1. Background

During the 21st Session of the UN Committee of Experts on International Cooperation in Tax Matters, the relevant members decided to include a new draft – Art. 12B on Automated Digital Services (ADS) as well as its Commentary – in the UN Model.[1] Concerning the agenda of the proposal, the Committee of Experts will have to present a final draft of the Article and its Commentary during the 22nd Session taking place in April 2021.

The first draft had to be refurbished as several members of the Committee made comments, on one hand, on the policy considerations on which the proposal is based along with its effectiveness, and on the other hand, on the way the new Art. 12B is drafted and its practical application.

The new Art. 12B consists of eight paragraphs. As an overview, the first paragraph provides which Contracting States are entitled to a taxing right: in principle the resident State. The second paragraph provides that income from ADS may also be taxed in the source State on a gross basis through a withholding tax at a rate negotiated by the two Contracting States. However, as stated in paragraph 3, the beneficial owner can alternatively choose that net basis taxation will apply to the relevant income by using a pre-determined formula. Therefore, the application of these paragraphs would encompass a departure from the arm’s length principle (ALP). Paragraph 4 provides a general definition of ADS for the purpose of the article while paragraph 5 specifies that neither paragraphs one, two and three will apply if the income from ADS arises through a permanent establishment (PE) or if it is effectively connected to a fixed place in the source country. Instead, in this case, Arts. 7 (business profits) and 14 (independent personal services) should apply. Paragraph 6 provides for the “sourcing” revenue rule and is based on the residence of the payer (or PE or fixed base of the payor in the state connected with the obligation to make the payment) of the ADS. Paragraph 7 determines that income from ADS is not considered to be arising in State of residence of payor if it is borne by the payor’s PE or fixed base in another State. Paragraph 7 deals with the non-arm’s length allocation of the income, leading to a taxation in both contracting States where the other provisions of the Convention must be considered.

2. Conceptual base for taxing business income

The conceptual base for taxing business income under the UN Proposal rests on the “supply – demand” logic in the sense that both production countries and market countries are entitled to tax business income of a global enterprise. This represents a departure from the view of the OECD States who have chosen to tax corporate income based on the “supply” framework. The question now arises as to why would OECD Member States agree to this conceptual base? Pillar I[2] seems to be compromise in the sense that the competing views of both “supply” countries and “supply – demand” countries are taken into consideration in its design. Clearly, allocating more taxing rights to market countries and a partial departure from the ALP illustrates this point.

3. Scope and Nexus

First, concerning the scope of the new Art. 12B, the UN has chosen to limit the scope to ADS only compared to the OECD Pillar 1 proposal where both ADS and Consumer Facing Businesses (CFB) are included. In a response to a comment, the Committee specified that it has no obligation to justify in the Article or its Commentary why CFBs are out of scope of the UN proposal.[3]

The general definition of ADS provided in Art. 12B states the following: “The term “income from automated digital services” as used in this Article means any payment in consideration for any service provided on the internet or an electronic network requiring minimal human involvement from the service provider. The term “income from automated digital services” does not, however, include payments qualifying as “royalties” or “fees for technical services” under Article 12 or Article 12A as the case may be.” In the Commentary, a list of services and activities that are considered ADS is provided and includes: Online advertising services, Sale or other alienation of user data, Online search engines, Online intermediation platform services, Social media platforms, Digital content services, Online gaming, Cloud computing services; Standardized online teaching services.”[4]

Art. 12B also states that payments qualifying as royalties or fees for technical services are excluded from ADS. Another list is provided in the Commentary of services and activities that cannot be considered as ADS and includes: Customized professional services, Customized online teaching services, Services providing access to the Internet or to an electronic network, Online sale of goods and services other than automated digital services, Revenue from the sale of a physical good, irrespective of network connectivity (“internet of things”)”[5]. It should be noted that some of these exclusions could be covered by the definition of CFBs under Amount A of Pillar1 under the OECD / IF project.

