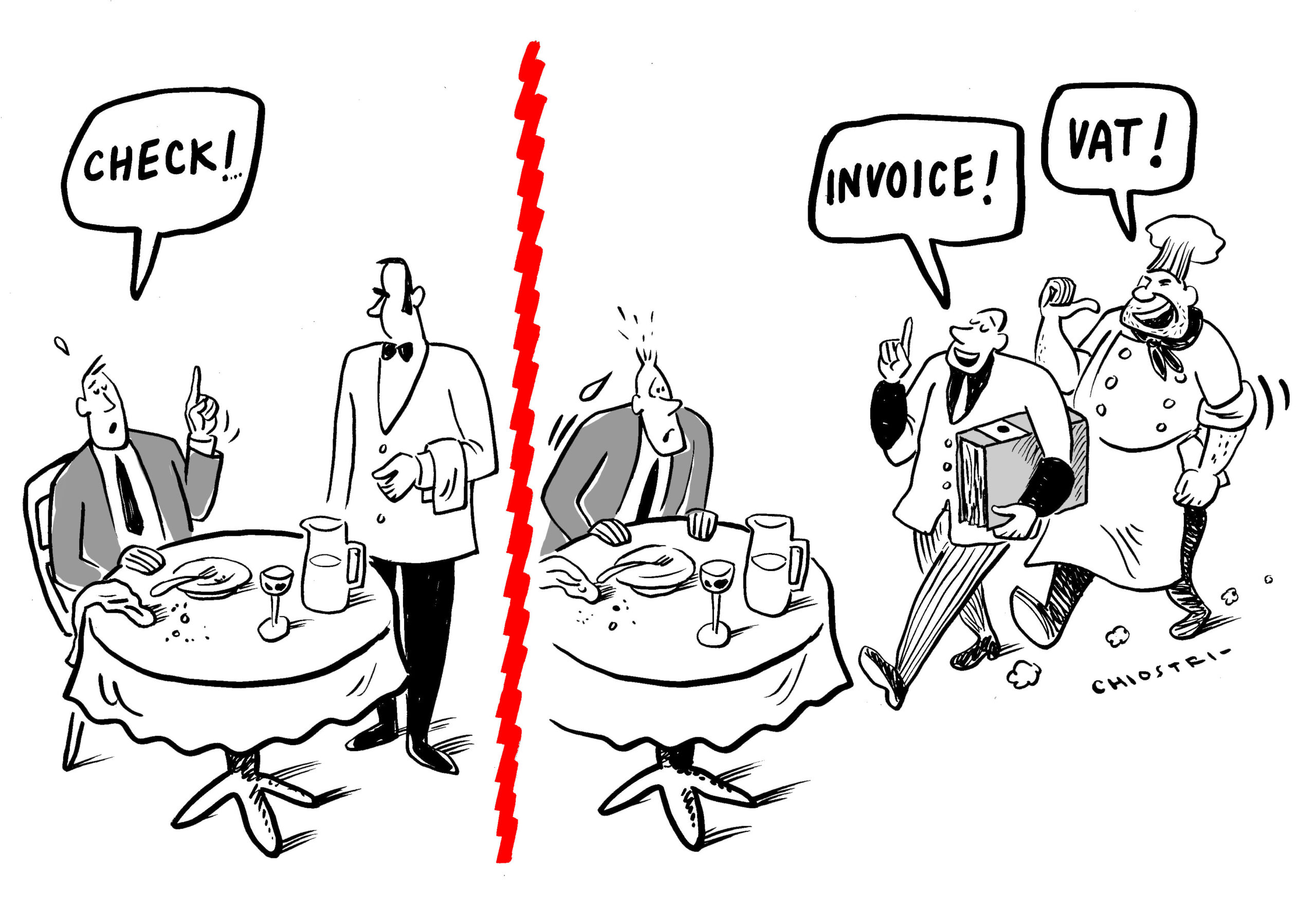

The customary request at the end of a meal for the “Check Please” might work in a restaurant – if they ever open again – but, in the VAT world, simply asking for the “check” won’t achieve the compliance goal. First and foremost, the customer has to request an invoice, not a check, and that invoice had better be in conformity with Chapter 3 of Title XI of Directive 2006/112/EC (the VAT Directive).

© 2020 Kluwer Law International B.V., all rights reserved.

