The Italian Supreme Court issued a landmark case (n. 27113 December 2016) setting out the principles to be taken into account when analyzing whether a company can be deemed the “beneficial owner” for the purpose of being entitled to double tax treaty benefits. In particular, the Italian Supreme Court examined whether a company resident for tax purposes in France (“French Co”) was eligible to obtain a dividend tax credit as provided for by the tax treaty between Italy and France.

Facts of the case

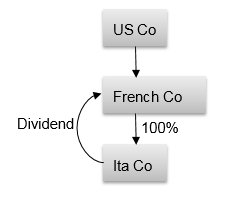

French Co was a holding company with respect to all European subsidiaries of the group and it owned 100% of the shareholdings of a company resident for tax purposes in Italy (“Ita Co”). The ultimate parent company of the group was resident in the United States (“US Co”). The figure below illustrates the part of the structure of the group relevant for the purposes of the case at stake.

Figure: Structure of the Group

In 2002 Ita Co distributed dividends to French Co net of the relevant withholding taxes. At that time, Italian domestic legislation entitled the Italian resident recipients to receive dividend tax credits, while non-Italian resident recipients were not eligible to such benefits. The only exceptions were the entities resident respectively in France and the United Kingdom that under the relevant tax treaties could claim the dividend tax credit. As a result of the above, French Co requested the Italian tax administration to make a payment of the portion of dividend tax credit to which it was entitled as per the tax treaty between Italy and France. The Italian tax administration did not reply to the request of French Co, hence indicating that the response to such request was negative.

Against this background, French Co decided to appeal against the negative response of the Italian tax administration. The First Level Tax Court decided in favor of the taxpayer, while the Second Level Tax Court (hereinafter referred to as “Tax Court”) reversed the decision. The case was then submitted to the Italian Supreme Court (hereinafter referred to as “Supreme Court”), which decided against the judgment of the Tax Court and set a number of very significant principles.

The Position and the Arguments of the Tax Court

According to the Tax Court, French Co was a mere conduit company and could not be deemed as the beneficial owner of the dividends. Accordingly it could not enjoy the benefits of the tax treaty. Moreover, as stated by the Tax Court, the sole purpose of the structure was to channel the dividends to the ultimate parent company and to obtain tax advantages. The Tax Court based its decision on the subsequent main arguments:

- US Co was the actual recipient of the dividend payments and the tax treaty between Italy and the United States did not provide for the dividend tax credit;

- the balance sheet of French Co reflected huge amounts of shareholdings, while the operating receivables were modest;

- French Co did not have employees, and in general, it lacked a relevant organizational structure to meet its corporate objectives;

- the effective management of French Co was not located in France. The Tax Court arrived to this conclusion by taking into consideration the fact that French Co did not have a relevant organizational structure and employees, as well as, it did not perform management functions and bore respective operating costs.

The Supreme Court’s decision

The Supreme Court did not share the conclusion of the Tax Court due to the following reasons:

- according to the judges, the Tax Court made a mistake as to the interpretation of the “beneficial ownership” concept. In this respect, the Supreme Court highlighted that French Co was the real owner of the shareholdings and actual recipient of the dividends. Moreover, those dividends were reflected on the balance sheet of French Co and could have been freely used by the latter;

- the Supreme Court emphasized that the structure of the group already existed as of 1946, while the Italy-France tax treaty was signed in 1989 and ratified in 1992. Moreover, according to the Supreme Court, the existence of an organizational structure was not necessary for a holding company such as e.g. French Co;

- according to the Supreme Court, the Tax Court made a mistake in the interpretation of the concept of the “place of effective management”. As stated by the Supreme Court, the place of effective management has to be interpreted taking into consideration the place of residence of the directors and the place where the key managerial decisions take place;

- the conclusion that the place of effective management is not in France, since French Co lacks the organizational structure was not acceptable for the Supreme Court.

Therefore, the Supreme Court required to reconsider the case in view of the following principles:

- the concepts of “beneficial owner” and “place of effective management” shall be construed in light of the nature of the parent company. What is worth noting is that the fact that a holding or a sub-holding company do not have a relevant organizational structure cannot impact the conclusion of whether the taxpayer is a beneficial owner of the dividends and where its place of effective management is located. Moreover, limited operating costs and operating receivables, absence of management service charges to the subsidiary and the fact that the parent company is itself wholly owned by a company that is not resident in the contracting state cannot influence the analysis for the purposes of the concepts of “beneficial ownership” and “place of effective management”;

- the concept of “beneficial ownership” shall be interpreted by considering whether the recipient of the dividends is eligible to freely use and get the enjoyment of those dividends; and,

- the concept of the “place of effective management” shall be interpreted taking into account where the managerial, administrative and coordinating decisions with respect to the shareholdings held by the parent company take place.

Comments on the Supreme Court’s Decision

The judgment of the Supreme Court sheds some light on the qualification of a pure (sub)holding company as beneficial owner of dividends distributed by its subsidiaries. Three issues should be taken into account:

- whether the (sub)holding company was set up or acquired the interest in the subsidiary in the context of an abusive plan. This was not an issue in the case at stake. As already mentioned, French Co owned Ita Co since 1946 and the former was the group (sub)holding company for the entire European Region rather than for Italy only;

- whether the (sub)holding company controls the flow of funds arising from the dividends distributed by the subsidiaries or is a pure flow-through entity. This requires an examination of the use of the funds by the (sub) holding, as well as, an analysis of the process leading to such use;

- whether the (sub)holding company is autonomous vis-à-vis its parent company in dealing with its subsidiaries. This is a quite subtle issue especially in those situations where the (sub)holding company has no personnel or organizational structure and its board members sit in the board of the ultimate parent company. In any case, the full ownership of the (sub)holding by a parent company resident in a different State is not by itself sufficient to impair the autonomy of the former.

The Key Message

The key message arising from the judgement of the Supreme Court is that the concept of the “beneficial owner” relevant for tax treaty purposes shall be assessed having regard to the activity of the relevant company and that the lack of personnel and organizational structure taken alone are not decisive for the characterization of pure (sub)holding companies as conduit vehicles.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.