In his last State of the Union speech on January 13, 2016 Obama put it quite clear: “The United States of America is the most powerful nation on Earth. Period. It’s not even close.”

With this statement Obama obviously addressed the position of the United States in terms of military capacity and its position in the world economy. However, the question arises whether the United States under Obama – or its successor (Trump?) – will show its power by shutting down international tax loopholes. Because if it doesn’t, other countries, especially the Member States of the European Union, seem suddenly eager to tax the so-called “stateless income”. Will the most powerful nation on Earth let this happen…?

Reverse hybrids

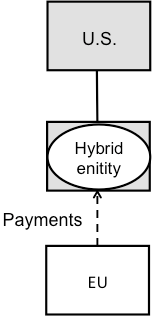

It is all about the so-called reverse hybrid entities in international tax structures.[1. In international tax practice this loophole is called a “reverse hybrid” because in contrast to many other loopholes the hybrid entity is the receiver of the payments. In other hybrid mismatch structures the hybrid entity is mostly the entity making the payment.] For decades, many U.S.-based multinational companies investing in Europe use these structures. An example is the Dutch CV/BV-structure. In a simplified way, the basics of these structures can be illustrated as follows:

The EU company may deduct payments paid to the hybrid entity resulting in a lower EU tax base. These payments include interest, royalties, rents and payments for services. The payments are not currently taxed at the level of the hybrid entity receiving it or at the level of the U.S. parent company. The result is often called a D/NI-outcome (where “D” stands for Deduction and “NI” stands for No Income).

The underlying cause of the D/NI-outcome is a mismatch between tax systems. From the perspective of the EU Member State the hybrid entity is tax transparent, while from an U.S. perspective the hybrid entity is non-transparent. This makes an EU Member State think that the payments are directly paid to the U.S. parent company and are taxed under the U.S. tax system. However, the U.S. is not taxing anything because it believes the payments are received by a taxable entity outside the U.S. No need to say the income ends up being “stateless”.

Recommendations OECD

Undoubtedly, the solutions recommended by the OECD to counteract this mismatch in tax outcome are very exciting from a tax policy perspective.[2. See the final report on BEPS Action 2: Neutralising the Effects of Hybrid Mismatch Arrangements, OECD, 2015.] It is suggested first that the U.S. should include the payment in the ordinary income of the U.S. parent company despite of the fact that the hybrid entity receives it. This would require a radical change in U.S. off shore taxation, for instance an amendment of the U.S. rules on taxation of Controlled Foreign Companies (CFC-legislation).

Subject to a number of conditions the OECD suggests a second-best option. If the U.S. will not include the payment in the ordinary income of the U.S. parent, the EU Member State can proceed to tax the hybrid entity as if it was an ordinary resident taxpayer.

The final and lowest ranked option suggested by the OECD is to skip the deduction at the level of the EU company making the payment to the hybrid entity.

Tip of the iceberg

With these three options on the table, U.S. based firms with subsidiaries in the EU have no clue yet what is going to happen. Are they really about to lose a widespread possibility to generate stateless income in the future? Policymakers in the U.S. and EU don’t seem to have made any choice yet.

However, recently a tip of the iceberg has become visible. From the draft proposal of the EU Directive against base erosion and profit shifting (“Anti-BEPS Directive”) it can be derived that EU Member States shall treat a hybrid entity no longer as tax transparent to the extent its income ends up being stateless.[3. See http://data.consilium.europa.eu/doc/document/ST-14544-2015-INIT/en/pdf (art. 12, par. 2).] This solution shows similarities with the second-best option recommended by the OECD and intends to include the hybrid entity as a taxable company under the tax laws of the EU Member States.[4. This intention seems to fail in any case in which the hybrid entity is not established under the laws of a EU Member State and has its effective place of management outside the EU.]

U.S. power play?

Now the EU has put its cards on the table, the million-dollar question is whether taxation of the hybrid entities by EU Member States will ever become reality.

It seems hard to imagine the U.S. would accept EU Member States to put a higher tax burden on U.S. firms just because of counteracting some technical hybrid mismatch in tax outcome. From an international tax law perspective the income of the hybrid entity is not generated in the EU whatsoever.[5. This because of the fact that the payments from the EU company to the hybrid entity are priced at arm’s length.] Moreover, the U.S. Treasury could end up paying the price because the additional taxation at EU level seems eligible for a foreign tax credit in the U.S. (if the hybrid entity would repatriate the income to the U.S. parent company).

Given that this first move by the EU indicates it is planning to tax the hybrid entity, I expect one of two following scenarios to happen.

Under the first scenario the U.S. will act fully in line with the OECD recommendations and amend its CFC-legislation by taxing the payment received by the hybrid entity at the level of the U.S. parent (as ordinary income). In this scenario the EU claim to tax the income will automatically be withdrawn.

Under the second scenario the U.S. isn’t going to change its CFC-legislation but will use its power to protect U.S. interest anyway. Recent concerns expressed by U.S. Senate Finance Committee Members about the consequences of EU state aid claims addressed to U.S. firms, show an increased alertness.[6. See http://www.finance.senate.gov/chairmans-news/finance-committee-members-push-for-fairness-in-eu-state-aid-investigations-.] That’s why I can’t rule out the possibility that power play of the “most powerful nation on Earth” can lead to a widespread hybrid mismatch to remain in international taxation forever.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.