The definition of ADS and its related Commentary are similar to the one found in the OECD Pillar 1 project; nonetheless, the Committee when questioned about the resemblance argues that “Reliance on IF work for this purpose has been done in order to reduce uncertainty and to avoid spill overs related to different scoping” and goes on asserting that “the intention of the proposal is not to describe what other fora is developing.”[6] Well, it is obvious that the UN” has been inspired by the work of the OECD. This is not a new phenomenon as the UN Commentary on Tax Treaties and UN Transfer Pricing Manual is heavily inspired from the work of the OECD.

Given the fact that CFBs are out of scope, the proposal is “less” neutral as it ring fences the digital economy. One may argue that this is against the interest of developing countries as they will be deprived from tax revenues from CFB related businesses (especially, CFBs that operate with centralized business models). In this regard, also see the sourcing rules for ADS businesses below (section 5).

Additionally, the new Art. 12B does not provide any revenue thresholds. In other words, any taxpayer that performs ADS, no matter its global revenue or its profitability will fall into the scope of the article. Moreover, it does not either require a threshold such as a permanent establishment, fixed base, or minimum period of “revenue” presence in a Contracting State. This may lead to disproportionate administrative burdens for both taxpayers and tax administrations and may create an unbalanced playing field for small and medium-sized enterprises with cross-border activities, as they may not have sufficient resources to meet this burden compared to larger MNE groups. The Committee mentions the fact that other articles, for example Arts. 11, 12 and 12A, do not require any threshold, thus it is not necessary for Art. 12B.[7] While this answer seems too simplistic, in any case, from an efficiency standpoint (compliance cost for both taxpayers and tax administrations) the proposal deserves a low ranking. This is also because the taxpayer will have to register in each and every country to give effect to this proposal (even if a local threshold is proposed the taxpayer will need to monitor the local threshold in each and every country to check whether or not a tax liability arises in the source country).

On the other hand, the OECD Pillar 1 proposal provides a global revenue threshold (which may possibly decrease over a period of time) and a de minimis foreign in-scope revenue test. Moreover, the Pillar 1 proposal requires a revenue threshold also for each specific type of activities, ADS and CFB, to trigger nexus to the local jurisdiction. Additionally, as compared to the UN proposal, the Amount A proposal put forward a one stop shop type of mechanism wherein the taxpayer will have to register only with the tax administration of the Ultimate Parent Entity (and this tax administration is required to transmit the tax revenues to the respective market countries).

4. Profit Allocation

a. Gross withholding approach

Art. 12B paragraph 2 states that “[…] income from automated digital services arising in a Contracting State may also be taxed in the Contracting State in which it arises and according to the laws of that State, but if the beneficial owner of the income is a resident of the other Contracting State, the tax so charged shall not exceed ____ percent (the percentage is to be established through bilateral negotiations) of the gross amount of the income from automated digital services.”

It can be argued that withholding taxes are a simple and effective method of tax collection imposed on non-residents. Indeed, as outlined by the Committee, “Many developing countries have limited administrative capacity and need a simple, reliable and efficient method to enforce tax imposed on income from services derived by non-residents.”[8] The Committee proceeds affirming that “Such a method of taxation may also simplify compliance for enterprises providing services in another State since they would not be required to compute their net profits or file tax returns, unless they themselves opt for net income basis taxation.”[9]

Therefore, on the one hand, the gross basis taxation approach appears as a simple approach which fosters tax certainty, especially for developing countries that may have fragile tax administrations. However, beyond its apparent simplicity, it is not a secret that gross taxation may have a negative impact on cross-border transactions even to the point of dissuasion of performing cross border activities.

