A Delaware company, which was a wholly owned subsidiary of a Swedish corporation (aktiebolag), acted as a non-independent agent on behalf of exporting companies in the United States. The profit of the subsidiary was exempt from corporate taxation in the United States, while the dividends paid to the Swedish parent were subjected to federal tax. Should the dividends received by the Swedish parent be exempt from Swedish tax? I provide hereby an alternative solution to the one issued by the Swedish Board for Advance Tax Rulings in the case X AB v Skatteverket[1].

A) Introduction

Usually the competition between fiscal jurisdictions leads to a reduction of the taxation rates for the mobile sources and a struggle to expand the taxation base. The IC-DISC (Interest Charge Domestic Sales Corporation) is a policy device, a choice made by the legislator in the U.S. that instead of lowering the rate from 35% to 20% for the export companies, it provided a fiscal facility which guarantees the same effect. In the present case, the Swedish Board for Advance Tax Rulings (‘Board’) had to decide on the treatment of dividends received by a Swedish parent from its U.S. registered subsidiary.

Consolidation of income and expenses or profits and losses of members of the group is not allowed for corporation tax purposes under Swedish law, but the members of the same group can benefit from a special relief under which it is possible to shift profits or losses amongst companies belonging to the same group. A characteristic of the Swedish tax system is that dividends and capital gains on holdings for business purposes are tax-exempt, while corresponding losses will not be deductible.

B) The objective of avoiding Double Taxation

The article 10 of the United States-Sweden Treaty on the Avoidance of Double Taxation and the Prevention of Fiscal Evasion[2] (hence-forth, the “Treaty”) dictates the following in relation to dividends paid by a subsidiary resident of United States to a parent in Sweden:

- Dividends paid by a company (Y, in this case) which is a resident of United States to a Swedish resident (X AB, in this case) may be taxed in Sweden.

- However, such dividends may also be taxed in the United States, and according to the laws in force there, but if the beneficial owner of the dividends is a resident of Sweden (X AB), the tax so charged shall not exceed 5 percent of the gross amount of the dividends if the beneficial owner is a company which owns at least 10 percent of the voting stock of the company paying the dividends;

X AB owns 100% of the stock capital of Y, however according to article 5(7) of the Treaty, Y shall not of itself constitute a permanent establishment in the U.S. of the Swedish parent company, X AB. As I will show later, the Treaty tenet pointing towards a lack of permanent establishment contradicts apparently the provisions of the Section 996(g) IRC.

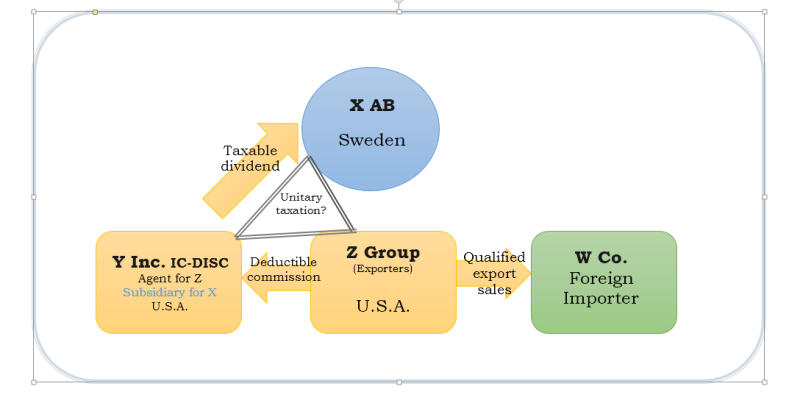

FIG.1: IC-DISC Structure with foreign parent

The tax paid on dividends in the United States according to Treaty rules should not exceed 5% of the gross amount of the dividends, if the Treaty enjoyed primacy over the U.S. federal IRC. From this perspective, the use of a cross-border configuration would reduce the tax rate in the United States as regards export sales from 35% to 5%. However, the real beneficiary of the tax reduction would not be Y Inc., but its principal Z (See fig. 1 above).

