The raison d’être of corporate taxation relates to the aim of achieving an impartial treatment of different legal forms in order to safeguard a level playing field for conducting business. In the EU this aim must be contemplated in conjunction with the objective of establishing an internal market free of fiscal barriers. The present post will explore the meaning of the fairness attribute in matters of exit taxation.

The Onno Ruding report, which is the outcome of a mandate for a Committee examination of corporate taxation in the European Community given by the Commission in October 1990, declared outspokenly that the excessive competition between Member States must be hindered by setting a minimum level of statutory tax rates and common rules for a minimum tax base. The conclusions of the Ruding report have been communicated by the Commission to the Council and Parliament in June 1992[1]. The target of attracting mobile investment or taxable profits of multinational firms has been identified as the cause of eroding ‘the tax base in the Community as a whole’[2].

The Committee of experts is concerned, however, about Member States tendency to introduce special tax schemes designed to attract internationally mobile business. These schemes normally cost the host country little in terms of tax revenue forgone. On the other hand, the loss in tax revenue by the country from which the activities are withdrawn can be considerable.[3]

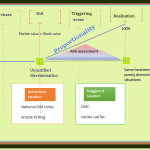

Article 26(2) TFEU defines the internal market as an area without internal frontiers. Do exit taxes create internal frontiers that impede the free movement of persons, services and capital? The answer is clearly affirmative and confirmed by constant jurisprudence[4]. The other meaning, namely that the practices of the Member States constitute the cause of the erosion of the tax base of the Union as a whole has been diluted down to many shades of grey concerning the ‘fair sharing of taxes’.

Besides the restriction against the economic freedoms, exit taxes may indeed entail a risk of either double taxation or double non-taxation. This risk can be addressed by coordination efforts or alternatively within the EU, by harmonisation measures adopted at the supranational level. The Action 6 of the recent BEPS Reports treats the issue of exit taxation aiming to preserve – through a mutual agreement procedure – the taxation rights of the exit State by ensuring a relief granted by the host State for the tax levied on the part of the income that accrued while the person was a resident of the exit State[5].

However, the concerns related to the increased capital cost and the asymmetric treatment of losses have not been dealt with by the OECD’s Action 6. It would be nonetheless reasonable to affirm that from the EU law perspective, the preservation of the allocated rights to impose taxation must be achieved in a manner that does not infer a disproportionate negative impact on the establishment and development of the internal market. As the international tax system stands now, either the host State or the exiting company would have to suffer the loss resulting from the territorial allocation of taxing rights.

Furthermore, the Ruding Report observed that the harmful tax schemes adopted by a Member State ‘normally cost the host country little in terms of tax revenue forgone’, while ‘the loss in tax revenue by the country from which the activities are withdrawn can be considerable’[6]. This view has already been contemplated in a previous post, in which I questioned whether the State aid rules could provide the accurate instrument for disciplining Member States tendencies to design attractive tax arrangements for ‘internationally mobile business’[7].

A wholly artificial transaction, which has the effect of reducing the tax base of the group, would not necessarily entail a reduction of the tax revenues for the Member State that issues the tax ruling. In some cases, the grant of an economic advantage may be imputable to one Member State, while the resources are attributable to a different Member State (or non-Member State).[8]

Such a practice does not involve a gratuity element, since the Member State does not give up on its ‘fair share of taxes’, but it might contribute to the erosion of the tax base of the Union as a whole. This interest cannot be properly defended in the absence of a minimum harmonisation of tax rates and a set of common rules on tax base accounting.

Would it be a good idea to abolish exit taxation?

The most radical way of abolishing exit taxation would be to eliminate corporate taxation and replace it with personal taxation. In the absence of corporate taxation, the shareholders would be directly liable for the income and gains obtained by the corporation. If the shareholder is nonetheless a foreign citizen with residence abroad, the state of residence of the corporation would not be able to impose taxation on the profits and gains achieved on its territory. The aim of ‘ensuring a fair share’ of taxation rights for the exit State is derived from the principle of territoriality. Unless the principle of territoriality were to be replaced with a new nexus, it would be impossible to abolish corporate taxation.

Another relatively radical solution would be to apply the fair value instead of historical cost as method of evaluation of the assets and liabilities. In a system that imposes taxation on the annual increase in fair market value, no unrealised gains would accrue, hence no exit tax would be required. However, this solution would most probably not be feasible for the tax administrations and moreover, the same asset would still have different fair values in different jurisdictions. For instance, the fair market value of a second hand vehicle may differ from a Member State to another[9]. Therefore, the historical cost is likely to remain the preferred modality of tax accounting.

The antithesis of abolishing exit taxation would be to impose it even on domestic situations. It is obvious that such a solution would have a negative impact on the capacity of companies to reorganise the structure of their business.

