profits on the basis of a pre-determined formula linked to MNE Group profits, including to countries where no physical presence exists. To understand the application of this approach, consider the following further facts of MNE Group X which operates only one “in scope”[3] consumer facing business line such as consumer electronics.

According to its consolidated financial statements for year 2020, MNE Group X has: (1) consolidated group operating revenue = $1 billion[4] and (2) consolidated expenses = $600 million. Therefore, the Group profits (3) amount to $400 million. This amount (3) represents the Groups Earning or Profit Before Taxation (EBT or PBT hereafter).

Also, assume that the Group generates ten percent of its global revenue from Country S1 ($100 million), twenty percent of its global revenue from Country S2 ($200 million) and thirty percent of its global revenue from Country S3 ($300 million). The balance revenue is generated from Country R. Let us also assume that MNE Group X generates similar revenues during the past three years from each market jurisdiction. Moreover, it invests heavily in Advertising, Marketing and Promotion related activities in all these jurisdictions. Accordingly, it is considered to satisfy the new “nexus” test[5] and is considered to have “significant and sustained engagement” in each Country. In order to allocate profits to market countries, the deemed residual profit split method[6] would apply as follows:

- Step 1: The Group EBT amounts to $400 Million and EBT margin amounts to 40% (EBT / operating revenues).

- Step 2: The deemed routine EBT margin is fixed at 10% (through multilateral negotiations) and thus 30% will be deemed to be non-routine EBT margin.

- Step 3: The non-routine EBT margin of 30% is split between production activities / intangibles (80%) and market activities / intangibles (20%). This split is also agreed through multilateral negotiations. Essentially, 6% of the EBT margin will be allocated to market related activities.

- Step 4: X Group’s market related profits is determined to be 6% of the overall revenues, which amounts to $ 60 Million ($ 1 Billion*6%). The reallocation will work as follows:

-

- Country S1: As ten percent of the global sales are derived from Country S1 it will be allocated USD $ 6 Million (60*100/1000 = 6) of that profit.

- Country S2: As twenty percent of the global sales are derived from Country S2 it will be allocated USD $ 12 Million (60*200/1000 = 12) of that profit.

- Country S3: As thirty percent of the global sales are derived from Country S3 it will be allocated USD $18 Million (60*300/1000 = 18) of that profit.

Ideally, the Amount A deemed profit should be taxable at ordinary corporate tax rates applicable in each jurisdiction. However, given the fact that countries are sovereign, it may well be possible that some countries could enact a higher tax rate for the Amount A profit or may not tax that deemed profit at all. This is one issue which the OECD will need to look into.

Also, with respect to Country S3, it should be noted that in the public comments, some MNEs (for instance, Johnson & Johnson) as well as other commentators have argued that Amount A should not be applicable in countries in which an MNE operates FFDs as those entities book a part of the residual profits[7]. Keeping that debate aside and assuming that the amount is also payable in countries where FFDs operate, the question then arises as to which Country would alleviate double taxation for the taxes paid in the market countries?

