Harmonisation of the efforts to discourage tax avoidance in the EU

Recently, besides the objective of maintaining a balanced allocation1 (a reflection of the principle of territoriality), the imperative of restoring trust in the fairness of tax systems has been gaining terrain as a possible justification for restrictions of free movement rights2. The Member States have to act in order to discourage tax avoidance practices and ensure fair and effective taxation in the Union in a sufficiently coherent and coordinated fashion3.

However, according to the proposal for a new directive issued in January 2016 and discussed by ECOFIN on 17 June 2016, the anti-avoidance rules will not cover transparent entities. The formation of certain transparent entities, Economic Interest Groupings (“EIGs”) for instance, is nonetheless governed by EU Law. First, it is up to Member States to decide whether or not groupings registered at their registries have legal personality. Second, the profits resulting from the activities of an EIG shall be taxable only in the hands of its members4. An EIG is thus a transparent entity.

I am questioning in this article whether the imperative of fairness essentially includes the absence of discriminatory treatment of different forms of organisation that serve the purpose of tax planning. If tax corrections are imposed in the case of groups based on the supposition that controlled transactions that do not fulfil certain conditions shall be treated as artificial, why should non-controlled transactions that do not reflect economic reality and target the same purpose, enjoy a better treatment?

The case of Spanish tax lease scheme serves as an example for a tax planning mechanism that used an EIG instead of a corporative structure in order to allocate profits and losses among investors5. This mechanism has not been caught under the radar of Spanish GAAR rules and the EU courts found it not to constitute State aid (being a non-selective fiscal advantage)6. In the meanwhile, in cases such as FFT, Starbucks and Amazon7 the tax planning mechanisms making use of corporative structures were deemed to be unfair (whatever that might mean) and alleged to constitute unlawful State aid.

At least intuitively, the exercise of comparative analysis projected by the arm’s length principle appears as contradictory, if one can refer for the purpose of comparison to wholly artificial arrangements engaged via non-corporative structures i.e. between non-associated companies that are perfectly legal under both national and EU law. Furthermore – in tax and financial law – there will always exist a difference between a purely theoretical justification of what the economic reality is supposed to be and the actual economic reality. This is why the use of excessive imagination in the depiction of theoretical models should be restrained in the context where such corrections may have negative and irreparable consequences in the actual reality.

Anti-abuse rules targeting “unfair” fiscal benefits

There are several types of fiscal benefits that are relevant in the context of abuse of law and tax avoidance. I will show that the arm’s length principle applies as the panacea for all evils covering all situations where the price of a transaction has been allegedly rigged to suit the fiscal interests of a group. Exit taxation, CFC-rules and interest limitation rules, all refer to the application of the arm’s length principle.

- Fiscal benefits provided by EU law;

- Fiscal benefits resulting from the non-harmonisation i.e. the differences between the legislation of state A in comparison with state B;

- Fiscal benefits available under the laws of state A.

1. Fiscal benefits granted by EU law

Deterring possible tax evasion, avoidance and abuse is an objective acknowledged and encouraged by the EU secondary law. The effect of the principle that abusive practices are forbidden applies to the field of harmonised indirect taxation, aiming to hinder wholly artificial arrangements that do not reflect economic reality and are set up with the sole aim of obtaining a tax advantage. Since harmonisation of direct taxation is only marginal being related to the negative impact of certain fiscal measures on the functioning of internal market, the discussion of fiscal benefits guaranteed by EU law is premature in this field.

2. Fiscal benefits resulting from the non-harmonisation i.e. the differences between the legislation of state A in comparison with state B

A) No abuse of EU law rights, if the presence in other Member States reflects economic reality.

If fiscal benefits result from a genuine movement of services, persons, capital or assets across the internal borders of the EU, the undertakings in question are entitled to obtain such benefits under EU law8. The aim of preventing the jeopardy of reduced revenues for the State budget does not constitute a legitimate justification for restricting free movement and obstructing the accomplishment of the objectives laid down by Article 26 TFEU9. An undertaking is free to enter or exit a Member State in order to obtain such fiscal benefits. The exit State has nonetheless the right to impose taxes on the difference between the market value at the time of exit and the tax value of transferred assets. The determination of the market value – the amount for which an asset can be exchanged or mutual obligations can be settled between willing unrelated buyers and sellers in a direct transaction – remains in some cases disputable. The arm’s length principle applies for the calculation of exit taxation whenever a transfer occurs between associated companies.

