- Purpose of the blog: To analyze the recent ruling of the US tax court (‘the Court’) in the case of The Coca-Cola Company (TCCC).

- Ruling: The US Tax Court, for the years 2007-09, ruled TCCC was under-compensated by its associated enterprises (AEs) for the use of intellectual property, and confirmed an addition of approximately USD 9.5 billion to the royalty income of TCCC.

- Key Observations – In a detailed ruling, the Court has made several observations while reaching its conclusion. In order to dissect the ruling with brevity, key observations have been summarised below:

-

- Bottlers, who characterized their business with TCCC as interdependent, were accepted as independent and “uncontrolled” for the purposes of arriving at an arm’s length price (ALP). The ruling does not cite any observations to indicate the converse perspective of bottlers being considered “uncontrolled”.

- The Court ruled bottlers could be treated as comparable to concentrate manufacturers, for applying the Comparable Profits Method (despite differing functions, risks, incomparable contractual terms, and ownership of intangibles).

- The Court ruled the ratio of Operating Profit/ Return on Assets could be an appropriate Profit Level Indicator (PLI) in the situation[1]. From the facts and observations, it appears neither bottlers nor concentrate manufacturers were performing routine manufacturing functions. Moreover, the use of Return on Assets as a PLI is often critiqued and highly debatable[2].

- The Court made interesting observations highlighting the importance of legal ownership of intangibles in the context of advertising spends[3]. The Court relied on Treasury Regs 1.482-4(3)(ii)(A) to conclude legal ownership was the test for identifying intangibles.

- The Court additionally reallocated some amount invoiced by the Service companies to bottlers. These were reallocated to the concentrate manufacturing supply points, as having been under-invoiced by them.

- The Court ruled non-inclusion of explanatory statements as directed by Rev Procedure 99-32, 1999-2 CB 296, while claiming dividend offset treatment, was not fatal to TCCC’s claim.

- The Court made observations on aspects such as the sanctity of the legal and taxable entity vis-à-vis a ‘business unit’ concept and importance of documentation.

What follows is an attempt to view the facts of the case[4] and Court’s observations from the lens of global transfer pricing framework.

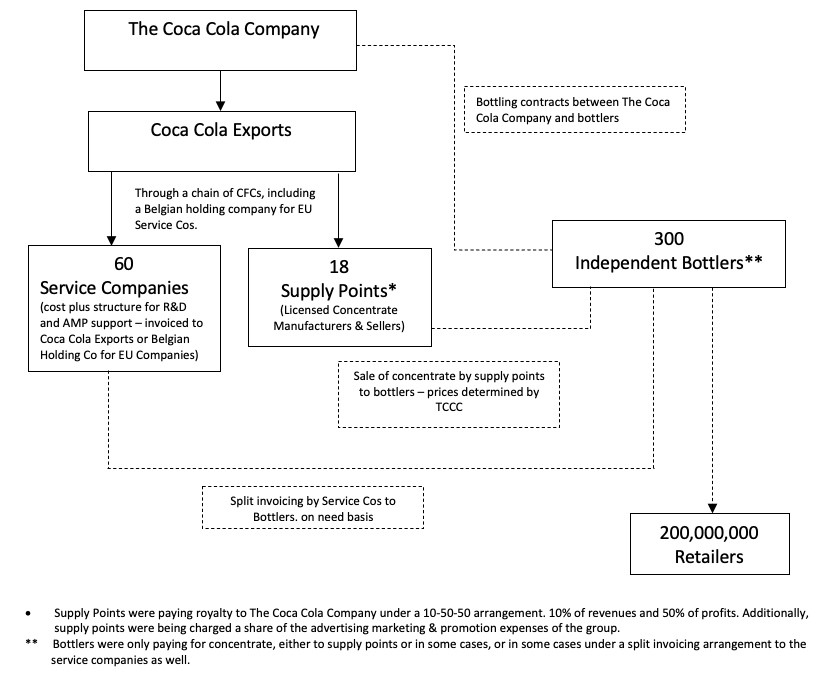

A brief overview of the structure is given as Figure 1 below:

- Analysis – Were the bottlers indeed “uncontrolled”?

Facts: TCCC’s had a network of bottlers entitled to the entire sale proceeds from TCCC’s products in their respective markets. The bottlers remunerated TCCC through the price they paid for concentrate.

With the concentrate price, bottlers also secured the right to use TCCC’s trademarks, access to TCCC-approved suppliers, database marketing materials, and right for ongoing consumer marketing support.

TCCC reserved the unilateral right to set the concentrate price, which in theory enabled it to determine the bottler’s profitability[5].

