Executive summary:

When we look at the digital economy, we tend to think of it as a global, intangible and knowledge-driven system. However, the digital economy is not only driven by patents or trademarks – so-called “intangibles” – but also driven by “resources, data and labour”.

Against the background of this incomplete understanding of the digital economy as a pure intangible something, and based on a multiple of studies, intangible assets by digital, data- and technology-driven companies might currently be overvalued. The potential consequences of such overvaluation could not only lead to an increase in aggressive tax profit shifting, but also increased inequalities between states and people, as well as distorted investment decisions in technology companies.

We assume several reasons for the overvaluation of intangible assets: an incomplete understanding of the digital economy, a distorted valuation of intangible assets as well as tax avoidance strategies of multinational companies.

To test our claim of lacking digital literacy, we conducted a quasi-experiment in the form of an expert workshop, asking “what aspects create value for Data Acquisition, Data Storage, Data Analysis, Data Usage as stages within the value creation process for an Amazon Echo System?”, and, by doing so, letting experts create and evaluate a realistic use case from the digital economy. The results, although limited, show that when confronted with a more holistic idea of the value chain of the digital economy as it is commonly understood, participants shift relative value from intangibles to labour, indicating a bias towards the overvaluation of intangibles.

This empirical research contribution provides evidence of an incomplete understanding of the so-called “digital economy” among experts and shows why it is worthwhile to shift the focus away from the “digital” towards the human and physical elements – with heavy consequences for the claim that the digital economy has no physical presence and is simply intangible driven.

Artificial intelligence and its simplified narrative

In the late 18th century, the so-called “chess Turk” referred to a chess machine that seemed to be able to play a strong game of chess against a human opponent. In fact, however, a human chess master hid in the machine, thus maintaining the illusion that the machine itself could play chess (Stephens, 2022). Almost 200 years later, it seems that no people have to pull the strings behind the scenes: IBM’s chess system Deep Blue beat reigning world champion Garry Kasparov in 1996 and 20 years later Google DeepMinds AlphaGo won against one of the world’s best Go players Lee Sedol – apparently entirely due to the ingenious ideas of their programmers, who had given the machines this ability.

However, this simplistic narrative of humans versus ever-improving machines is not enough to fully grasp the relationship between “smart” technology and society. Today, in light of the “Alexa everywhere” campaign with virtual private assistants in more and more households, Medina-Borja also speaks of an era of “intelligent everything”, in which many areas of industrialized economies are dominated by smart services (Medina-Borja, 2015).

In contrast to the understanding of “traditional” services as human-cantered processes, in which value is created jointly by the interaction of two or more actors (individuals, organizations or public/authorities), the concept of these smart services shifts the focus to the value creation between people and sophisticated – i.e. intelligent – technical objects (Medina-Borja, 2015; Barile et al., 2019). The adjective “intelligent” often refers to a list of potential characteristics of a human-interacting system, such as learning, contextual adaptation, data-driven decision-making, or other competencies that enable regulation, organization, management, and description (Beverungen et al., 2019). Knote et al (2020) even argue that these features suggest that these services should – to some extent – be viewed as autonomous, reflective, and cognitively advanced service counterparts for human users.

The amorphous, global, intangible and knowledge-driven digital economy?

Against this backdrop, it is not surprising that the digital economy today is often described as driven by innovation and technology, with its success mainly attributed to intangible assets and highly skilled information and technology personnel. But is the production of digital goods and services, e.g., the construction, maintenance, and value creation of digital systems, based only on these “global, intangible and knowledge-driven” value drivers? Or does this focus on new inventions and technologies perhaps even obscure the view of the outside world around digital services, including factors necessary to build, deploy and maintain them?

An understanding of extractivism helps us to understand the value chain of the digital economy not exclusively as digital or artificial, but as physical and driven by people (Mezzadra and Neilson, 2013, 2017; Riofrancos, 2020; Scott, 2020; Joler, 2020; Winterhalter, 2022): Thus, Joler argues that it is necessary to go beyond a simple analysis of the relationship between a single person, their data, and a single technology company to fully understand the digital economy and the planetary dimension of extraction associated with it. According to Crawford and Joler’s “Anatomy of AI,” every step of digital infrastructure and product supply chains should therefore be analysed in terms of labour, resources and data and their joint extraction.