One of the five areas encompassed by the directive refers to general anti-abuse rules (“GAAR”) aiming to fill in gaps, while not perturbing the applicability of the specific anti-abuse rules. GAAR shall be applicable to arrangements that are not genuine. The right to choose the most tax efficient structure for its commercial affairs is nonetheless upheld.

…economic operators may exercise their fundamental freedoms in a manner that enables them to minimise their tax burden, provided that the freedom in question is being exercised genuinely, that is to say, through a supply of goods or of services, a movement of capital or an establishment for the purpose of actually pursuing economic or commercial activity10.

The obtaining of an advantage suspected to be illegal shall appear to be contrary to the purpose of the applicable tax law and the key objective of the arrangement must be to reduce the fiscal liability11. However, taxable persons remain free to choose the organisational structures and the form of transactions which they consider to be most appropriate for their economic activities and for the purposes of limiting their tax burdens. Concisely, a genuine activity implies control of assets, human resources and actual risk-taking12.

B) Corporations are supposed to have a “dirty mind”

CFC rules rely as well on a presumption of artificiality requiring the fulfilment of two conditions: a relation of control (a controlling taxpayer) and a substantial reduction of the tax liability13. The principle of arm’s length is applicable for the calculation of attributed income. However, where the controlled foreign company carries on a substantive economic activity supported by staff, equipment, assets and premises, as evidenced by relevant facts and circumstances, no tax corrections shall be applicable14.

Interest limitation rules rely as well on a presumption, namely that borrowing costs that exceed 30% of the taxpayer’s EBITDA should not be deductible. However, this presumptive rule permits two general exceptions. The first concerns standalone entities and the second SMEs (with deductible exceeding costs of maximum 3 million euros)15. Moreover, loans used to fund a long-term public infrastructure project – where the project operator, borrowing costs, assets and income are all in the European Union – may be excluded. Even taxpayers with a ratio equity over assets, which is equal or higher than the equivalent group ratio can be allowed to deduct the full borrowing costs. In Case C-282/12 Itelcar the interest limitation rules have been admitted as appropriate for combating tax avoidance.

By providing that certain interest paid by a resident company to a company established in a non-member country, with which it has special relations, is not to be deductible for the purposes of determining the taxable profit of that resident company, [such rules] are capable of preventing practices the sole purpose of which is to avoid the tax that would normally be payable on profits generated by activities undertaken in the national territory. It follows that such rules are an appropriate means of attaining the objective of combating tax evasion and avoidance16.

However, the interest limitation rules would not satisfy the proportionality test, if the taxpayer were not be given the opportunity to provide evidence of any commercial justification that there may have been for that transaction17. Moreover, the taxpayer may prove that it could have obtained the same level of credit, on similar terms, from an independent entity18. The CJEU decided that the measure was disproportionate since the national tax law targeted both corporative and non-corporative encompassed under the term “special relations”19.

3. Fiscal benefits available under the laws of state A

A first category of cases do not concern the artificiality of the arrangement, but the symmetry between fiscal rights and obligations. In the context of taxation of groups, the condition that its subsidiaries20 or companies in which the taxpayer owns a holding21 shall be residents – where the benefit is granted to the parent-resident – would not be compatible with the EU free movement rules. The situation of indirect holdings22 has also been treated in the EU jurisprudence and the condition of residence imposed on the subsidiaries through which the taxpayer holds shares in a sub-subsidiary or on the common parent is deemed unlawful under EU law. As long as the requested fiscal benefit mirrors a fiscal obligation, such rules would be discriminatory. For instance, the benefit of deducting or offsetting losses against future profits must be available, if the Member State retains the right to tax such future profits23.

Another category of cases deals with benefits granted to certain arrangements under national tax law with no discrimination between domestic and non-domestic situations. State aid law would touch upon such arrangements if they were exclusively available to specific sectors or undertakings. This is the situation treated in Spanish tax lease case.

