In the introductory blog to this series, I talked about how many local files do not look like the OECD documentation requirements and that it is probably the consequence of pre-existing files being (poorly) adopted to the new requirements, rather than starting afresh. Here, I will explain how I believe a local file could look like when the OECD TPG, chapter 5, Annex II (hereafter “Annex II”) is followed closely, bearing in mind practicalities, such as the fact that:

- the world is hooked onto benchmark studies (rather than using internal comparables) and that TNMM (i.e. a one-sided method) is king;

- OECD TPG paragraph 5.22 allows cross referencing to the Master file (and I assume annexes to both the master and local file, such as published local and group accounts and benchmark studies); and

- the OECD (unfortunately) never cross referenced the data requested in Annex II to e.g. the 9 comparability steps of OECD TPG chapter III, the functional analysis of chapter I.D, or the limited documentation requirements of chapter 7.D.3 for Low value-adding intra-group services.

I will use SalesSub, a run-of-the-mill group Low Risk Distributor as example throughout this blog.

The big picture

Annex II requires information about:

- the local entity,

- the controlled transactions and

- financial information.

Making allowance for any introductory remarks, a table of abbreviations, etc. to all be fit into “Chapter 1: Introduction”, my local file will have 3 more chapters: “Chapter 2: SalesSub” (the local entity); “Chapter 3: SaleSub’s controlled transactions”; and “Chapter 4: SalesSub’s financial information”. To make allowance for any additional country specific local requirements, I may add “Chapter 5: Local law requirements”.

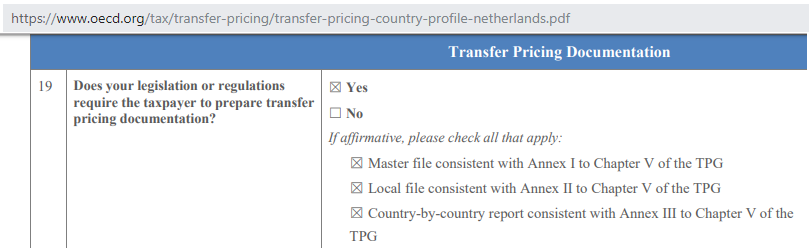

Why stick this closely to the format? Because most countries tell the OECD (and the world) that that is what they do. Here is an excerpt of the Netherland’s submission to the OECD (which look like many others’)

Note the words “consistent with” as opposed to “something like”.

I am not saying that my way of doing a local file is the right way, or the only way. What I am saying is that when one sticks closely to the instructions, then – hopefully – things cannot be that wrong.

Chapter 2: SalesSub

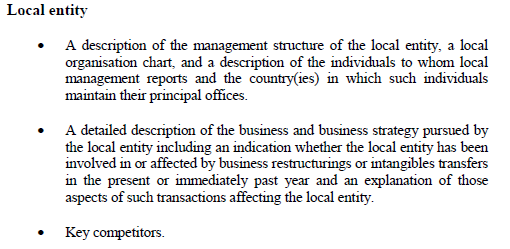

Annex II requires:

Chapter 2.1 SalesSub’s management

First, we need to describe SaleSub’s local management

- Getting back to coherence (see my first blog in this series), the description of the management structure of SalesSub should match the organization chart I will attach as annex to the local file. It should include all major departments in the organization, including any which do not report to the e.g. SalesSub’s local manager.

- The local organisation chart should be just that: a chart, showing hierarchies and who is reporting to whom up the chain within SalesSub. Most organisations have these charts available for internal use, typically in PowerPoint.

- Finally we need “a description of the individuals to whom local management reports and the country(ies) in which such individuals maintain their principal offices”. This is confusing.

- Does the OECD only want to know who e.g. the country manager of SalesSub reports to, or do they want every manager in SalesSub reporting to someone outside SalesSub? Bearing in mind the general new transparency standards, I would argue for the latter:

- it is the safer option,

- more importantly – it says more about how the MNE works.

Imagine SalesSub’s local inventory manager reporting to a foreign group logistics manager, or

SalesSub’s local division B sales manager reporting to the foreign division B regional manager, rather than SalesSub’s country manager, because that country manager is only responsible for division A products, etc.

- Do “dotted lines” count and do they have to be included as well? Again, I would. It makes sense, e.g. when looking at DEMPE functions. Imagine a local manager for brand and sales reporting to both SalesSub’s local country manager and someone in the Principal’s Group Marketing department. It will be difficult to claim group control over the local brand, if it is not mentioned that this local manager must report to Group Marketing for all things concerning branding.

