William Byrnes, Texas A&M University School of Law* (33-page draft research available on SSRN)

Howdy! Earlier today the General Court of the European Court of Justice (EGC) sided with Starbucks’ transfer pricing analysis of its Dutch coffee roaster, and thus against the European Commission’s approach. Thus, I feel that my transfer pricing research about this case has not been in vain. In 2015, after presenting it as a case study in Dr. Lorraine Eden’s transfer pricing course at Texas A&M’s business school, I began a Starbucks Netherlands transfer pricing comparable profits study funded by Texas A&M University School of Law as my faculty Summer research project.

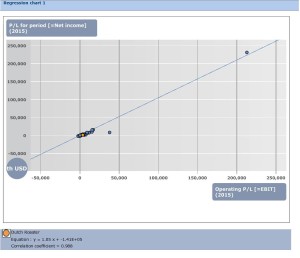

After six months of weekly calls directing my two research assistants (two graduate economic students: with the Texas A&M School of Agriculture, Department of Ag Economics and with the Bush School of Government) and with the kind assistance of several financial and economic data repositories, including the Worldwide Private Company Database from Thomson Reuters, Bureau van Dijk’s Orbis, ktMINE, and RoyaltyStat, I published in 2016 the results at many tax and academic conferences (for ease of reference, I will upload to SSRN my presented research paper https://ssrn.com/author=339796) and a synopsis here on the Kluwer International Tax Blog.[1]

In conclusion of my 2015-16 research, I found that Starbucks Netherlands, based on its provision of services as a toll manufacturer and reseller, was within the arm’s length range of other European coffee roasters, leaving a substantial annual residual. But like the EGC I could not explain, or rationalize for myself, the residual:

“… it cannot be denied that the variable nature of the royalty raises questions regarding the economic rationality of the royalty. In the case at hand, the Kingdom of the Netherlands and Starbucks have not provided any convincing explanation justifying the choice of an unusual method to determine the level of the royalty.”[2]

Unlike others, I did not jump to the conclusion that Starbucks was wrong in its allocation. I think that the Starbucks IP and intangibles are worth some if not all the residual. I just cannot show it through comparables with CUTs. I have stopped stressing that I cannot explain the residual allocation because the OECD also has not provided a good method much less solution to the issue of residual allocation. TheEGC found its peace in relation to Starbucks residual full sweep to Alki:[3]

“The residual nature of that royalty simply means that it was calculated, in principle, from the determination of the level of other relevant charges and incomes as well as from an estimate of the level of SMBV’s taxable profit. If those parameters were correctly identified, the mere residual nature of the royalty would not preclude the level of the residual royalty from corresponding to its economic value.” (emphasis added)

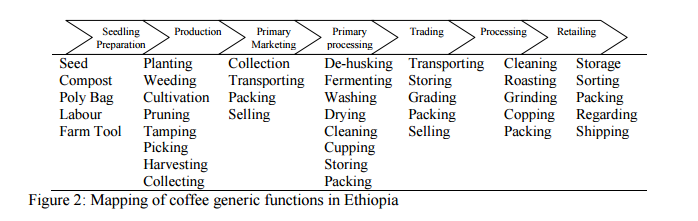

For the remainder of this article, I am providing my brief commentary about today’s 75 page decision (563 numbered paragraphs) of the General Court of the European Court of Justice (“EGC”) in favor of The Netherlands and Starbucks application of a transaction profits method and against the European Commission’s interpretation of the 1995 OECD Transfer Pricing Guidelines. Today’s EGC decision has several aspects beyond the ability of this article’s 3,500 words that I will cover in a forthcoming longer article, such as evidentiary standard applied, the intensity of review by the EGC, as well as specifics about the application by the EU Commissions and Starbucks of their respective chosen transfer pricing methods, and the pricing of the green beans. For pre-decision in-depth analysis of the Starbucks controversy, see my lengthier pieces published since 2015, including my own global value chain analysis and transaction profit method analysis of Starbucks’ Netherlands operational activities, as well as the pricing of green beans.[4]

The Crux of the State Aid Argument

The crux of the legal issue is the EU Commission’s contention, required as the third condition for a finding of State aid, that the Netherlands-Starbucks APA conferred a selective advantage on Starbucks manufacturing subsidiary in the Netherlands (SMBV, aka the “roasting operation”) that resulted in a lowering of SMBV’s tax liability in the Netherlands as compared with what SMBV would have paid under the Netherlands’ general corporate income tax system dealing with third parties.[5] And the crux of the dispute that determines the legal issue outcome is whose choice of transfer pricing method (the Commission or The Netherlands / Starbucks) is the most reliable.