Not addressing your hybrid mismatch article directly, but instead BEPS and recent EU state-aid impositions in general, Robert Stack, US Treasury official responsible for International Tax Affairs, stated to the Senate Financie Committee on December 1, 2015 that the US Treasury is concerned that the EU Commission appears to be disproportionately targeting U.S. companies.

Moreover, US Treasury is of the opinion that these actions potentially undermine U.S. rights under our tax treaties (given the US imposition of FATCA and other tax treaty overrides, you’ll snicker at that argument).

Regardless, and mopst importantly, U.S. Treasury is concerned that the EU Commission is reaching out to tax income that no member state had the right to tax under internationally accepted standards. Rather, from all appearances to the eyes of the US Treasury, the EU Commission is seeking to tax the income of U.S. multinational enterprises that, under current U.S. tax rules, is deferred until such time as the amounts are repatriated to the United States. Robert Stack stated “The mere fact that the U.S. system has left these amounts untaxed until repatriated does not provide under

international tax standards a right for another jurisdiction to tax those amounts.”

Senator Orrin Hatch (Utah), Chairperson of the Senate Finance Commt, stated in December 2015 that the EU Commissions “state aid” remedies and recent activities in the Eurozone look like attempts to impose retroactive taxation on a number of U.S.-based multinational companies.

And about BEPS he stated: “At the same time, while international efforts to align tax systems are worth exploring, we shouldn’t be negotiating agreements that undermine our own interests for the sake of some supposedly higher or nobler cause. The interests of the United States – our own economy, our own workers, and our own job creators – should be our sole focus.”

On January 15, 2016, the Finance Committee Members (Republicans and Democrats jointly) sent a letter to US Treasury stating that if the EU Commission imposes retroactive state aid penalties that impact US MNEs, then the US should respond with IRC Section 891 that allows the USA to double the tax rates on governments that “re-capture” that state aid.

Netherlands, Belgium, Luxembourg, and Ireland will need to tread cautiously. IRC Section 891 allows up to an 80 percent corporate tax rate to be applied to members of MNE groups of countries. IRC Section 891 states that under the laws of any foreign country, U.S. corporations are subjected to discriminatory or extraterritorial taxes, US tax may be doubled, up to a maximum 80 percent, for corporations of such foreign country.

Howdy Prof. van de Steek!

Not addressing your hybrid mismatch article directly, but instead BEPS and recent EU state-aid impositions in general, Robert Stack, US Treasury official responsible for International Tax Affairs, stated to the Senate Financie Committee on December 1, 2015 that the US Treasury is concerned that the EU Commission appears to be disproportionately targeting U.S. companies.

Moreover, US Treasury is of the opinion that these actions potentially undermine U.S. rights under our tax treaties (given the US imposition of FATCA and other tax treaty overrides, you’ll snicker at that argument).

Regardless, and mopst importantly, U.S. Treasury is concerned that the EU Commission is reaching out to tax income that no member state had the right to tax under internationally accepted standards. Rather, from all appearances to the eyes of the US Treasury, the EU Commission is seeking to tax the income of U.S. multinational enterprises that, under current U.S. tax rules, is deferred until such time as the amounts are repatriated to the United States. Robert Stack stated “The mere fact that the U.S. system has left these amounts untaxed until repatriated does not provide under

international tax standards a right for another jurisdiction to tax those amounts.”

Senator Orrin Hatch (Utah), Chairperson of the Senate Finance Commt, stated in December 2015 that the EU Commissions “state aid” remedies and recent activities in the Eurozone look like attempts to impose retroactive taxation on a number of U.S.-based multinational companies.

And about BEPS he stated: “At the same time, while international efforts to align tax systems are worth exploring, we shouldn’t be negotiating agreements that undermine our own interests for the sake of some supposedly higher or nobler cause. The interests of the United States – our own economy, our own workers, and our own job creators – should be our sole focus.”

On January 15, 2016, the Finance Committee Members (Republicans and Democrats jointly) sent a letter to US Treasury stating that if the EU Commission imposes retroactive state aid penalties that impact US MNEs, then the US should respond with IRC Section 891 that allows the USA to double the tax rates on governments that “re-capture” that state aid.

Netherlands, Belgium, Luxembourg, and Ireland will need to tread cautiously. IRC Section 891 allows up to an 80 percent corporate tax rate to be applied to members of MNE groups of countries. IRC Section 891 states that under the laws of any foreign country, U.S. corporations are subjected to discriminatory or extraterritorial taxes, US tax may be doubled, up to a maximum 80 percent, for corporations of such foreign country. When the lobby of the top US MNEs gets the Dems and the GOP on-board for a very rare common front, EU watch out.

Interesting that today’s EU Commission State Aid decisions regarding no taxation of port operating companies in France, Belgium and Italy are only prospective remedies, whereas the Starbucks, FIAT, and Belgium excess profit are retroactive ones (aka penalties).

Why the different treatment?

This was a very interesting article. Thanks for sharing it. My practice does not involve MNEs so I am only peripherally involved in this area through my general readings. Dear Prof. Byrnes -Thank you for your mention of Sec 891, a Code section of which I was previously unaware. I shall do some more reading on this. Do you know of cases where it was ever actually applied?