Lower energy cost is a major factor for U.S. manufacturers … to be able to offer on par production costs to China, and 10 percent to 20 percent lower costs than European manufacture.

I’ve been remiss in my blogging since the surprise victory of the presidential election. It is not because I think the apocalypse is on the horizon. On the contrary, the phones have been ringing off the hook. The late President Reagan’s 1984 campaign slogan comes to mind: “It’s morning again in America”. Impending U.S. tax reform has led to corporate advisory firms calling to pick the brains of tax academics who write in the areas of specific industries or international tax. It’s our Andy Warhol 15 minutes.

By the end of this year, Congress is likely to enact reform of the U.S. corporate tax system that will significantly depart from current policy. General bipartisan support for a significantly lower corporate rate of 20 percent than the current 35 percent falls into discord with regard to the mechanisms of how to achieve the rate. Should Congress expands industry based and investment type tax preferences? Should Congress exempt types of income from taxation, such as through patent boxes? Should Congress focus on suppressing the tax base by eliminating depreciation and amortization? How will the potential lost corporate income tax revenue be offset as required by the Pay-Go system that requires tax changes not add to the federal debt? How will tax reform impact my industry?

Over this past month as I performed my bi-annual update of my Tax of Oil & Gas Transactions book, I thought about how such reform may impact the U.S. oil & gas industry. I briefly present some of my findings for discussion, starting with the current state of the petroleum industry and its impact on the U.S. economy.

“Drill baby, drill”

Four days upon taking office, President Donald Trump published multiple oil & gas industry  midstream-related executive memoranda and an executive order designed to expedite current and future midstream projects. Two executive memoranda were specific to the Keystone XL and Dakota Access Pipelines, each directing respective authorities to take all actions necessary and appropriate to facilitate the implementation of the projects [1]. Additionally, President Trump signed an executive order to expedite the review and approval of high priority infrastructure projects [2].

midstream-related executive memoranda and an executive order designed to expedite current and future midstream projects. Two executive memoranda were specific to the Keystone XL and Dakota Access Pipelines, each directing respective authorities to take all actions necessary and appropriate to facilitate the implementation of the projects [1]. Additionally, President Trump signed an executive order to expedite the review and approval of high priority infrastructure projects [2].

However, the President also issued a memorandum for the development of plans to maximize the use of U.S. manufactured materials and equipment for all new pipelines as well as retrofitted, repaired or expanded pipelines inside the borders of the United States. This local sourcing requirement may impede or delay some projects [3]. In the context of proposed U.S. corporate tax reform and U.S. manufacturing cost competitiveness, the local sourcing order may be unnecessary.

How Much Does U.S. Oil & Gas Contribute to the U.S. Economy?

The U.S. oil and gas sector contributed approximately 3.1 percent of U.S. GDP in 2015 [4]. Unconventional energy development, such as fracking, contributes another $430 billion to annual U.S. GDP and supported 2.7 million employment in exploration, production, supporting industries, and local services [5]. The U.S. has also become the world’s top natural gas producer [6]. As of February 2017, the U.S. oil and gas extraction (upstream) industry employs 178,700 [7]. In 2015, total investment in the U.S. energy sector reached $280 billion and the U.S. produced more oil domestically than it imported from foreign sources. In 2015, the U.S. produced about 14.8 million barrels per day (MMb/d) of petroleum, and consumed about 19.5 MMb/d of petroleum, the difference made up by imports.

Yet, in 2015, the United States exported about 4.3 MMb/d of total petroleum liquids and refined products, which made the United States a net exporter of petroleum liquids and refined products [8]. The Consolidated Appropriations Act of 2016 repealed the 40 year old restriction on most crude oil exports.

As global oil and gas prices probably rise in 2017, production from U.S. shale formations is projected to increase substantially. In addition to shale, offshore oil and gas resources in the U.S. Gulf of Mexico and Alaska are highlighted as part of a five-year leasing program for high-resource areas under the U.S. Outer Continental Shelf Oil and Gas Leasing Program for 2017-2022, which is under development by the Bureau of Ocean Energy Management within the U.S. Department of Interior [9].

