There are several misconceptions in international taxation, some of them more pervasive than others. Many are often repeated by speakers at tax conferences without being contradicted.

The first is the so-called interest deduction bias. It is not the main topic of this blog, but I will deal with it by way of introduction.

The Interest deduction bias

The argument goes something as follows: “Because interest is deductible and dividends are not, taxpayers prefer debt over equity”. The world is not that simple:

- it depends on the debtor and creditor tax rates. If ACo in a 33% tax jurisdiction holds all the shares in BCo in 12.5% tax jurisdiction, ACo will general prefer financing BCo with equity rather than debt, especially if ACo’s dividends received are tax exempt;

- it depends on the withholding taxes. If a jurisdiction (take many South American countries), have 0% withholding taxes on dividends and 15% withholding tax on interest (in combination with interest deduction limitations), then parents will generally prefer financing local subsidiaries with equity, rather than debt.

It is true however, that in a 25% tax jurisdiction, ZCo has to earn an EBIT of 100 to pay its creditors 100 in interest, whereas ZCo has to earn an EBIT of (x/75=100 => x=) 133.3 to pay its shareholders 100 in dividends. This is generally what the interest bias argument is supposed to cover. However, even that argument needs to be nuanced when considering the ZCo’s creditor/shareholder’s after tax position. If the creditor is in a 25% tax jurisdiction as well, it would pay 25 in tax on its 100 interest income, leaving it with 75 after tax income only. This is the same amount as it would have from a ZCo dividend after tax, either because the dividends are tax exempt, or because the dividends are taxable and the shareholder gets an indirect tax credit.

So the only situation where ZCo’s financiers would have a “natural preference” for debt over equity would be where:

- they do not get an indirect tax credit or exemption (i.e. they are typically smaller than 10% shareholders, in which case they have little influence over the way in which ZCo’s finances are arranged in any case), or

- they are subject to a lower tax rate than ZCo itself is.

That is a very different story than the carte blanche statement of “Because interest is deductible and dividends are not, taxpayers prefer debt over equity”

Applying the wrong comparable: because dividend income is exempt, related costs should be non-deductible

I was recently attending a tax conference where a speaker declared that it was good thing that under the EU’s Common Corporate Tax Base proposals participation exemption, costs related to the participation were not deductible, as the denial of cost deductions for exempt income creates symmetry.

To understand why the symmetry argument is flawed, one has to go back to the very reason for introducing a participation exemption in the first place, which is to prevent double economic taxation of the same profits. E.g. ACo holds BCo which holds CCo which holds DCo; all are subject to 25% income tax; DCo makes 100 profit taxed at 25%; it pays a dividend of (100 – 100 * 25% =) 75 to CCo which is taxed at 25%; CCo pays a dividend of (75 – 75 * 25% =) 56,25 which is taxed at 25%; CCo does the same to BCo and BCo to ACo, which ends up with a total after tax dividend of 31.64%. Not good.

- Denying CCo, BCo or ACo a deduction for the costs incurred in acquiring their dividends does absolutely nothing for achieving the goal of preventing economic double taxation. To the contrary, it reintroduces economic double taxation, but then at creditor debtor level, instead the parent subsidiary level: it is like hitting someone (with double tax), putting a bandage on the wound and then hitting them again because they have a bandage.

- Denying CCo, BCo or ACo a deduction also has nothing to do with economic double non-tax: the subsidiary profits have been taxed already and the shareholder’s creditor is still subject to tax over its interest income, even when the shareholder receives exempt income.

So the economic double taxation introduced at the creditor debtor level cannot be justified by the exemption at parent subsidiary level if that exemption was a remedy against economic double taxation in the first place.

That the economic double taxation arising between a parent and its creditors should be addressed, is a matter of symmetry and consistency. The OECD, the EU and all the governments should not be seen to be deeply concerned about DNI (deduction, no inclusion), if they do not care about the shoe on the other foot, being IND (inclusion, no deduction). So, is there a fair reason behind the denial of interest deductions for exempt dividend income? I am afraid there is.

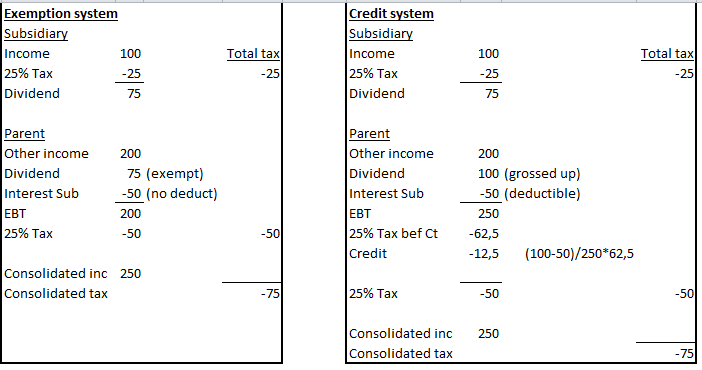

It lies in finding the right comparable situation, being that of a parent and a subsidiary where the dividends received by the parent are taxable with a credit given for the underlying taxes. Both the exemption and the credit serve the same purpose of preventing economic double taxation and an accumulation of corporate income tax on profit distributions. If the outcomes are different, then either one is providing double tax relief where profits have not been taxed, or the other partially fails at avoiding double tax (I am ignoring the so-called second limitation on tax credits for the sake of brevity). As the calculations below show, an exemption system would be unfairly advantaged over a credit system, where the credit is provided over the net foreign income (as most countries to my knowledge do), instead of the gross foreign income.

As can be seen above, in both cases the subsidiary has 100 EBT; the parent has 200 other income and 50 interest costs related to its dividend income; the tax rate is 25% in both the parent and the subsidiary countries; and the total tax due is 75. If the exemption country allowed the parent to deduct its dividend related interest of 50, the exemption parent would be subject to (50 x 25% =) 12.5 less corporate income tax than the credit parent and that would not be symmetrical / treating equal situations unequally.

That leaves us with the weaknesses of the credit system in general:

- a bias to capital export neutrality which runs contrary to a common market;

- leading to double taxation where the shareholder’s costs are larger than its subsidiary’s taxable income (because it is a one way link from subsidiary to parent only); and

- leading to double taxation where the subsidiary tax rate is higher than the parent tax rate (and the parent country only gives a partial tax credit). The parent rate tax rate is especially easy to surpass where the subsidiary country levies a dividend withholding tax on top of a corporate income tax.

A better system to follow would be that of an exemption with cost deductions, matched by a credit system with credit for gross income as this will eliminate the economic double tax between debtor and creditor whilst reducing the instances of economic double taxation between shareholders and subsidiaries. Instead, we end up creating symmetry at the lowest common denominator.

Conclusion

As much as I don’t like the fact that costs related to exempt income are non-deductible, because it creates economic double taxation between debtor and creditor, I have to acknowledge that allowing such a deduction does create asymmetry between tax exempt dividends and taxable dividends with underlying tax credits. However:

- there are other ways to achieve this symmetry; and

- to say that because dividend income is exempt, related costs should be non-deductible remains a strawman fallacy.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.