Distortions affecting the good functioning of the internal market

The issue of allocation of profits among enterprises and the importance of taxation for business decisions were addressed by the Ruding Report[10]. At that point it was agreed that a minimum interference with the fiscal autonomy of the Member States would be necessary in order to remove ‘those discriminatory and distortionary features of countries’ tax arrangements that impede cross-border business investment and shareholding’[11]. The Ruding Committee identified a set of criteria for the harmonisation of tax bases within the internal market.

- Neutrality between different legal forms

- Neutrality between different methods of financing

- Neutrality between distributed and undistributed profits

- Neutrality between investing in domestic versus non-domestic equity

- The need to create a strong European capital market

- The fair distribution of tax revenues between source and residence states

- Practicability, transparency, simplicity, collection and enforcement.

The Ruding Committee concluded that it was unlikely that Member States acting independently of each other could achieve any significant reduction in the distortions affecting the functioning of the internal market.

In 2008 the Council of the EU invited the Member States to adopt a set of guiding principles applicable on transfers of economic activities[12]. The 2008 solution is far from being ambitious and in comparison with the spirit of the Ruding Committee appears to be merely self-effacing. It attributes the responsibility for setting the balance between the interests of the exit State and the corporation to the host State.

In the aftermath of National Grid Indus[13], the set of guiding principles has almost no relevance. In 2015 Public Consultation on further corporate tax transparency, it is reaffirmed that ‘the interaction of different national tax rules remains a source of discrepancies and frictions’[14].

…it must be stated that recovery of the tax debt at the time of the actual realisation in the host Member State of the asset in respect of which a capital gain was established by the authorities of the Member State of origin on the occasion of the transfer of a company’s place of effective management to the host Member State may avoid the cash-flow problems which could be produced by the immediate recovery of the tax due on unrealised capital gains.[15]

A deferral should be made obtainable until the realisation of the asset or alternatively, transfer outside the territory of the European Union. Since the exit State has the taxing right for the deferred tax, it can require the corporation to send annual financial reports to the national tax authority in that State. Once country-by-country reporting becomes the norm, the possibility of control and the effectiveness of anti-avoidance measures will increase substantially[16]. Even if the tax bases are not harmonised, the possibility of control, collection and enforcement in regard of cross-border tax deferrals can be arranged at the supranational level.

However, if the amount of tax related to unrealised capital gains on assets is finally determined at the time, when a company transfers the assets to another Member State, the fact that some of these assets may not be divested subsequent to their transfer does not in itself have the effect of excluding the right of the exit State to collect that amount[17].

As EU law stands now concerning direct taxation, Article 49 TFEU cannot be interpreted as requiring the Member States to adapt their own tax systems in order to account for the possible exchange risks faced by companies as a result of the diversity of currencies still existing within the EU[18]. The lack of coordination between the national tax systems will continue to give rise to distortions that conceivably, may affect the good functioning of the internal market.

The Icelandic exit tax system

The case concerns division of companies, transfer of assets and transfer of registered office. The companies were taxed on the difference between the market price of assets and their book value for tax purposes after deduction of carry-forward losses. The earlier taxation of the cross-border situations resulted in a restriction of the free movement of capital or freedom of establishment depending on the fact whether or not the shareholder in question acquired definite influence.

The same result could be achieved by less restrictive measures. Iceland could determine the unrealised capital gains which it considers it has the right to tax, without that implying the immediate collection of tax.[19]

The second restriction consisted in the requirement of a guarantee for the case of deferred taxation without examining the risk of non-recovery. It applied to all cases where the amount of deferred taxation exceeded ISK 50 million. The EFTA Surveillance Authority reminds that the provision of bank guarantees is not automatically admitted as a lawful justification of a restriction imposed on the freedom of establishment.

In relation to the particular circumstances regarding the liquidation of a company, a bank guarantee might even be unnecessary if the risk of non-recovery is covered by the personal liability of shareholders for outstanding tax debts of the company.[20]

Moreover, the effort of tracing assets relates only to the recovery of the tax debt, not to the ascertainment of a capital gain or the maintained status as a separate legal entity[21]. The EFTA Surveillance Authority found that Iceland failed to fulfil its obligations arising from Articles 3l and 40 of the EEA Agreement (Articles 49 and 63 TFEU) in regard of the immediate exit taxation and Article 31 EEA in respect of the guarantee requirement.

Conclusions

Since various tax jurisdictions coexist within the EU, the transfer of an economic activity defines a temporal partition meant to preserve the allocation of taxing rights. At this point the fair value of the asset must be assessed and compared with the book value in the exit State and the host State must acknowledge a step-up or a step-down and recognise the existence of deferred taxes to be recovered subsequent to the transfer. The host State should facilitate the recovery and protect the right of the exit State to levy tax on the unrealised gains on the moment of actual realisation. The recovery of tax debt is a separate issue from the assessment and recognition of that debt.

Fair value is defined as the price that would be received, when an asset is sold or a liability is set-off in an orderly transaction between market participants at the measurement date. The concept is clearly related objectively to the principle of arm’s length endorsed by the OECD and enshrined in Article 9, however a transfer pricing adjustment to the arm’s length price results in the immediate taxation of an unrealised gain even for the case of purely domestic situations. Therefore, there is no discrimination between the domestic and the cross-border situation in this regard.