C) IC-DISC: a fiscal facility for the U.S. export businesses

In the United States a foreign person may be liable to pay taxes for effectively connected income (“ECI”) or for fixed or determinable annual or periodical income (“FDAP”). Interest and dividends are as a general rule included in the second category. However, according to Section 996(g), the distributions of dividend from an IC-DISC to its foreign shareholders are treated as ECI earned through a permanent establishment in the United States. Dividends received by foreign shareholders from an IC-DISC will be subject to tax at common tax rates applicable to U.S. taxpayers. Thus foreign individuals are eligible for rates of up to 20%, while foreign corporations of 35% (unless the Treaty overrides the provisions of the domestic tax rules).

In the case of a shareholder who is a nonresident alien individual or a foreign corporation, trust, or estate, gains referred to in section 995 (c) and all distributions out of accumulated DISC income including deemed distributions shall be treated as gains and distributions which are effectively connected with the conduct of a trade or business conducted through a permanent establishment of such shareholder within the United States and which are derived from sources within the United States.

An IC-DISC is a fiscal facility granted under the U.S. federal law. According to the U.S. Tax Court “[a] DISC may be no more than a shell corporation, which performs no functions other than to receive commission on foreign sales”[3]. The Court of Federal Claims in Vanderbilt v United States, stated that the intention of the American legislative was to remove a previous competitive disadvantage between domestic and multinational corporations. The purpose for enactment of the DISC provisions was to provide tax incentives for United States firms to increase their exports and to remove the previous tax disadvantage of firms engaged in export activities through domestic corporations instead of through foreign subsidiaries[4].

The IC-DISC treatment is nonetheless conditional. The corporation shall maintain a separate bank account, keep separate accounting records and file an annual income tax return according to law. On the other hand, a DISC does neither have to own assets and hire personnel nor provide any services. In order to acquire the IC-DISC status, a U.S. corporation must file an election with the IRS requiring to be treated as an IC-DISC for the U.S. federal income tax purposes.

It is of the essence to notice that this favourable status may go astray, if the corporation fails to satisfy a set of cumulative conditions stipulated by section 992 (a)(1):

- It must have a single class of stock;

- It must maintain a minimum capitalisation of $2,500 of authorised and issued shares and

- At least 95% of its gross receipts and qualified export assets must be related to the export of U.S. manufactured property at the end of the fiscal year.

Section 995(b)(2) contains an important stipulation that clarifies that the revocation of the IC-DISC status implies that the shareholder becomes liable to pay dividend tax for a pro-rata share of the DISC-income accumulated during the immediately preceding consecutive taxable years for which the corporation was a DISC.

A shareholder of a corporation which revoked its election to be treated as a DISC or failed to satisfy the conditions of section 992 (a)(1) for a taxable year shall be deemed to have received a distribution taxable as a dividend equal to his pro rata share of the DISC income of such corporation accumulated during the immediately preceding consecutive taxable years for which the corporation was a DISC[5].

An IC-DISC is usually owned directly or indirectly by an exporting company. The commissions paid by the exporter to the IC-DISC are tax-deductible for the exporter (see FIG. 1 above). The IC-DISC is a tax-exempt entity paying no tax on the income derived from commission. Up to $10 million the income can be deferred and a nominal interest charge will be due on the deferred income. The annual income exceeding $ 10 million shall be distributed as a dividend to the shareholders.

D) The Apple of Discord: The notion of ‘legal person corresponding to a Swedish Corporation’

In a recent ruling of the CJEU (Case C 686/13) it has been observed that the Swedish law concept of ‘holdings for business purposes’ does not require “intention to influence the management and control of the undertaking”. On the other hand, according to Ch. 39a art. 2 first indent ITA, only holdings corresponding to at least 25% (capital or voting rights) in a foreign entity can trigger CFC taxation.

In general dividends on non-listed holdings in foreign companies are exempt from Swedish withholding tax. The normal rate of withholding tax (where applicable) is 30 %, but it can be waived or reduced under most tax treaties. The foreign company must nonetheless be regarded as an equivalent of a Swedish corporation in order to benefit from the tax-free dividend rule. The required equivalence constitutes the Apple of Discord in the present case.

The Swedish law relies on a comparison between the fiscal regime of domestic corporations and of the foreign entities involved for the purpose of determining whether the latter are subjected to similar taxation in their country of residence. According to Ch. 6 art. 8 of the Swedish Income Tax Act (“ITA”) an association would be a foreign legal person if, according to the legislation of the country of origin:

- The association can acquire rights and assume legal obligations,

- It can bring a case before a court of law or any other public authority,

- Individual shareholders do not freely dispose over the assets of the company.