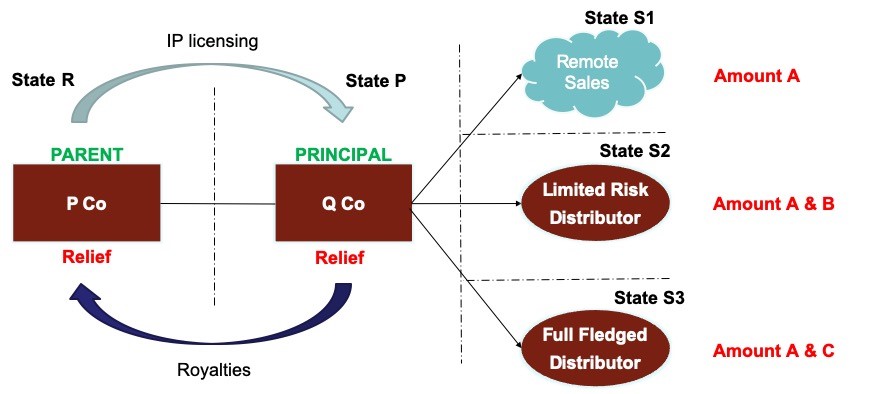

The first issue pertains to identification of the relevant taxable person. As the objective of Amount A is to reallocate a part of the residual profits to the market countries, we believe that the relevant taxpayer(s) to whom the Amount A liability should be allocated is/are the entities in the MNE Group that book residual profits under the current transfer pricing rules[8]. In our example, two entities can surely be considered to be the owner of non routine or deemed residual profits as they will be characterized as “entrepreneurs” for transfer pricing purposes. This would imply that both Country R (Company R) and Country P (Company P) could provide the relief for the Amount A tax paid in Country S1, Country S2 and Country S3. The relief could be divided in a predetermined proportion (based on sales or profit margins). This said, the FFD could also be characterized as an “entrepreneur” and there could be overlaps between Amount A and Amount C. The issue is addressed subsequently.

The second issue pertains to which method should be used by Country R or Country P to alleviate double taxation. Several commentators to the public consultation on Pillar I argued for a corresponding adjustment system[9]. However, in our opinion, that method is not suitable because “Amount A is not premised on there being identifiable transactions between particular group entities”[10]. Thus, we express a preference for a traditional method such as the credit method or new methods that are being explored such as “methods based on specific deductions or allowances that are not premised on identifiable transactions could be contemplated, such as exemption methods”[11].

4. Amount B and C of the Unified approach

Amount B seeks to determine a fixed return ‘based on the arm’s length principle’ (ALP) for low risk baseline distribution and marketing activities in order to enhance tax certainty[12]. In fact, such an approach is already followed by the tax administration in Israel, albeit in the form of a safe harbour. Moreover, the Israeli approach contains a detailed discussion on the type of activities that can be classified as low risk distribution and marketing activities. Thus, references could be made to their guidance to derive a definition of distribution / marketing activities that could be within the scope of this proposal. In our example, Amount B is relevant for fixing the arm’s length remuneration for the LRD in State S2.

Also, contrary to the approach followed in Israel, we are of the opinion that the different margins need to be proposed for different businesses. In our experience, the margins applied for low risk distribution / marketing activities differ from industry to industry and business to business. Thus, a range of arm’s length margins will need to be put forward. It should be noted that these activities should not amount to i) ‘unique and valuable contributions’, especially, activities that create valuable local intangibles; ii) be classified as ‘highly integrated’ operations, or iii) lead to ‘shared assumption of economically significant risks’ or ‘separate assumption of closely related risks’[13]. If they do, then the activities need to be analysed under Amount C.

Amount C seems to apply to FFDs. One could, once again, refer to the guidance provided by the tax administration in Israel to understand the concept of a FFD. Moreover, a reference could be made to the various ‘watch’ examples found in the transfer pricing guidelines (Examples 8-13 – Annex to Chapter VI). In many situations, local FFDs could also be booking residual profits especially, a part of profits linked to marketing intangibles (trademarks or tradenames) or market related features (market premiums as discussed in China). Thus, there could be an overlap between Amount C and Amount A (which also seeks to reallocate a part of the residual profits to the market countries)[14].

Coming back to our example, in Country S3, the products are sold through a FFD, which reports an arm’s length operating margin of 8% on sales (this amount could be based on a comparability study or could have been agreed in an Advance Pricing Agreement). Based on the above example, the Amount A taxable base in Country S3 is USD 18 million. The Amount C taxable base, as per the current transfer pricing rules, is equal to 8% on local sales. This amounts to USD 24 Million (300*8/100 = 24).

To a certain extent there is an overlap between Amount A and Amount C. Thus, in order to reduce this overlap, one possibility would be to start with Amount C (USD 24 Million). Amount A (USD 18 Million) could then be compared to the Amount C. As the local entities actual taxable profit, which also includes a part of the residual profit, is higher than deemed taxable profit no taxes will be required to be paid on Amount A.

