Introduction

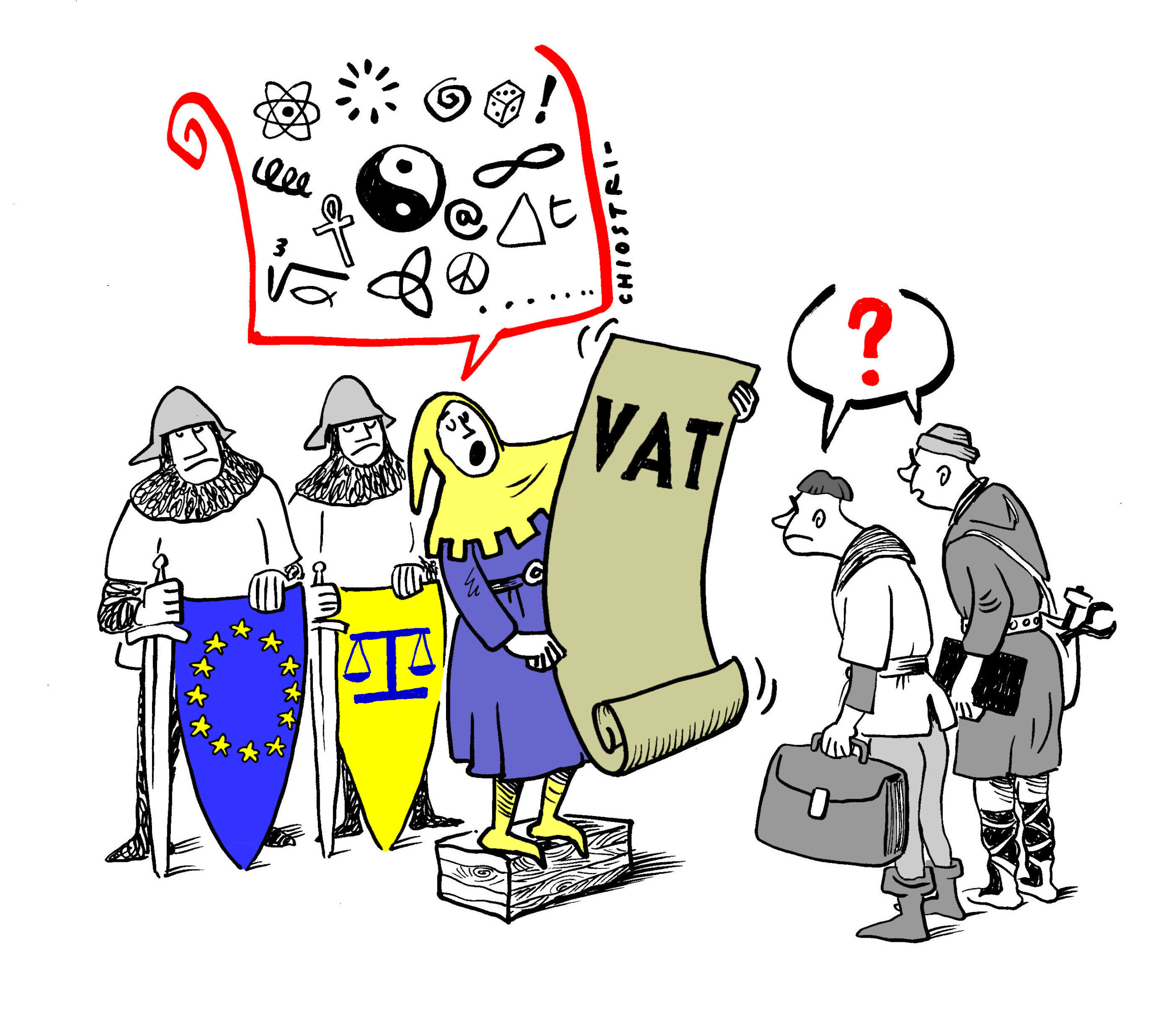

In today’s world, many things have become more intuitive – user interfaces of electronic devices, the way the merchandise is advertised, and how information is delivered. This contention seems to apply to communication in general: we have less time, energy, or resources to absorb information. Therefore, those who provide such information, do it in a more readable manner. The intuitiveness of the tools to operate in today’s world is advancing hour-by-hour, which does not necessarily mean that the world has suddenly become less complex. Interestingly, this phenomenon does not embrace the case-law of the Court of Justice of the European Union (CJEU), and cases on VAT are certainly no exception in this respect.

The endeavour and accomplishments of the CJEU in terms of interpreting and building norms within the EU VAT system are hard to deny. The settled content of such concepts as economic activity, taxable activities, supply for consideration, abuse of law, good faith, formal obligations, right to deduct, and alike create a system well-rooted in VAT specialists’ minds in Europe and all around the world. At the same time, the following fact cannot go unnoticed here: that the language and line of reasoning presented in the Court’s case law is often too complicated and unintelligible.