The Spanish tax lease (‘STL’) case

First, I will provide some basic understanding of lease contracts. A lease is a contract that conveys the right to control the use of an identified asset for a period of time in exchange for consideration. A finance lease transfers essentially all the risks and rewards incidental to the ownership of an underlying asset. A lessee has to recognise a right-of-use asset and a lease liability. A lessor in a finance lease agreement recognises finance income over the lease term, based on a pattern reflecting a constant periodic rate of return on the net investment. ‘Borrowing costs‘ in the meaning of the new Directive laying down rules against tax avoidance practices that directly affect the functioning of the internal market includes interest expenses on all forms of debt, other costs economically equivalent to interest and expenses incurred in connection with the raising of finance.The finance cost element of finance lease payments, capitalised interest included in the balance sheet value of a related asset, or the amortisation of capitalised interest constitute ‘borrowing costs‘. If borrowing costs are deemed excessive as discussed above, and their excessiveness cannot be explained rationally by referring to commercial reasons, corrections may be put in place by the concerned Member State.

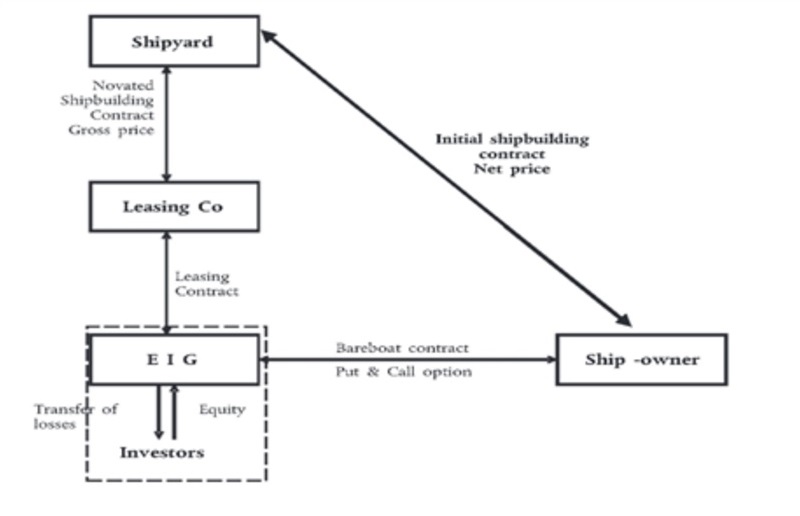

The Spanish tax lease case deals with a finance lease agreement that refers to the financing of commercial ships. Instead of using internal financing means as in the Fiat case, the shipping companies enjoy the advantage of leasing ships via an Economic Interest Grouping (‘EIG‘). Concisely, the shipping company undertakes to buy a vessel not directly from the shipyard that will build it, but from an EIG at the end of leasing term of 3-4 years. The EIG acts as lessee in a finance lease contract concluded with a leasing company. The EIG undertakes to pay an extra-instalment to the leasing company, which represents the difference between the gross price actually paid by the leasing company to the shipyard and the net price paid by the shipping company. Profits and losses made by the EIG are allocated among its members on a pro rata basis according to their holdings. Therefore, the rationale behind the extra-payment qualifies as tax planning. Moreover, this payment is not commercially rational, it does not have any other purpose besides the fiscal one. However, the transaction is engaged between independent undertakings, the EIG, as seller and the shipping company, as buyer.

In SA.34736 and SA.21233 the European Commission analysed the nature of the fiscal advantages received by the shipping company, the EIG, the shipyard and the investors members of the EIG. In SA.34736 the courts of the EU reached a definitive verdict in consideration of the fiscal advantage enjoyed by the shipping company finding that it did not amount to State aid. Regarding SA.21233, the General Court decided in joined Cases T‑515/13 and T‑719/13 that “where an advantage is granted, on the same terms, to any undertaking on the basis of a certain type of investment available to any operator, it acquires a general nature with respect to those operators and does not constitute State aid in favour of them” and that “in certain circumstances similar to the present case, obtaining a tax benefit related to an investment does not necessarily mean benefiting from a competitive advantage within the meaning of Article 107(1) TFEU“24.