The bottler agreements granted TCCC the right to review and approve bottlers’ annual business plans and update TCCC regularly on its implementation.

CCE, one of the top three Coca-Cola bottlers, described its relationship with TCCC as “interdependent” in its annual report filings[6].

A bottler’s poor performance or financial woes resulted in TCCC’s solution to acquire the bottler, put it into its “bottler hospital,” and supervise its operations from Atlanta headquarters until it had recovered financially and operationally. TCCC could thereafter divest the bottler to new owners retaining its bottler contract.

Analysis: The word controlled is defined under the US Treasury Regs1.482-1(i)(4) to include “control through acting in concert or with a common goal or purpose[7]. While the Court did not delve into the interpretation aspect, given the facts, it would be interesting to see if bottlers qualify as uncontrolled under the US Treasury Regs.

The OECD Guidelines define uncontrolled transactions to mean transactions between enterprises that are independent enterprises with respect to each other[8].

Indian Transfer Pricing laws specifically provide an inclusive, expansive definition of AEs to include businesses wholly dependent on the intangibles of an unrelated company[9]. Additionally, when concentrate manufacturers, being TCCC group entities, sell concentrate to ‘independent’ bottlers, but the terms are determined in substance between bottlers and the TCCC, the transaction would be deemed to be an international transaction between AEs[10].

Will the bottlers qualify as “uncontrolled” – this appears debatable. Assuming there was an AE relationship, and the terms of contract were determined, would demonstration of ALP in an uncontrolled situation where comparable price was charged, be adequate – this aspect remained unexamined. Whereas these could be more fact driven, the Court ought to have performed a detailed enquiry. In India, the Delhi High Court in the case of Rolls-Royce Singapore[11] recalled its order to perform a factual enquiry in relation to an agency relationship with an independent Indian company, since the terms of the agreement suggested an element of control on the quantum of commission earned by the agent.

- Points of enquiry with regard to bottlers being comparable with the supply points under a Functions, Assets & Risks (FAR) analysis

Facts: There were several differences in the way contracts were structured with bottlers and concentrate manufacturers. Agreements with the supply points were usually for a 12-month period, whereas bottlers were explicitly granted long-term rights (5-10 years). The supply points were permitted to exclusively sell concentrate to TCCC-approved bottlers. Bottlers had freedom to sell beverages to wholesalers or retailers of their choice, subject to territorial caveats.

The Court additionally made significant observations on the ownership of intangibles by the bottlers[12]. The Court’s observation on ownership of intangibles by bottlers assumes significance, since the Court also ruled bottlers are comparable to the supply points[13].

Our view is there was a vast difference between the FAR of bottlers and supply points. Moreover, it was not demonstrated using Return on Assets as a PLI eliminated the impact of such differences – in fact the Court has in great detail described intangibles of the bottlers. Such differences could have been material enough to warrant rejection of bottlers as comparables, contrary to the Court’s general observation[14].

In our view, the Court also committed an error in its observation, when it held the method used was conservative, if in view of the facts, bottlers should have been entitled to a higher relative return.

- Analysis – Advertising and marketing spend vis-à-vis creation of intangibles

Facts: TCCC was the registered legal owner of virtually all of the trademarks and other intangible assets necessary to manufacture and sell Coca-Cola, Fanta, Sprite, and other TCCC-trademarked beverages. However, according to TCCC, these were in effect “wasting assets”. What kept its products fresh in consumers’ minds, were the billions of dollars spent annually on television advertisements, social media, and consumer marketing. TCCC arguments to look beyond legal ownership and instead to “marketing intangibles” such as “marketing- related IP” or “IP associated with trademarks” did not find favor[15].

The Court, in our view, even from an accounting standpoint, having accepted audited accounts, ought to have recognized the principle of “going concern” is core to accounting, when it observed TCCC could terminate the supply contracts at will. If such termination was a focal point of concern, could the Court have made enquiries beyond what the auditors opined, remains to be seen.

Similarly, allocation of marketing expenses and royalties were not qualified by the auditors. The fact remains TCCC’s ownership of legal IPs was continuously enhanced with advertising spends, which fact the Court could not appreciate. Costs pertaining to these were proportionately absorbed by the supply points, and thus the allocation of marketing spends and the remuneration to TCCC under the 10-50-50 principle were acceptable from an accounting standpoint given that the sale consideration received by the supply points (for concentrates) was all-encompassing.

With respect to intangibles generated by marketing spends, the OECD Guidelines note[16] “Intangibles that are important to consider for transfer pricing purposes are not always recognised as intangible assets for accounting purposes”.