They argue that – similar to neural networks or algorithms – the hidden supply and value chains of the digital economy are currently still black boxes for us and therefore need to be systematically analyzed. From such a modular perspective, it follows that not only so-called key value drivers, but also all hidden value contributions necessary to enable the system of the digital economy are taken into account in the analysis. Resources, data and work can therefore be understood as an alternative taxonomy for the analysis of the digital economy and the starting point for the following considerations on the actually materialistic value chain.

The thesis: Overvaluation of the digital economy

We do not want to argue against the perception that the digital economy is not driven by innovative processes, build on (human) capital, and a new way of using data (E.g., the value of data is highly likely crucial for the company’s success. Insofar, the value of data or the user contribution in general shall not be contested.

Nevertheless, we still argue that when looking at the value of the digital economy or the respective business from a comprehensive as well as modular perspective, the valuation of intangible assets cannot be determined without taking into account “the whole picture”, including human- and physical-driven elements of the digital economy which are usually overlooked due to a limited understanding of the digital economy. In other words: although highly skilled ICT worker, capital, and the user contribution represent an essential part of modern (data and technology driven) business models, it is also the hidden factors which are indispensable and cannot neglected regarding the value chain equation. This bias of a limited understanding of the digital economy extends to the evaluators which could lead to biased evaluations, and more specifically an over-estimation of value created by intangibles.

This finding is not necessarily new in this respect: science and practice argue that the shift of intangible assets considerably facilitates tax evasion and at the same time leads to distorted company values due to their high valuation.

Building on the above concept of extractivism, however, an incomplete understanding of the digital economy on the part of experts dealing with the digital economy is fundamental.

Testing the thesis: a quasi-experiment as an expert workshop

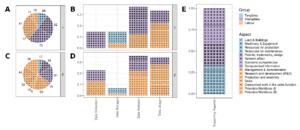

In order to test this fundamental assumption, we conducted a workshop on “Regulation of the Digital Economy”, which was attended by relevant actors with specific expertise from society, business, academia and government in the digital economy. The core question of the workshop was “What do you need to enable the big data phases of data collection, data storage, data analysis, data use of an Amazon Echo system?”. Based on this question, experts created and evaluated a realistic use case from the digital economy – first with regard to the classical understanding of digital value creation and then with an additional focus on otherwise rather invisible aspects, such as human work through data generation and data labelling, as well as material resources.

When explicitly asked in the form of a vote, the majority of experts did not share Joler and Crawford’s concept of extraction. At the same time, however, the results of the value distribution (see chart) show that when participants were confronted with a more holistic view of the value chain of the digital economy as we understand it, they valued intangible assets lower than before. In other words, taking into account several aspects, the value added contribution of labour increased significantly at the expense of capital (with the effect being higher for intangible assets than for tangible assets). These findings point to a link between knowledge about the digital economy and the way experts value intangible assets.

Implications of our thesis

If intangible assets are truly overvalued, this has implications for the role of ancillary functions, the resulting change in the allocation of profits in taxation, exploitation within the digital economy and the role of transparency in regulating the digital economy. Auxiliary functions / routine functions play a much higher role in digital business models than assumed, leading to the conclusion that it is not only about intangible assets or ICT workers, but also not only about the “user contribution” of customers / consumers with high purchasing power that generate the digital economy – it is the routine functions that are necessary to enable data processing of any form: Resources and especially human work in general.

For profit allocation in the area of international taxation, higher remuneration for routine functions would lead to a higher share of the tax pie in favour of the Global South, as well as to a reduction in inequalities within workers in the Global North in investment decisions.

