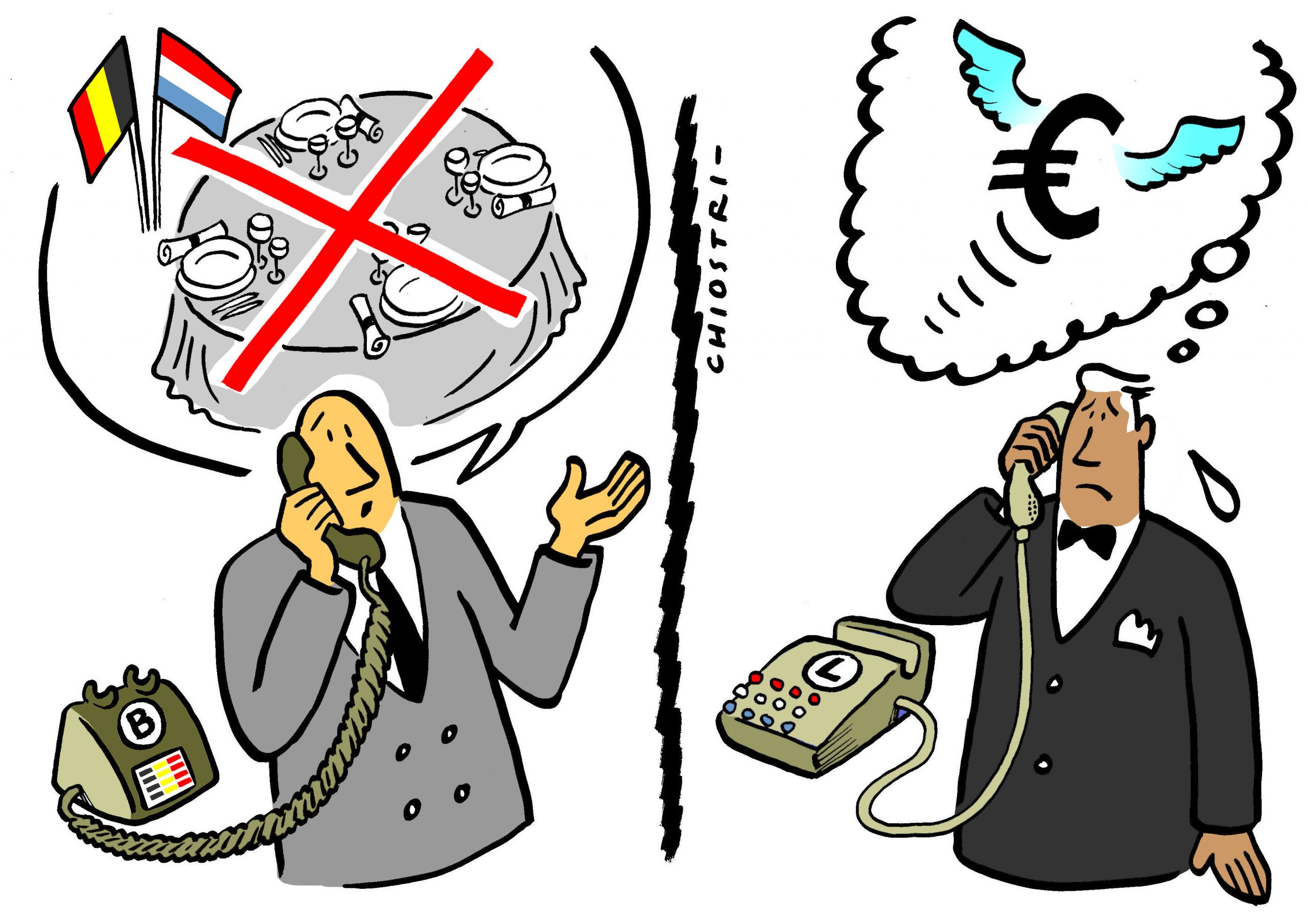

According to l’Echo of July 31st 2020, relying on information published in the magazine Paperjam, the Grand Duchy of Luxembourg has not yet paid Belgium 90 million Euros that had to be transferred before the end of March 2020. This sum is due pursuant to a clearing procedure of VAT and excises collected by the Luxembourg tax authorities. This is the consequence of a customs union between Belgium and Luxembourg signed in 1921. According to well-informed sources, the amount of taxes to be transferred from one country to another is determined during a yearly dinner, from which one may conclude that such a clearing is not supported by any sophisticated methodology or statistics. Probably because of Covid-19 restrictions, or other unknown reasons, this year the clearing procedure faces a problem.

