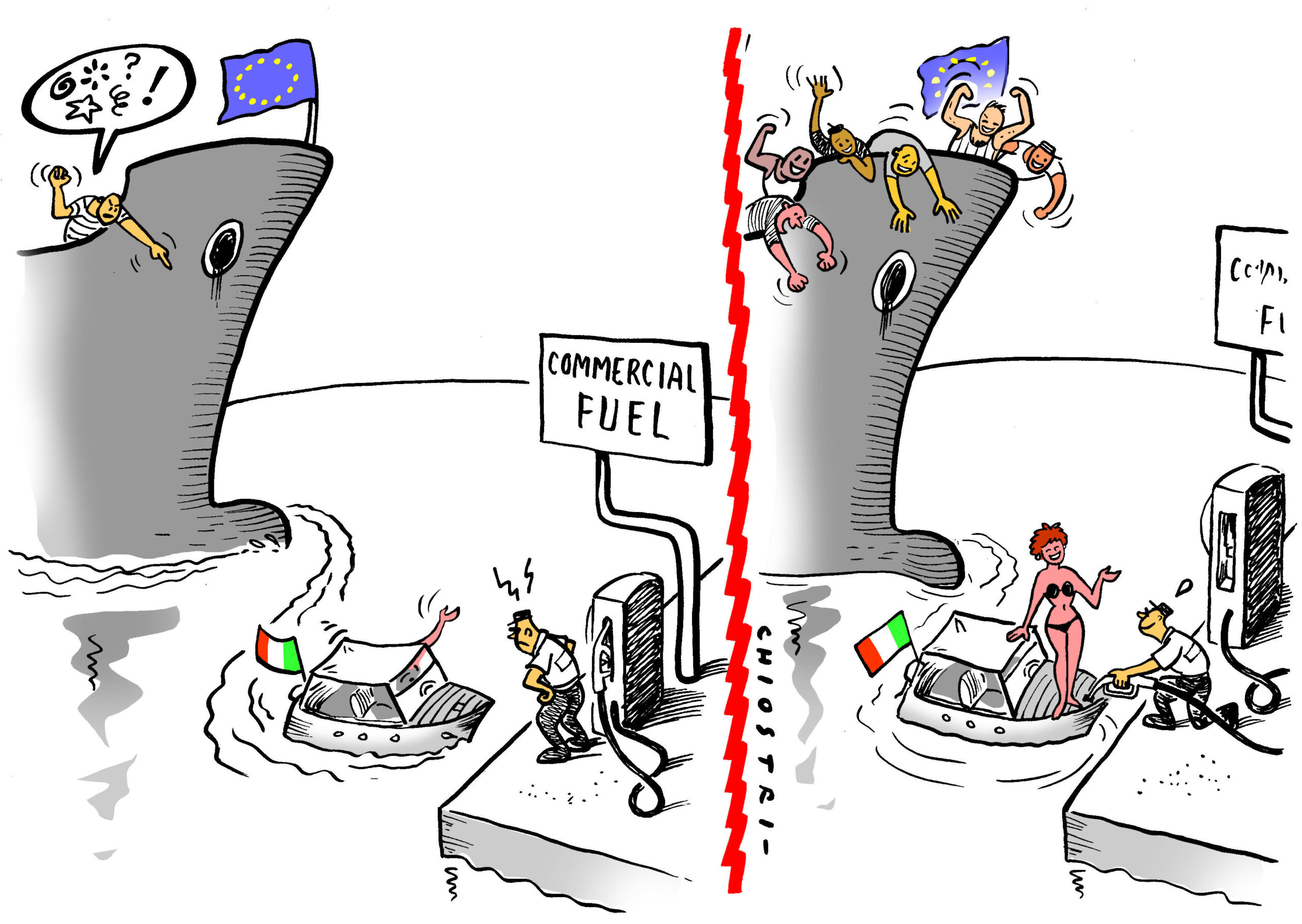

The Italian legislation on excise duties, and in particular Article 24 of Legislative Decree no. 504 of 26 October 1995 (hereinafter, “the Italian Excise Duties Act”) that provides an exemption for fuels used for navigation in general with the carve-out of recreational shipping, has been considered incompatible with EU law by the EU Commission recently.