However the most interesting aspect of the controversy continues to be how to allocate the residual between SMBV and Alki? In a broader framework, not part of the analysis contemplated by the applicable 1995 OECD Transfer Pricing Guidelines, is how to allocate the residual among Starbucks’ global value chain.

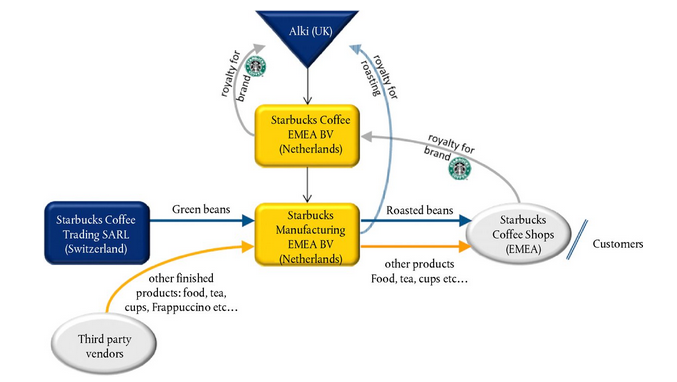

Secondarily is the reasonableness of the Netherlands / Starbucks approach that SMBV’s earnings not found to be within a Transactional Net Margin Method (TNMM) determined benchmark range for routine low risk services (the “residual”) must accrete to intangibles which are owned by Alki (Starbucks’ IP and intangibles licensing entity, a UK limited partnership passing through its income to Starbucks Bermuda).

Boiled down to the disputes essence, the Commission focused on determining the arm’s length pricing of the royalty paid by SMBV to Alki (Starbucks’ IP and intangibles licensing entity, a UK limited partnership passing through its income to Starbucks Bermuda) whereas The Netherlands / Starbucks focused on the arm’s length pricing of SMBV providing low-value services for roasting of coffee beans and for logistics and administrative services. The Commission, under its approach, considered the Comparable Uncontrolled Price (CUP) Method as the most reliable method to be used to benchmark SMBV’s payments to Alki.[6] The Commission presented into evidence three arm’s length contracts of SMBV and external roasters that did not include pricing for a licensing arrangement and referred to a total of ten such third party agreements in its 2015 decision.[7] The Commission had also undertaken a survey of five of Starbucks’ competitors as to their respective business model and value-creating activities.[8]

The Netherlands Tax Authority submitted a schematic overview of the points of comparison of the contracts relied upon by the Commission with arguments why each of the agreements was not comparable with the contractual relationship between Alki and SMBV.[9] Starbucks argued that the three third party agreements relied on by the Commission comparably failed because these are with subcontractors which, unlike SMBV, do not supply Starbucks branded products to customers but instead only undertake a roasting function.[10] Starbucks contended that all third-party manufacturers’ agreements that allow the supply of Starbucks-branded coffee products to stores or retailers require paying substantial royalties for the use of Starbucks’ roasting IP. Starbucks characterized SMBV as neither a mere roasting subcontracting nor an independent vendor operating on its own behalf. Instead, SMBV is a toll manufacturing roaster and a supplier of Starbucks branded products on behalf of Alki, with Alki contractually bearing the risks associated with an independent vendor. Thus, Starbucks argues that the Commission erred in relying upon the subcontractor type arrangements without royalties and erred in characterizing SMBV as a full vendor taking on the commercial risks of inventory and sales for its own behalf.[11]