A private person might wonder where to dispose of a printed invoice – at least in Germany they are commonly printed on a special kind of paper which can’t be recycled with normal paper because it uses a special kind of ink. Taxable persons, however, must know, or at least should know, that not only the right kind of paper and ink need to be used but also the kind of information that must be indicated on an invoice.

The VAT Directive sets forth very precise requirements for invoices in several provisions. Article 226, for example, sets out fourteen requirements for VAT purposes, whereas, under simplification schemes, invoices must meet at least four specific requirements. Consistent with the terms of the VAT Directive, EU Member States must implement the provisions through national, binding laws. Some parts even remain open for judicial assessment.

Germany implemented the requirements for invoices with § 14 and 14a UStG (the German Value Added Tax Act). Hence, the exertion of the right to deduct input VAT is dependent on a formally correct invoice, issued in conformity with German VAT provisions.

Now to the fundamental concern raised in this article: is every document perceived as an “invoice” correctable, leading to a retroactive input deduction, subject to a recovery of interest as well? In other words, what can taxpayers do when tax authorities do not accept presented documentation?

Two recent German Regional Finance Court decisions have addressed this question. The German legal process effectively consists of three instances.

Before answering the question in this blog as to what needs to be included in a proper invoice, one issue is whether an invoice is needed at all. First of all, there are many rulings by the Court of Justice of the European Union (CJEU) on this point and it is easy to be confused by case-law such as Senatex (in which the CJEU found that national provisions for the correction of an invoice in relation to the VAT ID not having retroactive effect are precluded by the VAT Directive), Barlis 06 (in which the CJEU prohibited the national tax authority from refusing the right to deduct VAT solely because the taxable person holds an invoice which does not satisfy the conditions required by Article 226(6) and (7) of the VAT Directive) or Vadan (in which the CJEU stated that the strict application of the formal requirement to submit invoices is contrary to the principles of neutrality and proportionality). These judgments do not lead to the conclusion that invoices are not required. Nonetheless, they do help clarify that past input VAT deductions based on a deficient invoice can be corrected with retroactive effect. Such rulings are beneficial to taxpayers because otherwise the input VAT deduction would be lost entirely or would at least be shifted to the time when the invoice has been corrected, meaning that interest would come due – currently with 6.0% in Germany. Thus, whether an old invoice can be corrected or is treated as a new invoice issued from scratch can have a dramatic impact on the overall cost to the taxpayer.

The German Federal Finance Court held that only initially incorrectly issued invoices can be corrected with retroactive effect (BFH, Judgment 15.10.2019 – V R 14/18, paragraph 38). According to this ruling, if an old invoice exists, it can be corrected – either by correction of specific mistakes or by replacement of a new invoice for the old invoice which is then cancelled. German tax authorities currently agree that an initial invoice is necessary in order to correct an old invoice with retroactive effect (BMF, Decree 18.9.2020, paragraph 6). Interestingly, the BFH was of a different view until 2016 (BFH, Judgement 20.10.2016 – V R 26/15).

So, when can an “invoice” be corrected? Or to be even more precise, what are the requirements for any document to be deemed an invoice that can later be corrected without incurring interest losses? These incurring interest losses would stem from the fact that the authorities would grant the input deduction at the time of the corrected invoice and not with retroactive effect dating back to the original invoice date.

The BFH ruled in 2012 (BFH, Decision 20.07.2012 – V B 82/11) that an invoice exists if the following five pieces of information are present:

- the name of the issuer of the invoice;

- the name of the recipient of the supply;

- a description of the supply rendered;

- the consideration paid for the supply; and

- the openly stated VAT actually paid.

It suffices that the invoice contains these pieces of information and that the information is not as indeterminate, incomplete or obviously incorrect equalling missing information (BFH, Judgment 20.10.2016 – V R 26/15, paragraph 19).

Now to the two Regional Finance Court cases.

Lower Saxony Finance Court, Judgment 11 K 324/19 of 17.09.2020

In this case, the taxpayer sought to deduct input VAT with an invoice of an erroneously reported reverse-charge mechanism transaction. The invoice in question lacked the minimum information as regards openly stated VAT. However, the issued invoice satisfied the rules for invoicing in reverse charge situations. The local Tax Office took the existing case-law by its literal meaning and it simply found that the documentation at hand was not an invoice and, hence, the taxable person could not claim any input VAT deduction. More in detail, the Tax Office held that information such as “0% tax rate”, “tax amount of 0€” or the addendum “tax exempt” could not lead to the conclusion that an invoice was issued, since no openly stated VAT amount was indicated therein. Further, in the view of the Tax Office, the principle of neutrality does not call for retroactive effect of the invoice correction, as the recipient of the supply is charged VAT for the first time by means of the corrected invoice.