The timing is also different. In respect of exit taxation, the realisation of gain will take place in the future and the actual price might differ from the fair value calculated at the moment of transfer. The transfer pricing implies a realisation that has happened at a price that is suspected to differ from the fair value at the same temporal moment. The meaning of fair measurement is the core issue during the first stage of a cross-border transfer that might trigger exit taxation. However, this kind of fairness does not have any political or legal connotation beyond its objectivity desideratum.

What can be said about the fairness of exit taxation from the legal point of view? Taxation should take place where and when the income has been generated. The constant case law from the CJEU and EFTA-Court recognises that because the exit State is the place where the income has been generated, it is fair to preserve the related taxing rights, hence the existence of exit taxes is necessary. The temporal aspect, namely the eventual difference between the fair value at the moment of transfer and the actual realisation price, exchange rate disparities and the duty to pay interest during the deferral period has not been sufficiently elucidated from the angle of a fairness assessment. The AG Kokott in her Opinion to National Grid Indus stated the following:

If the undertaking’s assets consist basically of a foreign-currency loan and if the unrealised currency profits accruing in the State of origin no longer appear for tax purposes in the host State, the final settlement tax must be deferred until the date when an undertaking remaining in the State of origin would have to pay tax on such profits, and currency losses arising up to then must be taken into account

The CJEU reminded in contrast that the Treaty offers no guarantee to a company covered by Article 54 TFEU that a cross-border transfer will be neutral as regards taxation. ‘Given the relevant disparities in the tax legislation of the Member States, such a transfer may be to the company’s advantage in terms of tax or not, according to circumstances’[22].

The conclusions of the Ruding Report are still valid today and they have been reaffirmed by the recent public consultation conducted by the European Commission (June-September 2015). An effective enforcement and transparency can be achieved through the cooperation between tax authorities. On the other hand, the third dimension of fiscal fairness – a better business environment – cannot be achieved unless the frictions and disparities between the national tax systems are levelled via harmonisation measures.

1. [Commission Communication subsequent to the conclusions of the Ruding Committee indicating guidelines on company taxation linked to the further development of the internal market SEC (92) 1118 final Brussels, 26 June 1992.]↩

2. [Ruding, Onno, Report of the Committee of Independent Experts on company taxation, March 1992, page 13.]↩

3. [Supra, footnote [1], page 7]↩

4. [Case C 269/09 Commission/Spain ECLI:EU:C:2012:439, Case C 38/10, Commission/Portugal ECLI:EU:C:2012:521, Case C-164/12 DMC ECLI:EU:C:2014:20 and Case C 657/13 Verder LabTec, ECLI:EU:C:2015:331.]↩

5. [OECD/G20 Base Erosion and Profit Shifting Project, Action 6: Preventing the Granting of Treaty Benefits in Inappropriate Circumstances, pp. 96-97.]↩

6. [Supra, footnote [3].]↩

7. [idem]↩

8. [E. Matei, ‘The Interplay between the State Aid Rules and other BEPS-Preventing Tools (SA.38375)’ Kluwer Tax Blog, 28 October 2015.]↩

9. [Case C-387/01 Weigel ECLI:EU:C:2004:256 [72-9]]↩

10. [http://europa.eu/rapid/press-release_IP-92-197_en.htm]↩

11. [Supra, footnote [2].]↩

12. [Council Resolution on coordinating exit taxation, Brussels, 2 December 2008.]↩

13. [Supra, footnote [4].]↩

14. [DG Financial Stability, Financial Services and Capital Markets Union

Unit B3 – Accounting and financial reporting, Public consultation on further corporate tax transparency, Brussels, 17 June 2015.]↩

15. [Case C 371/10 National Grid Indus ECLI:EU:C:2011:785 [68].]↩

16. [See the Public consultation on further corporate tax transparency http://ec.europa.eu/finance/company-reporting/country-by-country-reporting/index_en.htm]↩

17. [Case C-261/11 Commission/Denmark ECLI:EU:C:2013:480 [36].]↩

18. [Case C 686/13 X/Skatteverket ECLI:EU:C:2015:375 [34].]↩

19. [ESA Decision no 474/5/COL, Reasoned Opinion of 11 November 2015 can be read on http://www.eftasurv.int/press–publications/press-releases/internal-market/internal-market:-icelands-exit-taxation-rules-are-in-breach-of-eea-law.]↩

20. [Case E-15/11 Arcade Drilling 3 October 2012 [105]. See also my blog post from 18 August 2015: ‘Dual residence and the right to migrate under EEA law (Arcade Drilling)’.]↩

21. [Case C 371/10 National Grid Indus ECLI:EU:C:2011:785 [77] and Case E-15/11 Arcade Drilling 3 October 2012 [99].]↩

22. [Case C 371/10 National Grid Indus ECLI:EU:C:2011:785 [62].]↩

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.