EGC Holding on Commission’s CUP Approach and Comparability Issues

The ECG held that a number of elements of the 10 contracts of Starbucks to third party roasters were not comparable to the SMBV-Alki relationship.[12] Seven of the 10 agreements, the Commission found, were concluded after the APA and thus not reasonably foreseeable to include in an analysis to be made at the time of the APA’s conclusion. The EGC held that these seven may not form part of the Commission’s CUP analysis. Moreover, the EGC found that three of the 10 agreements were not even with coffee roasters and thus those third parties relationships were different factual situations that even if usable, would have required substantial comparable adjustments.[13] Two additional contracts were for toll manufacturing that sold all the production to one Starbucks subsidiary. The subsidiary undertook all distribution and sales functions. Thus, these two contracts were ruled noncomparable.[14] The EGC pointed out that one of the ten contracts provided for the payment of a royalty for the use of the roasting IP contradicting the Commission’s contention that an unaffiliated manufacturing company would not pay a royalty if it did not exploit the roasting IP directly in respect of end consumers on the market.[15] The EGC determined that the comments by Starbucks competitors that they did not charge royalties, such as Melitta, Dallmayr, and an anonymous competitor, were because the commercial relationships were different than SMBV and Alki. Melitta’s agreement may be characterized as a toll roaster called upon to meet surplus demand that was not shown to sell roasted coffee to stores or to other customers.[16]

Commission’s Contention Under CUP that Alki’s IP and Intangibles Held Zero Value for SMBV

Based on its CUP analysis, the Commission determined that the Alki’s intellectual property and intangibles had no value because the Commission contended that Starbucks’ five competitors did not value such in their respective business models and that third parties in the three contracts did not license and pay for such intangibles. Thus, the Commission concluded that the arm’s length price for the licensing arrangement and its corresponding royalty was zero.[17] Without arm’s length value, the Commission contends that the Netherlands Tax Authority should not have been allowed a tax-deductible payment from SMBV to Alki. Correspondingly SMBV’s tax base should have included the non-arm’s length licensing payments resulting in additional Netherlands corporate tax on such amount. Only if the Commission proves that the Netherlands lost tax revenue from the APA may the Commission then follow through with the argument that the amount of lost tax revenue represents an illegal state aid subsidy from the Netherlands to SMBV.

Summarizing the Commission’s arguments regarding the lack of value to be afforded the IP and other intangibles licensed by SMBV, the Commission contends that the value from the roasting know-how and roasting curves can only be ‘exploited’ when Starbucks products are sold by stores under the Starbucks brand, or alternatively by a fully independent vendor that benefits from increased sales or sales price by sell its production to final non-Starbucks franchised customers.[18] The Commission argued that it is economically irrational for the roaster/coffee producer to pay a royalty to use the roasting IP when it does not market the finished product directly.[19]

EGC Holding on the Value of IP and Intangibles in the Hands of SMBV

The EGC found the following facts agreed by both parties’ contentions:[20]

- The roasting IP was, in principle, capable of representing an economic value.

- SMBV is a roaster that was obliged to use the roasting IP to roast its coffee.

- Starbucks stores, both affiliated and unaffiliated, are required to purchase roasted coffee from SMBV and that SMBV is thus also the vendor of the roasted coffee.

Based on these three factual determinations, the ECJ ruled the Commission erred in its analysis that the value of the roasting IP is exploited only where the products are sold to final consumers. The EGC stated that:[21]

The question of who ultimately bears the costs corresponding to the compensation of the value of the IP used for coffee production is clearly separate from the question of whether the roasting IP was necessary to allow SMBV to produce roasted coffee according to the criteria stipulated by Starbucks stores, to which it sells, on its own behalf, the coffee.

In the event that SMBV sells the coffee it has roasted to Starbucks stores which require coffee to have been roasted according to Starbucks’ specifications, it is plausible that, in the absence of the right to use, or – to use the terminology of the contested decision – exploit the roasting IP, SMBV would not have been in a position to produce and supply roasted coffee according to Starbucks’ specifications in stores of the same name.