According to Ch. 2 art 5a, first indent, a foreign legal person is a foreign corporation for fiscal purposes if two conditions are fulfilled. Firstly, the association must be a distinct tax subject in its country of residence. Secondly, the taxation must be similar to the taxation of a company incorporated under Swedish law.

The second indent of Ch. 2 art 5a provides an alternative definition for the specific situation of foreign legal person resident of a State with which Sweden has concluded a tax treaty[6]. The possible application of the second definition is mentioned, though not actually examined by the Board. It must be specified that the interpretation of ‘corresponding to a Swedish corporation’ must allow a comprehensive definition of the legal term.

The Swedish parent had to decide either to collect the dividends or divest its shareholding. For this reason it needed a preliminary decision from the Board. It asked the following questions:

- Does Y correspond to a Swedish company in such a way as the shares can be qualified as holdings for business purposes as defined by Ch. 24 ITA?

- If the shares do not represent holdings for business purposes, shall Y be deemed to be a trading partnership in the meaning adopted by the Ch. 5 art. 2a ITA?

- No matter what answer is given to the previous questions, shall the income of Y be subject to the CFC-regime stipulated by Ch. 39a ITA?

The answers to each question are briefly reproduced below.

- The Board reminded that the concept of holdings for business purposes serves the aim of avoiding double economic taxation. The definition of holdings for business purposes is found in Ch. 24 art. 14 ITA. The holding must not be listed, the total number of voting rights attached to all the shares held by the company owning the shares in the company owned corresponds to at least 10 per cent of the total number of voting rights attached to all the shares in that company or the share is held for the purpose of the activities of the holding company or by an undertaking which, having regard to the conditions of ownership or of organisation, can be regarded as being close to that company.The answer provided to question (1) has been negative and it relies on the assumption that Y is not a foreign corporation as defined by Ch. 2 art. 5a. If this assumption is wrong, which I ponder it is, the answer will be reversed. If the Y-shares had been instead classified as holdings for business purposes, the dividends received by X would have been exempt from Swedish taxation according to Ch. 24 art. 17 ITA.

- The Board found that a Delaware corporation is a corporate body with distinct legal personality. However the Delaware-corporation in question enjoyed a special fiscal regime, which exempts it from income taxation.Y was found not to correspond to a Swedish corporation (aktiebolag) and it was deemed to be a legal person according to the definition stipulated by Ch. 5 art. 2a ITA[7]. The answers to questions (1) and (2) give the impression of circular reasoning. The Board points out in its answer to question (1) that tax-exemption would be excluded for dividends paid by a legal person defined according to the provisions of Ch. 5 art. 2a ITA. In my opinion the first two questions must be answered together and a formalistic approach engaging double exclusions must be avoided.

- The fact that the IC-DISC is tax-exempt has induced the conclusion that Y does not correspond to a Swedish corporation, but it is similar with a legal person, whose shareholders are subjected to tax abroad as defined by Ch. 5 art. 2a ITA. Chapter 39a art. 1 ITA stipulates that the CFC-rules are not applicable to legal persons of the type defined in Ch. 5 art. 2a ITA. Again if the profit is exempt from U.S. taxation at the level of corporation, the economic double taxation would not occur according to the interpretation given by the Board and the pursuit of avoidance of economic double taxation would become futile.

The decision of the Board disappointed both the plaintiff (X AB) and the respondent (Swedish Tax Office). The plaintiff expected that the provisions of Ch. 24 (holdings for business purposes) would apply, while the respondent anticipated that the provisions of Ch. 39a (CFC-rules) would be pertinent.

E) Conclusions

Under the Treaty, any entity which is treated as a body corporate for income tax purposes is a company, by that meaning a separate tax subject. Under the U.S. federal IRC, the IC-DISC is a corporation that must maintain a separate bank account, keep separate accounting records and file an annual income tax return according to law. Thus, it is reasonable to assume that Y corresponds to a Swedish corporation. Such a conclusion will automatically reverse the decision of the Board.

It would be reasonable to expect that X-Z belong to a common corporate configuration. In usual cases the exporter controls the IC-DISC directly or indirectly. There are cases where the exporter and IC-DISC are sister companies owned by a foreign corporation like X AB. In my opinion, Y cannot be distinguished from Z, as an economic unit, since Y does not have an economic existence, but it only serves as a form required by law. Therefore, when the cross-border relation is analysed the focus shall be placed in any case on the relation between X and Z looking through Y.