How Does U.S. Oil & Gas Contribute to U.S. Manufacturing Competitiveness?

A major impact of U.S. extraction and production (known as the “upstream” part of the energy supply chain) is that U.S. industry pays between 30 percent and 50 percent less for energy costs than competitors of other export countries [10]. Lower energy cost is a major factor for U.S. manufacturers, especially with the energy intensive processes (e.g. steel, aluminum, paper and petrochemicals), to be able to offer on par production costs to China, and 10 percent to 20 percent lower costs than European manufacture [11].

What Does ‘The Better Way’ U.S. Corporate Tax Reform Call For?

According to the American Petroleum Institute, the U.S. oil and gas industry average effective tax rate from 2010 through 2015 has been 38.7 percent, compared to by example the U.S. computer & peripherals industry at 24.4 percent and U.S. pharmaceuticals at 20.5 percent [12]. The OECD corporate tax rate average is more than 10 percent lower at 24.8 percent.

As of March 2017, the proposals and industry lobbies are still competing to percolate the language of such reform above the grounds of the variety of proposed reforms. The Ways and Means Chair (Kevin Brady of Texas) and Speaker of the House Paul Ryan have proposed a reform that would largely replace the U.S. corporate income tax system with a variant of a value added tax (VAT) regime, albeit the proposal specifically states that it should not be considered a VAT system because such nomenclature is political unpopular. The proposal called “A Better Way,” intends to shift the corporate tax from an income based tax to a consumption based tax, and from a worldwide based system to a territorial based system [13]. This reform plan has attracted the name “Destination-Based Cash Flow Tax” (DBCFT) in the literature and is based upon similar academic and U.S. Treasury proposals going back to the 1970s [14].

The reform plan has, in essence, two parts that include six major aspects. Part one is plain vanilla tax rate reduction: (1) reduce the corporate income tax rate to 20 percent, (2) eliminate corporate alternative minimum taxation (AMT), and (3) halve the tax rate of dividends and capital gains earned by shareholders. Part two (4) to allow the full, immediate deduction for investment, (5) disallow the deduction of net interest, and (6) deny a deduction for imports. This sixth item appears to carry the most controversy with U.S. trading partners, albeit it is merely the internationally applied VAT system of border adjustments: VAT is rebated to the seller for exports and VAT is imposed upon the buyer for imports. Denial of a corporate income tax deduction for the cost of imports achieves the same VAT outcome.

How May This U.S. Corporate Tax Reform Impact the U.S. Oil & Gas Industry?

This reform will drastically impact many aspects of the taxation of the oil and gas industry. The significant proposals of impact include: (1) the immediate expensing of investments instead of requiring depreciation and amortization; (2) elimination of taxation upon income from sales to and in foreign countries; (3) elimination of the corporate AMT and negatively speaking, (4) eliminate deductions associated with imports thus shifting a substantial portion of the corporate tax burden from exporters unto importers and (5) eliminate the net interest deduction. The reduction of the corporate tax rate accompanied by the immediate expensing of investment will greatly benefit all three streams (up, mid, and down) of the supply chain of the oil and gas industry.

The upstream segment will likely benefit the most from reform, by example from the immediate expensing of investment. U.S. capital spending for upstream, midstream, downstream, and corporate activities was $136 billion in 2016 which represents a 36.1 percent decline from 2015 [15]. Oil prices, especially at levels below 40 dollars a barrel, have severely impacted the industry appetite for investment. Immediate expensing will correspondingly free up short term earnings and profits and reduce shareholder pressure. Moreover, the major U.S. oil & gas exploration and production (E&P) companies and oilfield service providers (OFS) annually spend a range of approximately 100 million to one billion each on research and development (R&D) for new intangibles. Besides this R&D potentially qualifying for immediate expensing, according to the Better Way proposal, a form of the research and development (R&D) tax credit will remain [16]. Thus, the Better Way reform would encourage the domestic location of R&D and dissuade the licensing of foreign intangibles. The global focus on BEPS and the EU focus on state aid cases are chipping away at U.S. companies tax deferral via foreign companies. Thus, a significantly lower U.S. corporate tax rate may lead U.S. groups to repatriate IP and activities from foreign holding companies.