Thus, the EGC held that SMBV’s payment of a royalty to use the roasting IP is not devoid of all economic rationality as the Commission contended. The EGC stated that the exploitation of roasting IP is not limited to situations in which a roaster sells its coffee on the retail market to end consumers but may include arrangements whereby a roaster is active as a seller on the wholesale market. The EGC agreed that had SMBV merely processed coffee on behalf of Alki, then procurement of the technical specifications solely for manufacturing would not rise to the level of exploitation of the IP.[22]

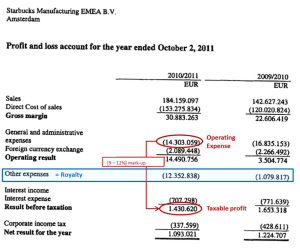

The Netherlands Use of TNMM

The Netherlands / Starbucks approach benchmarked only the arm’s length range for earnings of SMBV’s roasting and logistics / administrative services to other European coffee roasters. The benchmark range was determined using the TNMM. The TNMM was applied to SMBV as the “tested” party, comparing the expected profits of SMBV for roasting and logistics / administrative services to the same for other comparable third-party roasters. Starbucks concluded that SMBV’s portion of its earnings within the TNMM range attached to the pool of routine operational activities that Starbucks claimed as low-risk functions. The remaining earnings of SMBV not within the TNMM range, under this Netherlands / Starbucks approach, had to attach to something other than the low-risk routine activities. The Netherlands / Starbucks chose to accrete the residual ‘non-routine’ earnings to the IP and intangibles provided by Alki. These residual non-routine earnings were accounted for by sweeping them in the form of an end of year fluctuating royalty amount via a licensing agreement for IP and intangibles by Alki to SMBV. The royalty was annually deducted by SMBV. The EGC stated as I have myself oft contemplated about this case:[23]

“In that context, it should be noted that, indeed, it cannot be denied that the variable nature of the royalty raises questions regarding the economic rationality of the royalty. In the case at hand, the Kingdom of the Netherlands and Starbucks have not provided any convincing explanation justifying the choice of an unusual method to determine the level of the royalty.”

However, the EGC found its peace with connecting the residual to the IP and intangibles of Alki, holding:[24]

“The residual nature of that royalty simply means that it was calculated, in principle, from the determination of the level of other relevant charges and incomes as well as from an estimate of the level of SMBV’s taxable profit. If those parameters were correctly identified, the mere residual nature of the royalty would not preclude the level of the residual royalty from corresponding to its economic value.” (emphasis added)

Commission’s Argument that Alki Should Have Been the Tested Party.

The Commission argued that the 1995 OECD Transfer Pricing Guidelines (those in effect at the time of the entering into the APA) prioritize traditional transfer pricing methods, thus the CUP method, over transactional profit methods, thus the TNMM.[25] The Netherlands replied that the 1995 OECD TPG did not constrain the taxpayer from choosing which of the transfer pricing method to apply as long as the method chosen generated an arm’s length outcome. Pursuant to the Commission’s interpretation of the 1995 OECD TPG, the TPG prioritized that an arm’s length price had to be ascertained for each discrete transaction, thus including the annual royalty payment, instead of allowing an arm’s length profit determination for an amalgamation of routine functions.[26] The Commission sought to benchmark the royalty whereas Starbucks sought to benchmark the routine services.[27] Most relevant, the Commission insisted that Alki should be the tested party for application of the arm’s length benchmarking pursuant to either transfer pricing method, not SMBV.

EGC Holding Regarding Tested Party

The EGC held that the Commission’s reasoning on the choice of tested entity is erroneous. The EGC first pointed out that the 1995 OECD TPG does not lay down a strict rule on the identification of the tested party. Secondly, the EGC sided with the Netherlands that the 1995 OECD Guidelines indicate that the associated company to which the TNMM should be applied is the company for which reliable data on the most directly comparable transactions may be identified which is usually the company with the least complex functions.[28] Alki’s held IP and intangibles whereas SMBV performed routine operations. The EGC states that:

“If the choice of the least complex entity as tested party purports to limit errors, it is not at all inconceivable that applying the TNMM to the more complex entity might lead to an arm’s length outcome. In addition, in so far as the residual profits are allocated to the other party, the outcome should in theory be the same no matter which entity is tested.”