A little bit of background might help the reader to understand the current situation. In Luxembourg, VAT and excises on tobacco, alcohol and fuel are much lower than in the neighbouring countries (notably, Belgium, France, Germany and the Netherlands). Understandably, the prices of those products are also much lower. For example, in Martelange, at the border between Belgium and Luxembourg, most of the village and the main road are located in the Belgian territory. But all the tank stations and the shops are located in Luxembourg, on the other side of the main road. The car drivers on the road in Belgium have free access to the tank stations and shops in Luxembourg. Because of the Covid-19 fallout, the Belgian authorities have suddenly prohibited access to these tank stations and shops in Luxembourg, on the other side of the road. The delay of payment by Luxembourg to Belgium is, thus, possibly a retaliation measure in order to protect the shopkeepers of the Luxembourg side of the main road of Martelange. However, the problem is probably older and more serious than the peculiar situation of Martelange might suggest. In ordinary times, even during the summer holidays, there are in fact traffic jams close to each of the tank stations on the motorways crossing the Grand Duchy of Luxembourg. Up until now, Belgium has tolerated this deflection of trade in exchange for financial compensation. Officially, because these purchases would be made mainly by Belgians… (!). And this is at the core of the present discussion!

About 25 years ago, the Luxembourg authorities observed a sudden fall in tax revenues. The budget of the State was in danger. All the tax inspectors have been mobilized in order to detect massive frauds that only large international criminal organizations would have been capable of organizing. After a great deal of effort and investigations, no single piece of evidence of fraud was found. The loss was not localized in Martelange or in small tank stations in the countryside. In fact, the loss was mostly due to a reduction in sales in the tank stations on the motorways, and mainly on the motorway to Trier in Germany. Finally, it appeared that the problem was caused by a reduction of excise duties in Germany, which implied that many Germans had less incentive to make a detour for shopping in Luxembourg…

© 2020 Kluwer Law International B.V., all rights reserved.

This Belgo-Luxembourg affaire should deserve careful attention by the governments of EU Member States. As a matter of fact, this special clearing on VAT and excises between Belgium and Luxembourg is one of the very few practical examples of how the ‘definitive VAT system’ proposed by the European Commission since the early 1980s would function in practice. The other real-life example is the One Stop Shop (OSS) implemented since 2015 on B2C cross-border Telecommunication, Broadcasting and Electronically supplied (TBE) services. The VAT on such Business-to-Consumers (B2C) TBE services is collected by the Member State where the supplier is established or registered at the VAT rate applicable in the Member State of establishment of the final consumer. The Member State of the supplier collects the tax and transfers it to the Member State of the final consumer. This OSS is apparently functioning quite well. The reason may be because before 2015, most of the TBE suppliers were concentrated in very few Member States (Luxembourg, Malta, and the United Kingdom) where, for years, they enjoyed favorable VAT rates and/or corporate tax schemes. Under this OSS system, the Member States entitled to receive the tax is totally dependent on the Member State where the supplier is established. Anyway, for the majority of EU Member States, any alternative, even a flawed alternative[1], is definitively better than the previous deflection of trade and losses of tax revenues without OSS.

But is it correct to assume that States are only motivated by altruistic objectives while their citizens and politicians are not? Why the money collected with pain and effort should be attributed to other States? A tax inspector, or at least, a minister of finances, is motivated to collect taxes for his country. He is not in the position of a judge who has no interest in the fact that the tax is attributed to one Member State or another. This is the reason why, by the end of the 1980s, EU Member States have rejected the clearing system proposed by the European Commission, the so-called ‘Cockfield proposal’.

Since the early 1980’s, the European Commission seems to have ignored why Europe had adopted VAT in 1967.[2] The Treaty of Rome (1957) had introduced a complex system of lump sum refunds of turnover taxes on exports and taxation on imports. At that time, it was impossible to determine the exact amount of indirect taxes included in the price of goods or services. The system introduced by the Treaty was so easily manipulated by Member States that the turnover taxes existing at that time were actually perceived as hidden State Aids (excessive refunds on exports) and hidden customs duties (excessive lump sum taxes on imports). Of course, this was not compatible with the creation of an internal market. Therefore, the European Commission designed the current VAT system (much simpler than the first version of the French TVA), because the European Member States did not dispose of appropriate legal tools and could not trust each other. At that time, absence of trust between States was not considered as abnormal and it was not an obstacle to efficient organization and cooperation.