The upstream segment will likely benefit the most from reform, by example from the immediate expensing of investment. U.S. capital spending for upstream, midstream, downstream, and corporate activities was $136 billion in 2016 which represents a 36.1 percent decline from 2015 [15]. Oil prices, especially at levels below 40 dollars a barrel, have severely impacted the industry appetite for investment. Immediate expensing will correspondingly free up short term earnings and profits and reduce shareholder pressure. Moreover, the major U.S. oil & gas exploration and production (E&P) companies and oilfield service providers (OFS) annually spend a range of approximately 100 million to one billion each on research and development (R&D) for new intangibles. Besides this R&D potentially qualifying for immediate expensing, according to the Better Way proposal, a form of the research and development (R&D) tax credit will remain [16]. Thus, the Better Way reform would encourage the domestic location of R&D and dissuade the licensing of foreign intangibles. The global focus on BEPS and the EU focus on state aid cases are chipping away at U.S. companies tax deferral via foreign companies. Thus, a significantly lower U.S. corporate tax rate may lead U.S. groups to repatriate IP and activities from foreign holding companies.

From a negative perspective, the denial of deductions for imported petroleum products as well as the tools and the technology will prove difficult for industry in the short term and especially downstream companies. The impact of the border adjustment may, in alignment with the President’s January 24th local sourcing order, result in the industry developing a domestic based supply chain. But such supply chains require years to accomplish. The border adjustment’s success potentially hinges upon a 25 percent appreciation of the dollar within a short window of the new tax regime taking effect. The appreciated dollar will, it is suggested, offset the cost of the lack of expensing imports by reducing the dollar cost of those imports.

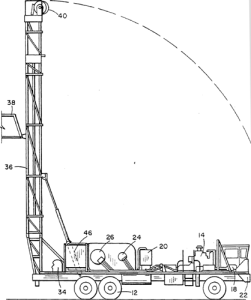

Regarding the growing global concerns of base erosion and profit shifting through transfer pricing, industry and advisory firms estimate that approximately 40 percent of the oil and gas industries U.S. cross-border transactions are intragroup. These transactions include tangible products such as oil, gas, chemicals, and equipment. The intragroup transactions also include technical services, intra-group financing, and the transfer and licensing of intangibles including intellectual property and technology. For context, examples of oil and gas upstream intangibles developed in U.S. include technological innovations related to horizontal drilling, hydraulic fracturing, seismic imaging, as well as the intangible category of technical “know how”, generally evidenced by recorded processes that achieve a consistent level of quality to accomplish an outcome.

industry and advisory firms estimate that approximately 40 percent of the oil and gas industries U.S. cross-border transactions are intragroup. These transactions include tangible products such as oil, gas, chemicals, and equipment. The intragroup transactions also include technical services, intra-group financing, and the transfer and licensing of intangibles including intellectual property and technology. For context, examples of oil and gas upstream intangibles developed in U.S. include technological innovations related to horizontal drilling, hydraulic fracturing, seismic imaging, as well as the intangible category of technical “know how”, generally evidenced by recorded processes that achieve a consistent level of quality to accomplish an outcome.