Another possibility is to reduce from Amount A, an amount that is linked to non routine margins. Assume that routine ALP margin for low risk distribution / marketing functions is fixed at 4% on sales (Amount B). Thus, the amount that will be reduced from Amount A will be linked to the non routine margin, that is, 4% on Country S3 sales which amounts to USD 12 Million (300*4/100=12). Thus, the taxable amount under Amount A in Country S3 amounts to USD 18-12 = USD 6 Million[15].

To summarize, the situation of the centralized business model will be as follows post the Pillar I re-allocation exercise (tentative assessment):

5. Dispute prevention and resolution

With respect to Amount A, we strongly believe that the focus should be on dispute prevention mechanisms. For instance, multilateral competent authority arrangements should be developed which would reflect a common understanding of several issues in the proposal. This said, the proposal will also need to be backed by a mandatory binding arbitration system for issues that will not be resolved by the dispute prevention mechanism[16]. The mandatory binding arbitration system will need to be accepted by both developed and developing countries.

With respect to Amount B and C, the focus should also be on enhancing the existing dispute prevention framework such as by encouraging the use of multilateral APAs or enhancing the participation of countries in the ICAP project. Overall, efficient prevention and dispute mechanisms will need to be developed in order to ensure that the proposal is successful.

The author would like to thank Mr Stefaan De Baets (PwC) for his inputs on this contribution. The author would also like to thank Gabriel Candil, Yvan Mollier and Fabio De Angelis (all working with large MNEs) for their comments.

[1] For a more recent update on this topic, see OECD/G20, Statement by the OECD/G20 Inclusive Framework on BEPS on the Two-Pillar Approach to Address the Tax Challenges Arising from the Digitalisation of the Economy, January 2020.

[2] For example, Company R could also own a Group IP Holding Company. The IP Holding company, which performs the DEMPE related activities, could then license the IP to Company P.

[3] The proposal is applicable to businesses that carry out Automated Digital Services (ADS) or businesses that are consumer facing businesses. For a discussion on the scope, see OECD/G20, supra n. 1, paras. 14-32.

[4] It is expected that Amount A will only apply to MNE Groups whose revenue exceeds Euro 750 Million. For a discussion on the revenue threshold, see OECD/G20, supra n. 1, para. 35.

[5] For a discussion on the new nexus, see OECD/G20, supra n. 1, paras. 36-41.

[6] For a discussion on Amount A, see OECD/G20, supra n. 1, paras. 42-47. For a detailed discussion on this method, see V.Chand, Allocation of Taxing Rights in the Digitalized Economy: Assessment of Potential Policy Solutions and Recommendation for a Simplified Residual Profit Split Method, Intertax available on https://www.kluwerlawonline.com/abstract.php?area=Journals&id=TAXI2019106

[7] Public Comments, Johnson and Johnson, p. 5; See Public Comments, Skadden, p. 4.

[8] For a discussion on relief from double taxation, see OECD/G20, supra n. 1, paras. 48-52.

[9] Public Comments, Uber, p. 10; Public Comments, Amazon, p. 8; Public Comments, Nestle, p. 12; Public Comments, Skadden, p. 6; Public Comments, Digital Economy Group, p. 5; Public Comments, KPMG, p. 13; Public Comments, EY, p. 13. These comments are available on https://www.dropbox.com/s/3pb98p1o3qnz3me/oecd-public-comments-secretariat-proposal-unified-approach-november-2019.zip?dl=0

[10] See OECD/G20, supra n. 1, para. 50.

[11] See OECD/G20, supra n. 1, p. 15.

[12] For a discussion on Amount B, see OECD/G20, supra n. 1, paras. 58-64.

[13] OECD, Revised Guidance on the Application of the Transactional Profit Split Method, OECD/G20 Base Erosion and Profit Shifting Project (OECD 4 Jun. 2018).

[14] See OECD/G20, supra n. 1, paras. 56-57.

[15] Also see Public Comments, Skadden, p. 4.

[16] See OECD/G20, supra n. 1, paras. 65-82.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.