- Does the OECD only want to know who e.g. the country manager of SalesSub reports to, or do they want every manager in SalesSub reporting to someone outside SalesSub? Bearing in mind the general new transparency standards, I would argue for the latter:

Chapter 2.2 SalesSub’s business

Next, we need to:

- describe the business;

- describe the business strategy pursued by SalesSub; and

- include an indication whether SalesSub has been involved in or affected by business restructurings or intangibles transfers in the present or immediately past year, plus

- give an explanation of those aspects of such transactions affecting the local entity.

This sub-chapter could have 3 sub-sub-chapters in line with the above 3 points.

2.2.1 Business description

For a simple LRD, a description of the business, rarely needs to be more than 5 – 10 lines.

- I would include e.g. a description of major divisions if SalesSub operates as LRD for different group divisions and if those divisions operate independently from each other, e.g. with different sales teams, etc,

- I would not go into SalesSub’s history if it does not clearly explain the way SalesSub is operating today.

- I would include something about SalesSub’s clientele, e.g. whether they are 5 large supermarket chains being responsible for 90% of SalesSub’s turnover, or whether they are 15,000 small businesses that needs to be visited individually on a regular basis as this would greatly influence the type of employees and the decision making processes in SalesSub.

2.2.2 Business strategy

The business strategy should come from SalesSub’s annual business plan, or similar type of document used for internal business, marketing or budgeting planning; it should not be something dreamt up by the group tax department or even the local finance manager. Generally, anything from 3-5 bullet points changing year by year or 1 or 2 full text paragraphs should do.

2.2.3 Business restructurings and their effects

- This paragraph would be restricted to “SalesSub was not involved in any business restructurings or intangibles transfers during the current or preceding year.”, if there had been none.

- Had there been any in the previous year, I would refer to that year’s local file for further details.

- Had there been any in the current year, I would refer to “Chapter 3: Controlled transactions” for further detail.

Chapter 2.3 SalesSub’s Key competitors

I have seen many variations of how this is represented in local files, from detailed charts showing competitors and market share by brand and any significant moves made by competitors in the local market, to the mere mention of the largest players in the market. Considering the limited guidance given by the OECD, I would argue that anything goes, but that beyond the mere listing of names, one ought to focus on those aspects of key competitors which influence the comparability factors of any of the controlled transactions discussed in the local file.

Bearing in mind OECD TPG paragraph 5.22, reference can also be made to the master file for more general competitor information.

By now our total Chapter 2 should be something between 1 and 2 pages.

Chapter 3: Controlled transactions

I trust that my description of “Chapter 2: SalesSub” demonstrated my approach of going through Annex II, bullet by bullet and phrase by phrase.

As a general observation, I would keep transactions together and discuss them start to finish, e.g. talking about limited risk distribution by describing the transaction, giving the amount, identifying the associated enterprises, etc. Thereafter I would e.g. discuss head office services by describing the transaction, giving the amount, identifying the associated enterprises, etc.

I do see, but do not agree with the approach where:

- first a description of each transaction (LRD and head office services) is given;

- then the amounts for transaction (e.g. LRD services and head office services) is given a few pages later;

- then the associated enterprises for LRD and head office services are identified;

- etc for all 14 bullets under “Controlled transactions” in Annex II.

I think the latter alternative complicates the understanding of transactions as their descriptions are spread over most of the local file and continuously interspersed by irrelevant information about other transactions.

Chapter 3.1 Acting as a limited risk distributor

The very name of this chapter may be controversial. Should it focus on SalesSub’s function as an LRD and be called “Distribution services”, or should it instead focus on the purchasing of goods and be called e.g. “Purchasing of finished goods”? Different arguments can be made for both views. I prefer the former, as it attaches to the legal agreement title encompassing a host of rights and responsibilities which can be discussed hereafter.

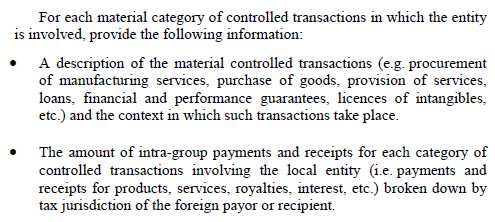

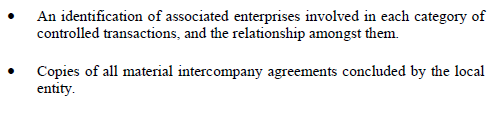

Annex II requests

Chapter 3.1.1 Description of the transaction and its context

Bearing in mind that we still have a full functional and comparability analysis ahead of us, I would keep the description of the transaction short; 5 – 10 lines. Where possible, I would summarise and reference key phrases from the LRD agreement itself. (It is a good way to be sure there is an agreement and that one knows what is in it.)