Conclusions

First, it must be said that the Commission contests the decision of the General Court in cases T 515/13 and T 719/13 asserting that the General Court erred in law in its interpretation and application of Article 107(1) TFEU as regards the notions of ‘undertakings’, ‘selectivity’ and ‘selective advantage’25. The Commission cites from its Notice on the application of the State aid rules to measures relating to direct business taxation and reminds that “treating economic agents on a discretionary basis may mean that the individual application of a general measure takes on the features of a selective measure, in particular where exercise of the discretionary power goes beyond the simple management of tax revenue by reference to objective criteria“. Enabling undertakings to diminish the fiscal obligations by applying early depreciation of leased assets involves a selective advantage granted to the EIG and its investors, if the tax authorities exercise discretion in approving such favourable treatment26. The same is affirmed concerning the possibility to avoid taxation of capital gains by converting from normal to tonnage tax system. Spain argues that it should not be held responsible for advantages acquired by taxpayers in a move to reduce their tax burden. Let’s suppose now that the CJEU will uphold the decision of the General Court in cases T 515/13 and T 719/13, meaning in consequence that the measure involves tax planning that despite the fact that it is based on a wholly artificial arrangement, it is legal under both Spanish and EU law.

If instead of an EIG, the investors had established a corporation that acted as an intermediate between shipyards and the shipping company, the transaction would have been regarded as wholly artificial. It does not reflect economic reality and it does not serve any reasonable commercial purpose. On the other hand, in their defence the shareholders of the lessee – in this hypothetical scenario – could argue that similar transactions have been engaged between independent companies, so the arm’s length principle has been observed27. Hence, it can be concluded that the relevance of the arm’s length principle would suffer a prejudice if the STL or other similar non-corporative arrangements were permitted by law. My claim is that only tax neutrality is prone to satisfy the exigency of a fair and effective taxation within the EU. Against this background, the epithet “fair” appears to be empty of any legal meaning.

Looking retrospectively to the Itelcar ruling, it can be said that the Portuguese approach that included non-corporative arrangements under the term of “special relations” could be interpreted as a reflection of the principle of tax neutrality and in this sense, it could be considered to be “fairer” than the current standpoint treating corporations as usual suspects.

1. [Case 446/03 Marks & Spencer [43].]

2. [A Fair and Efficient Corporate Tax System in the European Union: 5 Key Areas for Action COM(2015) 302 final]

3. [Proposal for a Council Directive laying down rules against tax avoidance practices that directly affect the functioning of the internal market 2016/0011(CNS)]

4. [Council Regulation (EEC) No 2137/85 of 25 July 1985 on the European Economic Interest Grouping (EEIG)]

5. [Joined Cases T‑515/13 and T‑719/13 Spain v Commission]

6. [Cases mentioned above and Case C-100/15 P Netherlands Maritime Technology Association v Commission]

7. [European Commission, Decision of 21 October 2015 concerning aid to Fiat, not yet published; European Commission, Decision of 21 October 2015 concerning aid to Starbucks, not yet published; European Commission, Decision of 7 October 2014 concerning alleged aid to Amazon by way of a tax ruling, OJ C 44, 6.2.2015, p. 13–29.]

8. [Case C-196/04 Cadbury [51], [54].]

9. [Cadbury [49].]

10. [Case C 419/14 WebMindLicenses, Opinion of AG Wathelet of 16 September 2015 [68].]

11. [Article 6 of Council Directive laying down rules against tax avoidance practices that directly affect the functioning of the internal market, COM/2016/026 final – 2016/011.]

12. [Case C 419/14 WebMindLicenses, Judgment of 17 December 2015 [50].]

13. [Article 7(1) of Council Directive laying down rules against tax avoidance practices that directly affect the functioning of the internal market, COM/2016/026 final – 2016/011]

14. [Article 7(2) of Council Directive laying down rules against tax avoidance practices that directly affect the functioning of the internal market, COM/2016/026 final – 2016/011]

15. [A standalone entity means a taxpayer that is not part of a consolidated group for financial accounting purposes and has no associated enterprise or permanent establishment.]

16. [Case C 282/12 Itelcar v Portuguese Treasury [35].]

17. [Itelcar [38].]

18. [Itelcar [39].]

19. [Itelcar [42].]

20. [C-386/14 Group Steria]

21. [Case C 66/14 Finanzamt Linz]

22. [Joined Cases C 39/13 to C 41/13 SCA Group Holding]

23. [Case C 388/14 Timac Agro]

24. [Cases T-515/13 and T-719/13, Spain v Commission [148-9]]

25. [Case C-128/16 P Commission v Spain pending]

26. [Commission Decision of 17 July 2013 on the aid scheme SA.21233 C/11 (ex NN/11, ex CP 137/06) implemented by Spain Tax scheme applicable to certain finance lease agreements also known as the Spanish Tax Lease System (notified under document C(2013) 4426) [138]]

27. [See supra fn [18]]

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.