Since the early 1980s, the European Commission assumes that Member States ‘should’ naturally cooperate with each other. Indeed, they have the obligation to cooperate with each other. However, such spontaneous cooperation between States or peoples without appropriate enforcement rules is not based on sound economic theory, nor on empirical evidence. The difficulty of the European Commission to submit proposals acceptable by Member States of the EU is the consequence of this fundamental error.

In addition, the OSS proposed since 2012 by the European Commission in cross-border B2B transactions is silent about an immediate deduction of the input VAT by the purchaser of goods and services established abroad. The payment of the VAT by the supplier to the OSS in his country, followed by a subsequent transfer of the tax collected to the Member State of the acquirer would be a long and difficult process, impossible to monitor by the Member State where the customer is established. This is precisely the kind of difficulty highlighted by the current tax dispute between Belgium and Luxembourg.

But instead of creating a complex new system, why not slightly improve the existing one? For example, by a combination of a few changes, that is:

- By taxing the intracommunity supplies of goods and services at the rate applicable in the country where the customer is established (like the system existing for B2C TBE services since 2015 and B2C distance sales of goods as from 2021). This would require an alignment of the rules of place of supply of goods with those of services (as already applicable since 2010 for services). The current follow-up of the physical movements of goods should be abandoned as the main rule, and only be used as a secondary method of control. Indeed, why maintain rules based on the physical follow-up while physical controls have been abolished since 1993? Have these rules based on physical controls not proven to be cumbersome and inefficient enough?

- By adapting slightly the existing ‘recapitulative statement’ of intracommunity supplies of goods and services, as has already existed since 2010, through the inclusion of one additional column mentioning the amount of VAT charged to each foreign EU business during a period. In this way, the tax authorities of the Member States of establishment of the supplier and of the customer would receive precise information on the intra-EU transactions between specific businesses established in their respective territory. As a matter of fact, the total amount, VAT exclusive, of the supplies to each foreign customer is already mentioned on the existing recapitulative statement and the IT infrastructure is already in place and functioning properly, both at businesses’ and tax authorities’ level.

- By requiring a payment of VAT directly by the supplier to a financial account belonging to the tax authorities of the Member State of establishment of the foreign business customer.

In this way – I would argue – a clearing procedure managed by EU Member States or by the European Commission itself would not be necessary. Each EU Member State entitled to collect the tax would have immediate and complete control on the tax collected. The existing recapitulative system would function, in effect, as a One Stop Shop for B2B intra-community transactions. Thanks to new technologies, and with little change to their existing internal procedures of collection of VAT, the EU Member State of the supplier and the EU Member State of the customer would be informed in real time of the declaration and of the related payment.[3] In case of discrepancies between the tax actually collected and the one declared in the monthly or quarterly recapitulative statement, the Member State of acquisition can immediately address a warning to the acquirer or start an investigation into the latter’s business.

Business lobbies are certainly not pleased by taxing intra-community supplies, because of the significant impact on cash-flow associated with their economic operations.[4] They would rather prefer a generalized reverse charge system, even on pure national transactions, i.e. no VAT at all, similarly to a United States’ Sales Tax that is only collected by the retailers, thus putting on these latter all the incentive to fraud and the associated liability.

Actually, those who decide the future of VAT rules, i.e. EU Member States, the European Commission and large Business lobbies, seem to consider themselves as trustworthy and altruistic, because of their function, and not naturally selfish, like ordinary consumers or SMEs. Unfortunately, such a perception is not in line with economic theory, as well as empirical observations. This contradiction in the self-perception of the decision-makers should be – I would argue – a serious warning to Europe, like the tax affaire of this summer between Belgium and Luxembourg…

[1] See M. Lamensch & E. Ceci, VAT Fraud: Economic Impact, Challenges and Policy Issues (European Parliament 2018), p. 48 and European Court of Auditors, Special Report 12/2019: E-commerce: Many of the Challenges of Collecting VAT and Customs Duties Remain to Be Resolved (European Union 2019).

[2] For more details, see C. Amand: Intra-EU Trade and VAT: Will the Distinction between Goods and Services Still Be Relevant after 2020?, 31 International VAT Monitor 4 (2020).

[3] For more details, see C. Amand, EU VAT or the Emergence of an Efficient Consumption Tax in an Internal Market, in CFE Tax Advisers Europe 60th Anniversary – Liber Amicorum (S. van Thiel, P. Valente & S. Raventós-Calvo eds., IBFD 2019).

[4] See Business Europe, Towards a Simplified, Sustainable and Robust VAT System (December 2019), https://www.businesseurope.eu/sites/buseur/files/media/reports_and_studies/final_vat_brochure.pdf .

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.