There’s a growing debate in market jurisdictions such as India where Courts have ruled disproportionate AMP expenses create intangibles or provide benefit to the AEs, which need to be factored into a transfer pricing analysis. Though, the larger debate is before the Supreme Court for its final view, the view of High Courts[17] largely supports that unless its discernable from the terms of the contract that there was an obligation to incur such advertising costs, which a routine distributor, in an uncontrolled situation may or may not incur, the approach of the tax administration was faulted, and an important jurisdictional requirement was breached. In the Indian cases, the Courts were dealing with situations where it was not denied that the relationship was that of an AE.

With regards to the Court’s observation on the profitability of the supply points being more than that of TCCC, reference can be drawn to para 6.47 of the OECD TP Guidelines “a determination that a particular group member is the legal owner of intangibles does not, in and of itself, necessarily imply that the legal owner is entitled to any income generated by the business after compensating other members of the MNE group for their contributions in the form of functions performed, assets used, and risks assumed.”

Summary: The AMP spends accounted for by the supply points could be considered as intangibles for the purposes of transfer pricing[18].

The Court’s observations on quality of documentation finds multiple mention; from contracts being ‘terse and incomplete’ to lack of documented basis of expense allocations etc. It appears the Court would have been more receptive to some of TCCC’s grounds had it been able to derive greater comfort from the documentation.

- Conclusion: Overall, the ruling leaves open two fundamental issues:

Whether conclusion on using margins earned by bottlers as benchmarks was right: were bottlers independent, truly comparable based on the FAR analysis, was return on assets an appropriate PLI. It appears even if bottlers were to be considered independent, they perhaps did not offer the right benchmark set for concentrate manufacturers. In any event, return on assets seems an inappropriate PLI given the Court’s own extensive observation on the interplay of intangibles.

Whether AMP expenses of the supply points truly did not create intangibles? For an organization, which prides itself on its global brand recognition – “Coca-Cola is the best-known brand in the world, recognized by more of the planet’s 7.7 billion inhabitants than any other English word but “OK.””. This seems impossible without sustained AMP, a share of which was undisputedly being borne by the supply points.

[1] The Court did observe by way of a footnote (no. 40) TCCC did not dispute application of Return on Assets as a PLI.

[2] As an example, see this blog https://blog.royaltystat.com/returns-on-assets-roa. At footnote 40 of the Ruling, the Court also noted the petitioner’s concern to use of ROA in view of the intangible assets owned by the supply points.

[3] The Court observed as under: “No authority for the proposition that spending money on consumer advertising, without more, gives rise to freestanding intangible assets as a matter of economic substance”. The Court also observed if a company attempted to capitalize its ordinary advertising expenses as intangible assets, “we suspect a bank would be hesitant to lend against that security”. The Court further went on to rule “even if advertising could be capitalized as intangible assets, TCCC failed to show how this would comport with economic substance, when advertising by the supply points supported “somebody else’s products” (being TCCC’s products).”

[4] Brief facts: TCCC is incorporated and a tax resident in the US. TCCC has a wholly owned subsidiary, The Coca-Cola Export Company (Exports), which is also incorporated and tax resident in the US. Exports, through a chain of Controlled Foreign Corporations, owned 60 service companies and 18 manufacturing affiliates (Supply Points), located across the globe. During the period 2007-2009, Supply Points dealt with 300 bottlers which in turn served 200 million retailers.

TCCC was the legal owner of all the registered intellectual property which included trademarks, brandnames, logos, patents[4]. TCCC also owned the secret formulas and the proprietary manufacturing process. The service companies had R&D centers and were responsible for local advertising, in-country marketing to consumers and supervising relationships with bottlers. The Supply Points manufactured the concentrate based on intellectual property (IP) supplied by TCCC, and additionally financed consumer advertising in foreign markets, by way of an expense allocation in their books of accounts. The concentrate manufactured by the supply points were sold to independent bottlers who produced the beverages and marketed the same to retail establishments.

TCCC had entered into a Closing Agreement with the IRS in the year 1996. The agreement was for the period 1987-1995, whereunder supply points could compensate TCCC under a 10-50-50 rule (10% of gross sales by supply points plus 50% of the profits to be split with TCCC). The agreement also provided the Supply Points could discharge their obligations either by way of royalties or by repatriating through dividends. TCCC continued this method for the period 2007-09 also.

[5] The Ruling notes in the real world, “concentrate prices were established through local negotiations.” Generally, the parties’ goal was to achieve something like a 50%-50% split of the System profit. In practice, the division usually ranged between 45% and 55% in favor of one party or the other. TCCC and its bottlers implemented an informal “true up” strategy to ensure that marketing expenses were split roughly 50-50 between them.

