Practical Issues of the Anti-Hybrid Rule in the Parent Subsidiary Directive

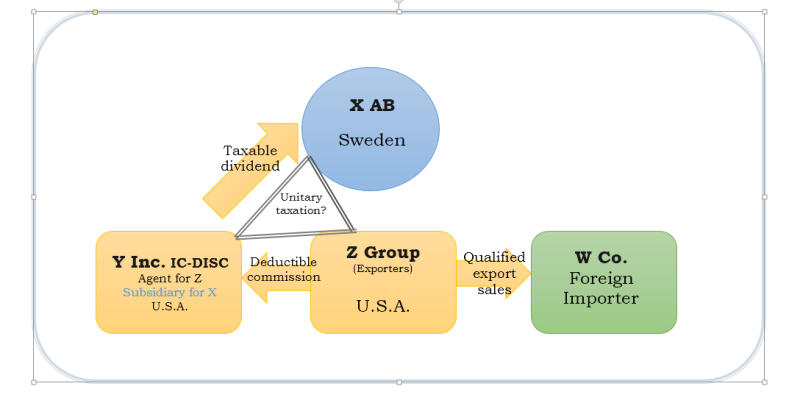

In a recent post, Professor Werner Haslehner raised an interesting discussion on the new wording of Article 4.1 (a) of the Parent-Subsidiary Directive (“PSD”), which obliges the Member State of the parent company to tax the dividends received to the extent that the corresponding payment are deductible from the corporate income tax paid by the…