EGC Holding Regarding Whether The TNMM Profit Level Indicator Should Have Been Sales or Operating Costs

Starbucks based its TNMM analysis on operating costs. The Commission argued that SMBV’s main function was not the distribution of roasted coffee but was actually the resale of non-coffee products. Because of this, the Commissions contended that sales were the best profit level indicator because SMBV was a reseller whose earnings were based on a margin on products distributed. The Commission points to the fact that SMBV’s total sales practically tripled, while the ‘gross margin’ more than doubled over that same period while the operating costs increased by only six percent.[29] The Commission undertook a TNMM analysis by searching for companies whose main function was the wholesale of coffee-derived products and using sales as a profit level indicator.[30]

The Commission’s analysis consisted of identifying a peer group on the basis of “resale” functions. The Commission found that the interquartile range on the return of sales was 1.5 percent to 5.5 percent. The Commission then applied it to SMBV’s results obtained from 2007 to 2014 and found that SMBV’s tax base calculated on the basis of the APA was lower than the quartile range of SMBV’s tax base as followed from applying the Commission’s method approach.[31]

The EGC pointed out that the Commission did not undertake an arm’s length remuneration analysis for the functions performed by SMBV within the Starbucks group. Thus, the EGC held the Commission’s analysis was not comparable and had weak probative value.[32] Moreover, the Commission’s results, when challenged, were replicable neither by Starbucks nor by the Commission.[33] Starbucks’ tax advisor undertook an analysis based on the criteria used by the Commission and of 87 companies identified, only three were the same as the Commission’s results relied upon. The Commission then tried and was unable to replicate its own analysis, lacking five of the initial 12 companies identified.[34] The EGC pointed out that the Commission made other significant errors, such as comparing operating profits with taxable profits instead of like with like.[35]

The EGC held that even if the Commission had not erred in characterizing SMBV’s main function as the resale of non-coffee products, the Commission did not show in its analysis that a profit level indicator based on operating costs could not lead to an arm’s length outcome.[36]

Also, note that the EGC held that Starbuck’s cost-base adjustment not to be erroneous. Starbucks’ tax advisor used the NACE Code 1.1 (Nomenclature of Economic Activities) 15.86 for process of tea and coffee within the Amadeus database. The tax advisor’s query rendered 240 companies, from which the tax advisor excluded 88 non-comparable tea and coffee processors. The remainder companies used for the pool yielded an Operating Profit / Total Operating Costs median net margin of 7.8 percent. However, Starbucks’ tax advisor proposed that the underlying costs only for which SMBV performs a value-added role should form the basis of the pool for which the markup would be applied. Thus the pool consisted of:

- costs of personnel employed for manufacturing,

- costs associated with its supply chain activities,

- costs of production equipment such as depreciation, and

- costs of plant overheads.

SMBV excluded from its cost pool, for purposes of applying the remuneration mark-up:

- the costs of green coffee beans (cost of raw materials),

- the logistics and distribution cost for services provided by third parties,

- the Starbucks cups, paper napkins, etc.,

- the remuneration for activities provided by third parties under so-called “consignment manufacturing contracts”, and

- the royalty payments to Alki LP.

The Commission focused on the fact that half of the sales revenue attributed to SMBV is generated from non-coffee sales that are booked for invoice consolidation convenience by SMBV. Starbucks alleges that these ancillary activities are not part of a “roasting” operation. The administration itself, Starbucks contends, is a low margin activity. The EU Commission challenged the tax advisor’s exclusions, stating that the distinction between costs that pertain to value-added activities and costs that would not pertain to such activities does not exist in accounting rules and that such classification of costs relies solely on the judgment of the tax advisor, not upon the OECD Guidelines.

Based on the above approach and comparability filter, the tax advisor regressed out COGs and financing of COGs from the pool’s companies. Based on these adjusted Operating Costs, the median net margin increased to 9.9 percent, but correspondingly applying to a smaller base.