Why it so remains to be further studied and explained. Yet, in this short note, I would demonstrate this complexity and lack of clarity based on the example of the CJEU’s judgment in Budimex (2 May 2019, C-224/18). For this, I will quote a few paragraphs (in bullet points) of that judgment and comment on the course of the Court’s reasoning.

Budimex judgment: background and the problem to be solved

The background and problem to be solved in the case are pretty straightforward. Budimex is a Polish company performing construction and installation works. According to Polish legislation, such services’ tax point depends on when the service is performed or completed. It was not clear (and – due to lack of clarity in the judgment – still is) whether the service should be considered as completed on the day when the works are de facto terminated or upon formal acceptance of the completed works by the client in the form of a report or acceptance protocol.

The CJEU has framed the underlying problem: can we consider the formal acceptance of service (construction works) as its completion (paragraph 20)?

Analysis of the Court’s reasoning

The course of the argument up to paragraph 26 does not cause any troubles, and it is easy to understand. However, the subsequent paragraph reads as follows:

- 27: Whilst it is true that construction or installation services are commonly regarded as supplied on the actual date the work is completed, the fact remains that, for a transaction to be regarded as a ‘taxable transaction’ within the meaning of the VAT Directive, economic and commercial realities form a fundamental criterion for the application of the common system of VAT, which must be taken into account (see, to that effect, judgment of 22 November 2018, MEO — Serviços de Comunicações e Multimédia, C‑295/17, EU:C:2018:942, paragraph 43).

It is not entirely clear why the information carried here in the first part of the sentence matters. In any case, the most crucial statement here seems to be that ‘economic and commercial realities’ are those that are relevant. Next, after this statement, the Court continues its reasonings and mentions the importance of contractual terms. However, what is the link between the economic realities and contractual terms remains unclear, though the Court uses an expression ‘in that context’:

- 28: In that context, it has been held that the relevant contractual terms constitute a factor to be taken into consideration when the supplier and the recipient in a ‘supply of services’ transaction within the meaning of the VAT Directive have to be identified (judgment of 20 June 2013, Newey, C‑653/11, EU:C:2013:409, paragraph 43).

This statement, derived from one of CJEU’s precedents, only indicates that contractual terms must be taken into consideration to identify the transaction parties, but not to identify the day on which the service is completed. The Court does not explain how its findings translate to the case at hand but instead jumps immediately to the conclusion:

- 29: Therefore, it is not inconceivable that, taking account of contractual terms reflecting the economic and commercial realities in the field in which the service is supplied, that service may be regarded as supplied only at a time after the actual completion of the service, following the performance of certain formalities indistinguishably related to the service and conclusive in ensuring its complete performance.

Although the paragraph begins with the adverb ‘therefore’, it is hard to perceive its implications fully. Up to this point, nothing more than two ideas were raised: that ‘economic and commercial realities’ are relevant to apply VAT provisions and that the contractual terms are important in determining the parties of the transaction. And yet, from these two premises alone, the Court draws the following conclusion:

- That the service may be regarded as supplied after formalities ensuring its complete performance;

- But this is valid only if we take ‘account of contractual terms reflecting the economic and commercial realities in the field in which the service is supplied’;

- And this is not a statement that is true for sure; this is only “conceivable”.

It is worth mentioning only as a side note that the sentence is very hard to comprehend by an average user of language and law (as a matter of fact, nearly all of the critical paragraphs from the judgments are underlined by Microsoft Word with a blue line and a suggestion ‘grammar: long sentence (consider revising)’).

This puzzling conclusion is followed by the passage:

- 30: In that regard, it must be borne in mind that a supply of services is taxable only if there is a legal relationship between the provider of the service and the recipient pursuant to which there is reciprocal performance, the remuneration received by the provider of the service constituting the value actually given in return for the service supplied to the recipient (judgment of 2 June 2016, Lajvér, C‑263/15, EU:C:2016:392, paragraph 26 and the case-law cited).

This paragraph does not raise significant doubts in terms of its content for a VAT specialist. Indeed, it is repeated quite often by the CJEU. However, it is hard to figure out why such a paragraph is ultimately here, as it does not seem to have a link with paragraphs 29 and 31. In any case, subsequently, after bringing up the legal norms of significance here, the Court rightly invokes the facts provided by the referring Polish court:

- 31: In the present case, it follows from the information provided by the referring court that the terms of contracts concluded by the applicant in the main proceedings provide the client with the right to check the conformity of the completed construction or installation work before accepting it and the supplier with the obligation to carry out the necessary modifications so that the end product does in fact correspond to what was agreed. In that regard, Budimex claims, in its written observations, that it was often impossible for it to ascertain the taxable amount and the amount of VAT due before acceptance of the work by the client.

This passage is clear enough. However, it is not apparent why the Court invokes the taxable amount in the last sentence. As it turns out later, the taxable amount is a relevant issue in the context of this decision. However, it would be better to bring it up in a separate stream of reasonings since the CJEU contemplates questions concerning the taxable amount only further on in its judgement.