I would spend the same amount of space on the context. Typically, it is here where I introduce the group’s principal structure and the roles of both parties at a holistic level, referencing the master file where appropriate.

Chapter 3.1.2 The amount paid plus parties and agreements involved

In the case of SalesSub the next three bullets from Annex II above, can pretty much be described in 1 – 3 sentences. E.g. “SalesSub bought Euro x mio of finished goods from PrincipalCo in Holland. The Limited Risk Distribution Agreement underlying these purchases is attached as Annex A.”

Chapter 3.1.3 Detailed functional and comparability analysis

Next, Annex II requires:

Things get tricky in the next bullets, as they seem to be a blend of BEPS wishes and the 9 comparability steps from chapter III, harking back on the 5 comparability factors and detailed functional analysis of chapter I.D of the OECD TPG.

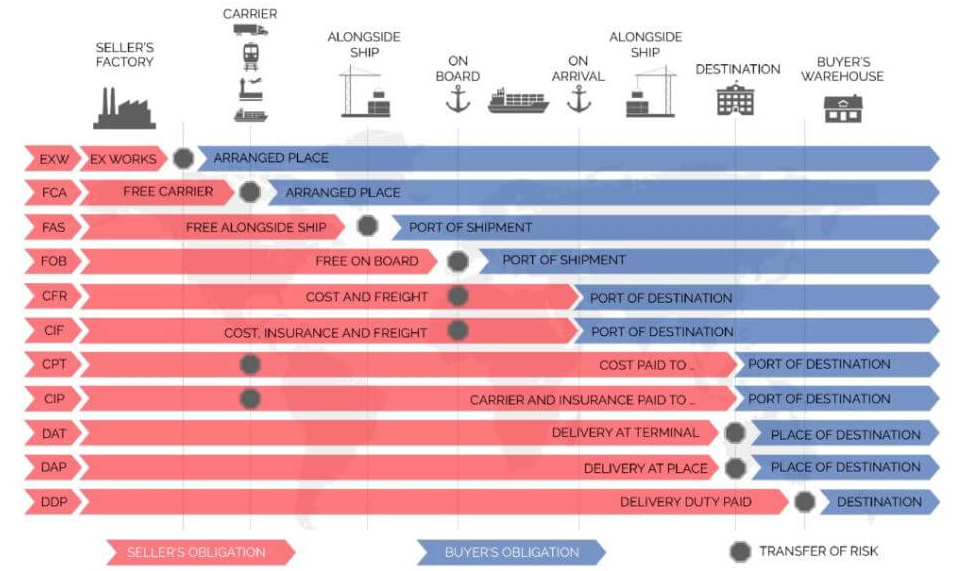

It seems pretty clear that the words “A detailed comparability and functional analysis” must be what constitutes the bulk of the local file. What often may be forgotten, is the end of that first bullet, “including any changes compared to prior years.” I take these last words to refer to changes made within the intercompany transaction itself, rather than referring to a business restructuring only (which often would be a different standalone intercompany transaction, requiring its own analysis, more in line with chapters VI and IX of the OECD TPG). E.g. if the incoterms of the LRD changes from Ex-Works to DDP, the following chart should make it pretty obvious why and how changes should be explained.

From: https://www.bansarchina.com/incoterms-2010/

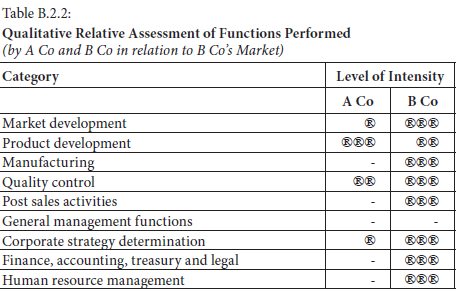

A next question, especially in principal structures, is what to do with the functions, assets and risk (FAR) analyses of SalesSub and the principal. Should one describe the FARs of both parties and summarise them in a table form akin to the following from United Nations Practical Manual on Transfer Pricing for Developing Countries (2017), paragraph B.2.3.2.14?

Or – my preference – can one analyse the FARs of the SalesSub in detail, linking them to SalesSub’s org chart and balance sheet where possible, and refer to the principal’s local file for the principal’s relevant FAR’s instead? I will discuss this second alternative hereafter.