* Professor William Byrnes is an author of Practical Guide to U.S. Transfer Pricing with the forthcoming rewritten and revised 4th edition of approximately 2,000 pages to be published in November 2019. William Byrnes has authored and co-authored 1,000 articles published by financial media such as American Legal Media and National Underwriter Co. Find samples of his long articles and chapters at SSRN.

[1] Initially at the Texas A&M Law’s presentation of our faculty research projects and the Texas Tax Professors annual article workshop, both wherein I received thoughtful feedback and critiques.

[2] ¶367 Netherlands v Eur. Comm., ECG, Case T-760/15, ECLI:EU:T:2019:669 (J. Gen. Ct. 7th Cham., Ext. Comp. Sep. 24, 2019) (hereafter “Starbucks EGC decision 2019”)

[3] ¶368 Starbucks EGC decision 2019.

[4] For ease of reference, I uploaded the 33-page draft study to SSRN (https://ssrn.com/author=339796) of my independent Starbucks transfer pricing comparable profits study of 2015, funded by Texas A&M University School of Law as a faculty academic Summer research project.

[5] ¶33 Starbucks EGC decision 2019 referring to ¶ 228 On State Aid Implemented by the Netherlands to Starbucks SA.38374, C (2014) 3626 (Fin. Dec. Oct. 21, 2015) (hereafter referred to as “Starbucks Commission final decision 2015”).

[6] ¶179 Starbucks EGCdecision 2019.

[7] ¶285 Starbucks EGC decision 2019 referring to ¶300 Starbucks Commission final decision 2015.

[8] See ¶17 and ¶20 Starbucks Commission final decision 2015. Three of five competitors are identified as Alois Dallmayr Kaffee oHG, Nestlé S.A., and Melitta Europa GmbH & Co. KG.

[9] ¶115 Starbucks EGCdecision 2019 referring to Annex A.7, The Netherlands app. to EGC, Starbucks EGCdecision 2019.

[10] ¶218 Starbucks EGC decision 2019.

[11] ¶236 Starbucks EGCdecision 2019.

[12] ¶287 Starbucks EGC decision 2019.

[13] ¶¶292, 293 Starbucks EGC decision 2019.

[14] ¶¶298, 300 Starbucks EGCdecision 2019.

[15] ¶312 Starbucks EGC decision 2019.

[16] ¶351 Starbucks EGC decision 2019.

[17] ¶173 Starbucks EGC decision 2019. The Commission also determined that a 2011 price increase by Starbucks Switzerland’s coffee trading operation was not arm’s length, SMBV overpaid for the raw material of the green coffee beans.

[18] ¶253 Starbucks EGC decision 2019.

[19] ¶254 Starbucks EGC decision 2019.

[20] ¶259 Starbucks EGC decision 2019.

[21] ¶¶260, 261 Starbucks EGC decision 2019.

[22] ¶264 Starbucks EGC decision 2019.

[23] ¶367 Starbucks EGC decision 2019.

[24] ¶368 Starbucks EGC decision 2019.

[25] ¶¶175, 185 Starbucks EGC decision 2019 referring to ¶4.9 point 2, 1995 OECD Transfer Pricing Guidelines (hereafter “1995 OECD TPG”).

[26] ¶191 Starbucks EGC decision 2019.

[27] ¶192 Starbucks ECJ decision 2019.

[28] ¶3.43 1995 OECD TPG.

[29] ¶459 Starbucks EGCdecision 2019.

[30] ¶477 Starbucks EGC decision 2019.

[31] ¶478 Starbucks EGC decision 2019.

[32] ¶481 Starbucks EGC decision 2019.

[33] ¶¶482, 483 Starbucks EGC decision 2019.

[34] ¶¶485, 486 Starbucks EGC decision 2019 explain the technical reasons for why the results may not be replicable.

[35] ¶¶496, 497 Starbucks EGC decision 2019.

[36] ¶460 Starbucks EGC decision 2019.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.