Afterwards, the Court rightly and consequently concludes what are the VAT implications of such a contract in light of the VAT rules construed before:

- 32: First, whilst the requirement constituted by the drawing up of a formal record of acceptance by the client takes place only after the time given to the client for notifying the supplier of any defects, which would be for the supplier to remedy so that the construction or installation service complies with the terms of the contract, it is not inconceivable that that service is not entirely performed before the time of acceptance.

The information is delivered here in a too much-articulated sentence and complicated manner. It should be enough to say, for example, that ‘the content of the contract in the light of the conclusion form paragraph 29 seems to indicate that the service is not entirely performed without the formal acceptance by the client’. The Court also makes a reservation that such a conclusion is not inevitable; it is only ‘conceivable’.

Further, the Court comes back (or at least it is supposed so) to the thread opened in the second sentence in paragraph 31 above concerning the taxable amount (indeed, it would be easier to have it in one separate stream of thoughts):

- 33: Second, it must be borne in mind that the taxable amount for the supply of services for consideration is the consideration actually received for them by the taxable person (judgment of 7 November 2013, Tulică and Plavoşin, C‑249/12 and C‑250/12, EU:C:2013:722, paragraph 33).

- 34: Therefore, in so far as it is not possible to ascertain the consideration due by the customer before the customer has accepted the construction or installation work, the VAT on such services cannot be chargeable before that acceptance.

The above paragraphs are simple, straightforward, and well connected between each other. These considerations do not apply, however, to the immediately following paragraph that, arguably, in the CJEU’s intention has the role in concluding its reasonings:

- 35: Accordingly, provided that the acceptance of the work has been stipulated in the contract for the supply of services, provided that such a requirement reflects the conventional rules and standards in the field in which the service is supplied, which is for the referring court to ascertain, it must be held that that requirement is itself a part of the service and that it is therefore decisive in determining whether that service has in fact been supplied.

This statement is confusing at best. The CJEU claims that formal acceptance is decisive in determining completion of the service provided the acceptance is stipulated in the contract. This conclusion might follow from the previous considerations. However, at the same time, the Court points out a new condition that ‘such a requirement reflects the conventional rules and standards’ in a given field. This statement is astonishing: ‘the conventional rules and standards’ are concepts that were not mentioned in any previous reasonings by the Court. In its prior considerations, the CJEU did not explain what those rules and standards are, why they matter, and how they influence its opinion while making it a key criterion in solving the case’s central problem. Previous considerations only indicate that formal acceptance by the client of the works carried out by the supplier is crucial if the supplier has to rectify defects of his work before the client accepts. No prior reference to ‘the conventional rules and standards’ is instead given.

© 2021 Kluwer Law International B.V., all rights reserved.

Eventually, the Court moves to the conclusion of the case:

- 37: In the light of all of the foregoing, the answer to the question referred is that point (c) of the first paragraph of Article 66 of the VAT Directive must be interpreted as not precluding, if an invoice relating to the performance of the service supplied is not issued or is issued late, the formal acceptance of that service from being regarded as the time when that service was supplied, where, as in the case in the main proceedings, the Member State provides that VAT is to become chargeable on expiry of a time limit running from the day when the service was supplied, provided, first, that the formality of acceptance was stipulated by the parties in the contract that binds them according to contractual terms reflecting the economic and commercial realities in the field in which the service is supplied and, second, that that formality constitutes the actual completion of the service and determines the amount of consideration due, which is for the referring court to ascertain.

The outcome does not appear coherent with the Court’s previous line of arguments, and it can be claimed that help provided for the referring court is limited. The CJEU states that – basically – the formal acceptance may be regarded as the completion of the service when the following criteria are met:

- such formality was stipulated in the contract (this element fairly stems from the Court’s considerations);

- the contract reflects the economic and commercial realities (which is also clear);

- these economic and commercial realities have to be somehow connected with the field in which the service is provided (this element is mentioned but not explained by the Court – as stated above);

- fulfilling of formality constitutes the actual completion of the service (which is, in essence, the case’s main problem – i.e. when and if such formality constitutes the service’s actual completion: it is puzzling to answer the main question by making it dependent on… the same question!);

- such ‘formality determines the amount of consideration due’ (this element does not result from the Court’s reasonings; earlier the Court stated that if the amount due is known only after the client’s acceptance, then such acceptance is necessary to consider the work as completed; but this does not automatically mean that this is the condition sine qua non to consider the service completed if we know the amount anyway).

Comment and conclusion

I do not claim that the language of the Court can be different. I assume that there are significant reasons for it to be this way. Only I intend to draw attention to the fact that the language and reasoning in some Court’s cases are hard to understand. From practice, I know that many tax lawyers – including VAT specialists dealing with cross-border cases – have a hard time understanding what the Court precisely intended to say in some instances. If it is so, it requires attention, reflection and maybe some steps to be taken. For the jurisprudence of the Court has greatly improved the VAT system in Europe. And the more understandable it is, the more impact it will have. And vice versa.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.