The impact might also be that the establishment of a PE might already be possible without overstretching the concept of a PE, especially when we (re-)consider new types of (decentralized) work like CrowdWorker for Pre-Data-Analysis or content moderators as well as new working behaviour in general like “home office”, or (decentralized) tangible capital like edge computing devices (this is especially true for auxiliary activities according to Art. 5 (4) OECD-MC). In this sense what follows is that we must rethink the value chain of the “digital” economy, including a more comprehensive, modular analysis of the value chain, with less top-down but bottom-up approach. The greater ensemble is that to determine transfer prices according to the ALP on a strictly transaction-based analysis and an isolated consideration of the individual transactions from an economic point of view is hardly possible. It is therefore necessary to identify and assess the situation within the MNE group, or as Greil puts it: “(…) one has to familiarize oneself with the MNE group and its value chain, value network or value shop and a complete value chain analysis has to be carried out. (…) Only then it is possible to assess how third parties would have assessed the facts and whether there is a misallocation of profits”.

We argue that only when the triad of “resources, data, and labour” are included within this value chain analysis, a lasting and convincing line of argumentation can be established in the context of an audit. But the main implication might be regarding the discussion of a fair nexus in the changing world, especially regarding the issue of (working presence) PEs, thus we should take into account the insights from the taxonomy of the triad labour, resources, data, in the end meaning that even for the digital economy there might be substantial physical as well as taxable presence on the ground.

But the results also encourage us that when we talk about the future of work, the digitization of our society and the transformation to automation and robotization and the resulting inequalities, we should keep in mind that “intangibles”, “technology” or even “robots” are not simply the result of a genius from the cloud, but on the use (or even exploitation) of work, data and resources. Without wanting to argue against the paradigm of the knowledge society, and certainly not against innovation and technology, the concept of extractivism as well as our preliminary results suggest that it is not just a few, but many functions that form the backbone of this paradigm. So when we talk about key value drivers along the value chains of the digital economy, it’s important to mention that we’re not just talking about something we can’t touch and therefore understand, or something that’s only digital or fully automated – like the idea of a self-driving car – but instead about something very real. This is not just about the user contribution in the Global North, which determines the value of a company, but about a bundle of services in the form of data, labour and resources that are not recognized, neglected and usually poorly paid – in contrast to the value contribution assigned to in our quasi-experiment.

The big picture reflects lessons learned from the so-called information society: the more information you have and understand it, the better the outcome in terms of regulation, or in other words – transparency works: in the area of international taxation, it could help prevent aggressive profit shifting by multinational companies, in the area of ESG investment decisions it could help to improve the right decision. and in the area of consumer protection, it could help consumers to be better informed and to know the hidden value of a digital product.

The under-regulation of the digital economy has long been seen as an unavoidable condition of the global economy rather than as a soluble policy problem – but if one does not stop on an abstract level to analyse this intangible driven something but begins to deconstruct it on a material, concrete level, this narrative of intangible progress should and can be contested. Insofar, new methods for an in-depth and comprehensive analysis of the “hidden” value chain which is rather driven by de-centralization than de-materialization must be developed, especially in the realm of transfer pricing. Further research can provide proof that in order to develop, maintain, and implement a digital business model, you need a significant physical, human driven nexus on the ground.

This leads to the most interesting and probably most important question: If the digital economy has been analysed poorly so far and the impact of automation overstated, such biases are probably included in the transfer pricing models too. And that matters for 2023 international tax debates. After all, low taxes paid by tech companies was a key driver of every major international tax reform (e.g., BEPS, DSTs, Pillar 1, Pillar 2). If we’ve all misunderstood tech and overvalued the value of automation, would we still have a problem once the whole value chain would have been properly evaluated? Could tax authorities start attacking those transfer pricing models today without any (significant) change of law?

This article is a summary of a study conducted by Jan Winterhalter, Lukas Seiling, Mariam Sattorov during a research stay at the Weizenbaum Institute Berlin, and represents only preliminary results; the full study will be published at International Tax Studies in May 2023. A working paper is available here The Physical, Human Driven Digital Economy: The Overvaluation of Intangibles and its Effects on Tax and Society by Jan Winterhalter, Mariam Sattorov, Lukas Seiling :: SSRN

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.