FIG. 2: Structuring an IC-DISC for different types of shareholders

I will rely on the reasonable assumption that dividends are actually paid by Z to X AB, if the IC-DISC is defined as a device with no economic substance. According to the Treaty, such dividends shall be exempt from Swedish tax to the extent that the dividends would have been exempt under Swedish law, if both companies had been Swedish companies. This provision shall not apply unless the profits out of which the dividends are paid have been subjected to the normal corporate tax in the United States.

The nominal rate for corporate tax in the United States is 35%. It is not clear though what is meant by normal corporate tax and the definition of ‘corresponding to a Swedish corporation’ is also uncertain. Fact is that the tax reduction attained via the DISC-construction is not related to the Swedish territory. The U.S. level of taxation of 23.8% specific for the DISC configuration is still higher than the Swedish nominal rate of 22%, though lower than the nominal tax rate in the U.S. of 35%. As I have mentioned above, a certain interpretation of Section 996(g) may lead to an actual taxation level of 35% for a foreign corporation in its quality of shareholder of an IC-DISC.

The comparison between the IC-DISC and a trading partnership is in any case far-fetched, since a partnership must be founded by minimum two individuals or legal entities and in the present instance, X AB is the sole shareholder of Y Inc. The IC-DISC construction does not aim to transfer a burden, which normally would be imposed on the parent company in Sweden, but sooner it provides a modality to grant fiscal benefits to U.S. exporters[8]. The ‘IC-DISC veil’ should be pierced in order to contemplate the economic rationale of this at least theoretically fascinating configuration.

[1] X AB V SKATTEVERKET, FILE 87-14/D, 30 JUNE 2015.↩

[2] CONVENTION BETWEEN THE GOVERNMENT OF THE U.S.A. AND THE GOVERNMENT OF SWEDEN FOR THE AVOIDANCE OF DOUBLE TAXATION AND PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON INCOME (1996-01-01). HTTP://WWW.IRS.GOV/PUB/IRS-TRTY/SWEDEN.PDF↩

[3] FOLEY MACH. CO. V. COMMISSIONER, 91 T.C. 434, 438 (1988); JET RESEARCH, INC. V. COMMISSIONER, T.C. MEMO. 1990-463, SUMMA HOLDINGS V. COMMISSIONER, T.C. MEMO. 2015-119. SEE ALSO THOMAS INT’L LTD. V. UNITED STATES, 773 F.2D 300, 301 (FED. CIR. 1985).↩

[4] VANDERBILT V. UNITED STATES, 95-283 T, (FED. CL. 2010).↩

[5] THIS TYPE OF PRO-RATA TAXATION CORRESPONDS TO THE TAXATION REGIME OF PARTNERSHIPS IN SWEDEN I.E. AN ASSOCIATION WITHOUT LEGAL PERSONALITY (HANDELSBOLAG/HB).↩

[6] MY TRANSLATION OF CH. 2 ART. 5A, SECOND INDENT ITA: A FOREIGN CORPORATION IS DEFINED AS A FOREIGN LEGAL PERSON, WHICH BELONGS AND IS SUBJECTED TO INCOME TAX IN A STATE WITH WHICH SWEDEN HAS CONCLUDED A TAX TREATY THAT IS NOT LIMITED TO CERTAIN TYPES OF INCOME, IF THE LEGAL PERSON IS RESIDENT OF THAT STATE UNDER THE TAX TREATY AND ITS FISCAL SITUATION IS COVERED BY THE TREATY RULES ON AVOIDANCE OF DOUBLE TAXATION.↩

[7] TECHNICALLY, THIS LEGAL PERSON IS ASSIMILATED TO A TRADING PARTNERSHIP (IN ORIGINAL “HANDELSBOLAG”), A DISTINCT LEGAL PERSON ACCORDING TO COMPANY LAW, HOWEVER, NOT A SEPARATE FISCAL SUBJECT ACCORDING TO TAX LAW. A TRADING PARTNERSHIP MUST HAVE MINIMUM TWO FOUNDING PARTNERS.↩

[8] IT COULD BE ARGUED THAT SUCH A REGIME CONSTITUTES ILLEGAL SUBSIDIES UNDER WTO LAW.↩

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.