SalesSub’s functions

When it comes describing functions in particular there is another reason for linking these closely to SalesSub’s org chart. It is this: too often does one see a description of functions of a company, which frankly can only leave one with the impression that the author of the local file must be miles away from the actual business. Some simple examples:

- all the group’s LRD local files look 90% alike regardless of whether we are dealing with the largest or the smallest LRD’s and regardless of whether the LRD acquired other distributors and other functions in the past five years. That does not make a “detailed” functional analysis;

- sometimes, especially in template driven local files, functions present in other group LRD’s, but absent (or very restricted) in the LRD at hand, remain included due to the very fact that the author of the local file did not bother to check if the stated functions performed do indeed match the LRD org chart.

After one has described each department in the LRD involved in distribution activities, one could then conclude with a sentence like “For the functions performed by the principal, please see the principal’s local file, attached as annex x.”

The same would then be done for a description of each party’s assets used and risks controlled.

The principal’s local file

I am surprised how often one comes across groups where there is no local file for the principal. I totally understand that we are allowed to minimize duplication, but I do not believe that the master file can simultaneously function as a local file for the principal, or, alternatively, that the collected local files of the principal’s group service providers (contract manufacturers, R&D centres, LRD’s, etc) can do the job. The latter leads to a slicing and dicing of the so-called most important value contributor of the MNE into a vague, scattered nothingness.

Is it not better to make one coherent, complete overview of all the principal’s functions, assets and risks (likewise referring to the principal’s org chart and balance sheet just as one does in the other local files) and then reference those FAR’s in the other local files’ controlled transaction descriptions? If one has nothing to hide (which should largely be the case after BEPS Action 13), I find it difficult to see any arguments against.

Obviously, I would not include an extensive description of all the principal’s intercompany transactions with each of its service providers, as those are already described in all the other local files. One would merely list these transactions and then refer to other local files for further details.

The most appropriate method, the tested party and important assumptions made

To the extent these points are not addressed in the benchmark studies themselves already, one should address them here in a few lines only, rather than embarking on a tedious copying and pasting or summarizing of chapter II of the OECD TPG. Local files should be judged by the quality of the business facts described, not by the kilograms of paper copied from the OECD TPG.

To the extent these points are address in the relevant benchmark studies, a mere reference to the relevant paragraphs of the benchmark aught to suffice. The same would apply for the following bullets from Annex II (identifying the tested party and important assumptions made. For the first bullet below, I would simply refer to Section B.5 of chapter III of the OECD TPG, as this is quite a silly question, probably included at the behest of the last antiquated antagonists of multi-year analyses. The next two could generally be fulfilled with references to the benchmarks as well.)

Chapter 3.1.x . Conclusion on the arm’s length price

To me the next two bullets are tied to the second bullet from the financial information required. I.e.

This

and this

![]()

belongs with this

It is where the taxpayer takes the (post yearend and late yearend adjusted) numbers from the SalesSub’s accounts (IFRS or local GAAP, depending on what your TP documentation is based on), shows how the Return on sales, or resale price margin is extracted from that, and how that correlates to the acceptable interquartile ranges determined under the benchmark study. When all of this is done, e.g. by a calculation attached as an annex to the local file, the actual text of this sub-chapter might be as short as saying

“We conclude that SalesSub has received an arm’s length compensation for its LRD services provided to the Principal, since its EBIT/Net sales margin is within the interquartile range of comparable limited risk distributors. See Annex z for the relevant financial information and how the TNMM was calculated and applied.”

The rest of the bullets of Annex II are pretty self-explanatory (copies of rulings, local accounts) and for the last one (“Summary schedules of relevant financial data for comparables used in the analysis and the sources from which that data was obtained.”) a simple reference to the relevant paragraphs in and annexes to the benchmark study ought to suffice.

Materiality

One final point is the issue materiality. It is great that Annex II refers to “each material category of controlled transactions”. Materiality is addressed in subchapter D.3 of chapter V OECD TPG. However, it is a pity that there are so many countries that have adopted a “no materiality threshold” for their TP requirements as that potentially requires a “detailed comparability and functional analysis” of even the simplest and tiniest euro for euro recharges of costs between companies. I doubt that there are many taxpayers doing this. If anything, some – but not all – taxpayers would include an overview of all intercompany payments, including recharges, and explain that further information about these transactions are available upon request. That really should be appropriate.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.