Beginning this year, the large oil and gas companies will submit globally standardized Country-by-Country Reports (CbCR) to the revenue authority of the group parent. The CbCR includes group financials explained with narrative from a transfer pricing context. The recipient revenue authorities will then automatically share the CbCR with the revenue authorities of other countries in which a group has a tax nexus. New tax risk includes multiple country transfer pricing audits for each of these large companies on an annual basis as well as “leaked” CbCR to competitors and anti-industry groups. These risks will require the U.S. oil and gas industry to rely on the U.S. Treasury for protection through the MAP procedures and other means. That protection, at least for a Trump administration, may be more forthcoming for companies that repatriate activities and jobs to the U.S. Thus, the likely U.S. industry actions based on a Better Way align with the likely industry needs of the Brave New World of BEPS and CbCR. [download my OECD v US transfer pricing regulations article]

William Byrnes’ authoritative Federal Taxation of Oil and Gas Transactions is the go-to analysis of the major issues for the upstream (extraction), midstream (transportation) and downstream (production refinement and distribution) aspects of the oil & gas supply chain.

[1] Presidential Memorandum Regarding Construction of the Keystone XL Pipeline (Jan 24, 2017) and Presidential Memorandum Regarding Construction of the Dakota Access Pipeline (Jan 24, 2017). Available at https://www.whitehouse.gov/briefing-room/presidential-actions?term_node_tid_depth=46&page=3 (accessed March 10, 2017).

[2] Expediting Environmental Reviews and Approvals for High Priority Infrastructure Projects, Exec Order (Jan 24, 2017).

[3] Presidential Memorandum Regarding Construction of American Pipelines (Jan 24, 2017).

[4] 2015 Industry Data, Bureau of Economic Statistics (Nov 3, 2016). Available at https://bea.gov/iTable/iTable.cfm?reqid=51&step=51&isuri=1&5114=a&5102=1#reqid=51&step=51&isuri=1&5114=a&5102=1 (accessed March 10, 2017).

[5] America’s Unconventional Energy Opportunity, Michael Porter, David Gee and Gregory Pope, Harvard Business School and Boston Consulting Group (2015) at 6. Available at http://www.hbs.edu/competitiveness/Documents/america-unconventional-energy-opportunity.pdf (accessed March 14, 2017).

[6] See the energy industry data published periodically by the U.S. Energy Information Administration and the International Trade Administration. Available at https://www.eia.gov/petroleum/ (accessed March 15, 2017) and at http://ita.doc.gov/td/energy/ (accessed March 15, 2017).

[7] NAICS 211, Bureau of Labor Statistics, Department of Labor. Available at https://www.bls.gov/iag/tgs/iag211.htm (accessed March 10, 2017).

[8] U.S. Energy Information Administration. Available at https://www.eia.gov/energyexplained/index.cfm?page=oil_imports (accessed March 10, 2017).

[9] Available at https://www.selectusa.gov/energy-industry-united-states (accessed March 109, 2017).

[10] America’s Unconventional Energy Opportunity, Michael Porter, David Gee and Gregory Pope, Harvard Business School and Boston Consulting Group (2015). Available at http://www.hbs.edu/competitiveness/Documents/america-unconventional-energy-opportunity.pdf (accessed March 14, 2017).

[11] “U.S. Manufacturing costs are almost as low as China’s, and that’s a very big deal,” Fortune (June 2016). Available at http://fortune.com/2015/06/26/fracking-manufacturing-costs/ (accessed March 14, 2016).

[12] Note that some academics argue that Big Oil has paid half the nominal rate over the same period.

[13] Available at https://abetterway.speaker.gov/_assets/pdf/ABetterWay-Tax-PolicyPaper.pdf (accessed March 10, 2017).

[14] See by example Blueprints for Basic Tax Reform, U.S. Treasury (January 17, 1977). Available at https://www.treasury.gov/resource-center/tax-policy/Documents/Report-Blueprints-1977.pdf (accessed March 10, 2017).

[15] “Capital expenditures to be squeezed further in 2016”, Conglin Xu, Oil & Gas Journal (March 7, 2016).

[16] See Deloitte’s 2013 research from the 10K filings of the major U.S. companies published in Managing the transfer pricing of intangibles in the oil & gas sector, Transfer Pricing Week (Sep 8, 2015).

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.

This blog was… how do you say it? Relevant!! Finally I’ve found omething

which helped me. Thanks a lot!