The Regional Finance Court in Hanover, Lower Saxony did not agree with this argumentation. The German reverse charge provision (§ 13b UStG) is the national implementation of Article 199 VAT Directive. This article provides that the person liable for payment of VAT is the taxable person to whom any of the listed services in Article 199 is provided. The transaction was initially presumed as a reverse charge transaction; however, this classification was wrong, as agreed by both parties later on. Assuming this contention was true, the parties transacted in accordance with the special invoicing provisions. German VAT law, in fact, explicitly precludes suppliers in reverse charge cases to state VAT separately. If they did otherwise, they would owe VAT according to Article 203 VAT Directive (§ 14c UStG). German tax authorities share this assessment in a Decree (BMF, Decree 18.9.2020, paragraph 6), which, however, was issued after the proceedings in court.

In the case, the court ruled that the tax authorities cannot preclude the retroactive correction of an invoice simply because the original invoice does not separately state VAT. The court considered that information such as “0% tax rate”, the “tax amount of 0€” or the addendum “tax exempt” is not wrong but only incomplete. Accordingly, the court concluded that, in the case at hand, the originally issued invoice can be corrected.

The local Tax Office has appealed the ruling which is pending at the BFH under the case number V R 33/20.

Regional Finance Court Münster, Judgment 15 K 2680/18 U of 29.09.2020

In another ruling, the Regional Finance Court in Münster, North Rhine-Westphalia addressed a similar question: is a lease agreement with the addendum “with statutory owed VAT” an incorrect invoice capable of being corrected at a later point in time?

In this case, the plaintiff leased business property from another taxable person. The lease agreement contained the expression “plus statutory owed VAT”.

The court was asked whether this lease agreement could constitute a retroactively correctable invoice. A few years after the commencement of the lease, the landlord issued an invoice as to correct, with retroactive effect, the invoice issued at the beginning of the lease. The question was whether the updated invoice gave a clear expression that the landlord opted out the VAT exemption for long-term rents, as VAT was paid from the beginning. Whether or not the VAT exemption was opted in the original lease agreement was disputed.

The local Tax Office was of the opinion the original lease agreement did not contain the aforementioned minimum requirements for being an invoice, as the VAT amount and VAT rate were not separately stated. Hence, it was the Tax Office’s view that the lease documentation itself did not constitute an invoice capable of being corrected retrospectively.

The plaintiff objected that the addendum “plus statutory owed VAT” was sufficient for the issued document being regarded as an “invoice”. Further, in the eyes of the plaintiff, the requirement was fulfilled through the supplementary documentation in the form of the bank statements.

The court sided with the tax authority. Recalling the BFH case-law, the court noted that in case of continuing obligations, a contract only represents an invoice if the VAT is separately stated in the contract and if, in addition, supplementary payments are presented from which a settlement for a certain period is indicated (BFH, Decision 03.02.2016 – V B 35/15). The court ruled that the original lease agreement did not constitute a correctable invoice, as it did not include the requirement of separately stated VAT. In addition, the court found that the language in the addendum “plus statutory owed VAT” was not sufficient to constitute the required information for an invoice, as “plus statutory owed VAT” is not an explicit waiver of the VAT exemption. In contrast, in the corrected subsequent invoices, the open statement of VAT constituted a waiver of the exemption.

It is currently open if this ruling will become legally binding or if the plaintiff will appeal.

Conclusion and take away points

How do these judgments fit together? The first case tells us that falsely indicating reverse charge fulfills the requirement of openly stated VAT while the second case tells us that “plus statutory owed VAT” does not. Do they fit together? They do.

In the first judgment, the taxpayer (or both transacting parties together) erroneously assumed that reverse charge applied. Therefore, they consequently and intentionally did not state a VAT amount and VAT rate.

In the second case, the taxpayer did not opt out of the VAT exemption. While an invoice can be corrected retroactively under certain requirements, a subsequently issued invoice cannot heal or correct the option to waive the VAT exemption in a previously issued document.

Take away points: even if a retroactive correction of invoices is in principle possible, taxpayers must not forget to check every formerly issued invoice carefully before deducting any input VAT. For the time being, non-taxable persons – in Germany – need only to worry about how to recycle the invoices.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.