[6]While the [bottler] agreements contain no automatic right of renewal * * * we believe that our interdependent relationship with TCCC and the substantial cost and disruption to that company that would be caused by non-renewals ensure that these agreements will continue to be renewed.

[7] https://www.irs.gov/pub/default_path_no_value/isi_c_06_02.pdf

[8] Definitions under OECD Transfer Pricing Guidelines 2017.

[9] Section 92A(2)(g) of the Income-tax Act, 1961

[10] Section 92B(2) of the Income-tax Act, 1961

[11] Rolls Royce Singapore Pvt. Ltd. Vs Assistant Director Income Tax (Delhi High Court) Appeal Number: Rev. Pet. No. 658 of 2011 in ITA No.1278 of 2010

[12] The Court observed as under:

The bottlers owned and controlled genuine intangible assets in the form of retail distribution networks, sales forces, and customer lists–each deriving from the bottlers’ relationships with tens of thousands of wholesale and retail customers. The supply points held no comparable assets: They sold concentrate to bottlers as directed.

As compared with supply points, bottlers also had a much stronger claim to intangibles in the form of “long-term franchise rights.” The supply points had no comparable leverage over the Company and thus no plausible claim to “long-term franchises”.

The bottlers’ trade marketing activities were extensive and varied. Bottlers managed most price promotions. Bottlers often integrated these retail promotions with the Company’s global sponsorship campaigns and consumer marketing themes–a good example of how consumer marketing and trade marketing were “mutually reinforcing.”

All in all, we find that the bottlers, as compared with the supply points, owned far more intangible assets and invested at least as much in marketing that directly benefited petitioner’s brands.

[13] The Court ruled because they operated in the same industry, faced similar economic risks, had similar (but more favorable) contractual and economic relationships with petitioner, employed in the same manner many of the same intangible assets (petitioner’s brand names, trademarks, and logos), and ultimately shared the same income stream from sales of petitioner’s beverages. The Court also observed “We find that the bottlers in many respects enjoyed an economic position superior to that of the supply points, which would justify for the bottlers a higher relative return. Dr. Newlon’s choice of methodology was thus conservative. “

[14] At Page 195, the Court observed “concentrate and hamburger are not similar products” – the authors seek the liberty to state from an economic and commercial standpoint, bottlers and concentrate manufacturers were equally chalk and cheese in terms of their business and contractual models, and FAR profile.

[15]The Court relying on the DHL ruling held, “We find no support for petitioner’s argument in law, fact, economic theory, or common sense. The regulations “explicitly state that legal ownership is the test for identifying the intangible.”

Additional noteworthy observations of the Court were as under:

Petitioner’s first problem is its failure to explain how and why particular costs were allocated to particular supply points.

Second, petitioner has cited no authority for the proposition that spending money on consumer advertising, without more, gives rise to freestanding intangible assets as a matter of economic substance. If a debtor attempted to capitalize its ordinary advertising expenses as intangible assets, we suspect a bank would be hesitant to lend against that security.

Third, even if advertising expenses could properly be capitalized as intangible assets, petitioner has failed to show this treatment would comport with economic substance when the advertising supports somebody else’s product.

TCCC owned virtually all the intangibles relating to manufacture and sale of its branded beverages. To the extent the ServCos’ advertising expenditures added value, they added value to the trademarks and brands that TCCC owned. These expenditures did not create new, freestanding intangible assets in the hands of the ServCos or the supply points.

Petitioner’s own past practice shows that the supply points, in economic substance, did not own “marketing intangibles.” Petitioner’s agreements with the supply points were terminable (and frequently were terminated) by TCCC at will.

Level of profitability is more than sufficient to explain their (supply points’) willingness to absorb the consumer marketing costs petitioner allocated to them.

[16] Para 6.7 of the 2017 OECD Transfer Pricing Guidelines.

[17] [2015] 64 taxmann.com 150 (Delhi)[11-12-2015] Maruti Suzuki India Ltd. vs. Commissioner of Income-tax, [2016] 65 taxmann.com 141 (Delhi)[23-12-2015] Bausch & Lomb Eyecare (India) (P.) Ltd. vs. Additional Commissioner of Income-tax, [2015] 64 taxmann.com 324 (Delhi)[22-12-2015]

Commissioner of Income-tax -LTU vs. Whirlpool of India Ltd.

[18] The Court did note that if these spends were to be considered as intangibles, supply points were not compensated for these intangibles when the supply points were shut down. That’s however a separate matter and should not take away from the characterization.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.