Notably, the Commission has launched an infringement procedure before the Court of Justice of the European Union (CJEU) [1], arguing that the Italian exemption on excise duties for pleasure boats is incompatible with Article 14 of Directive 2003/96/EC (hereinafter, “the Energy Directive”), setting forth harmonized taxation of energy products and electricity at EU level.

The Directive provides, on the one hand, for a compulsory exemption for fuels used for commercial navigation, such as the transport of goods or passengers, while, on the other hand, it excludes from the exemption fuels used by private recreational crafts.

© 2020 Kluwer Law International B.V., all rights reserved.

Under the wording of the Directive, “private pleasure craft” is defined as any vessel used by its owner or by the natural or legal person authorized to use it under a lease or any other title for non-commercial purposes.

This is the moot point in the case at hand. Article 24 and Annex I, Table I, point 3, of the Italian Excise Duties Act in fact grants an exemption to all undertakings engaged in the rental of recreational crafts, without distinguishing between commercial or private use by the charterer’s business. Excise duties on fuel are therefore not due in all cases where the recreational craft is chartered, irrespective of whether the craft is used for commercial or private purposes.

According to the EU Commission, the lack of a case-by-case verification of the charterer’s commercial purpose constitutes a breach of the Energy Directive, as interpreted by the CJEU [2]. In particular, the CJEU has made clear that, for the purposes of the applicability of the said exemption, it is not sufficient to consider each and every rental as a commercial activity for the charterer, but instead the actual use made by the charterer of the pleasure boat must be duly verified.

On the contrary, under Italian law it suffices for the vessels to be used under a rental contract in order to be able to benefit from the exemption from excise duties for the required fuel. Recently, the issue has also been addressed by the Court of Cassation. Notably, the Italian Supreme Court held that the commercial use of a recreational craft cannot be presumed simply by a reference to the rental contract, but rather it is necessary to ascertain, based on the specific facts of the case, whether navigation by the user implies the provision of services for consideration [3].

The consequences for Italy in case the incompatibility in question will be confirmed by the CJEU might be burdensome: further to the need to revoke the exemption, pursuant to Article 107 TFEU Italy will have to claw back previously uncollected excise duties on fuels for up to the last five years (five years is in fact the maximum period for tax recovery under customs law).

Italy is indeed not new to those kinds of infringement procedures. With a note issued on 25 July 2019, the Commission ruled that Italy had not charged the correct amount of VAT on yacht leasing, on the ground that such exemption does not comply with EU law. In particular, the Commission recalled that VAT legislation authorizes tax exemptions for services only provided the actual use and enjoyment takes place outside the Union, but it does not allow a general lump-sum VAT reduction to be applied without proof of where the service is actually used. According to the VAT rules established by Italy (and, similarly, by Cyprus), the larger a vessel is, the less such vessel is likely to be used within EU waters. In this way, the applicable VAT base can be significantly reduced.

Ultimately, the aforementioned VAT dispute was settled after a new provision was introduced under Italian VAT law during 2020 [4]. In essence, the new rule stipulates that the place of supply of services relating to means of transport is considered outside the EU if it is proven, on the basis of adequate means of proof, that the actual use and enjoyment of the boats in question takes place outside the EU.[5]

[1] CJEU, Case C-341/20.

[2] See, e.g., CJEU, 21 December 2011, Case C-250/10, Haltergemeinschaft LBL GbR, EU:C:2011:862, par. 21, 22 and 25; CJUE, 13 July 2017, Case C-151/16, Vakarų Baltijos, EU:C:2017:537, par. 29 and 30.

[3] Italian Supreme Court, judgment no. 23226 of 23 October 2020.

[4] See Article no. 1, par. 725 and 726, of 2020 Budget Law no. 160 27 December 2019; Article no. 7 quarter, par. 1, e) and Article no. 7-sexies, par. 1, e-bis), of Presidential Decree no. 633/1972; Article no. 48, par. 7, a), of Decree Law no. 76/2020.

[5] Official Ruling of the Director of the Revenue Agency no. 234483/2020 has identified the concrete ways in which the operator must determine the place of performance in light of the principle of effectiveness.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.