Moreover, taxation on a gross basis is problematic as it may be passed on to the consumer with the service provider raising prices for customers in the source country as highlighted in a comment made to the Committee[10]. The commentator also made a reference to the Covid-19 crisis and to the fact that gross taxation can lead to an excessive taxation, which should be avoided at all costs in such economic context. To these claims, the Committee replied that “There is no reason to assume that the tax will be passed on to the consumer in all situations. In any case, such situation for ADS taxation is no different from similar scheme of taxation for royalties and FTS.”[11] In this regard, as an example, it should be noted that following the adoption of the DSTs in France and the UK, Amazon made it clear that it will pass on the cost to the sellers of the marketplace.[12] With respect to the equalization levy adopted by India, businesses such as Apple have already been passing on the cost to Indian consumers.[13] Netflix figures as an exception, as the group seems to have decided to absorb the equalization levy instead of passing it to the consumer.[14]

Concerning the withholding tax rate, it must be negotiated bilaterally and the Committee in the Commentary advanced that a low rate of 3-4% of the gross amount should be adopted to diminish the possibility of double taxation and excessive taxation.[15] If the tax rate were to be higher than the foreign tax credit limit in the residence country, it could have a negative impact on investment and deter it. This point has been outlined as being a concern for several group members. Members of the Committee also outlined other possible consequences of a withholding tax:

“- the possibility that some non-resident service providers may incur high costs in providing automated digital services, so that a high rate of withholding tax on the gross payment may result in an excessive effective tax rate on the net income derived from the services;

– the fact that a reduction of the withholding rate has revenue and foreign exchange consequences for the country imposing withholding tax, and

– the relative flows of payments in consideration for automated digital services (e.g., from developing to developed countries).”[16]

Unfortunately, the Committee did not specifically reply to these concerns.

Moreover, while a withholding tax makes more sense in B2B businesses (e.g., cloud computing or online advertising), it fails in a B2C context as you cannot expect individuals to withhold taxes (several ADS service providers operate in the B2C space such as Netflix, Air BnB, Uber, Amazon and so on). In a B2C context, the UN recognizes that alternative collection mechanisms can be put in place due to the complexity of collecting withholding taxes when the ADS is rendered to individuals.[17] The Committee mentions alternative collection mechanisms already adopted in some jurisdictions: “In this sense, domestic legislation in some jurisdictions levying taxes on automated digital services requires non-resident providers to present a tax return where the tax obligation has been self-assessed and subject to examination by the tax administration. Other jurisdictions, instead, have the obligation to determine and pay the tax due by the non-resident provider, to the financial intermediary that individual consumers access to make the payments for the automated digital services involved.”[18] It is also stated “The UN Model Tax Convention does not provide further guidance on domestic law issues. It allocates taxing rights, and it is up to sovereign States to develop mechanisms to enforce such taxation.”[19] While self-assessment and shifting the obligation on financial intermediaries seems good in theory it is quite challenging to enforce such mechanisms (especially, the latter). As a result, given the fact that the tax cannot be collected upfront in B2C scenarios raises serious questions about the effectiveness as well as enforcement of the proposal.

b. Net approach

Art. 12B para 3 offers the alternative option to apply a net basis annual taxation instead of a gross basis taxation. In the Commentary, the Drafting Group detailed the rationale of this provision: “This option would provide relief in those cases where the taxpayer may have a lower tax liability than the liability determined as per withholding tax mechanism as also in cases where it has a global business loss or a loss in the relevant business segment during the taxable year.”[20]

The profit to be used for calculating profitability would be profit before tax (PBT) based on the accounts of the beneficial owner (possibly the tax administration of the source country may not get this information unless they go through the Exchange of Information mechanisms), or the consolidated accounts of the MNE group, in the latter case applying the financial accounting standard used by the ultimate parent entity. Adjustments such as the exclusion of income tax expenses can be made.

The election of the net basis taxation would lead to a departure from the current profit allocation mechanism, the arm’s length principle (ALP). Indeed, Art. 12B para. 3 is not based on the current transfer pricing rules but rather on a predetermined formula. This formula would work as following: “the qualified profits shall be 30 percent of the amount resulting from applying the profitability ratio of that beneficial owner’s automated digital business segment to the gross annual revenue from automated digital services derived from the Contracting State where such income arises.”[21]

As the 30% choice has not been explained in the first draft and its Commentary, the Drafting Group decided to clarify such percentage in the Commentary affirming that “The figure of thirty percent is based on allocation by assigning equal weightage to assets, employees and revenue.”[22] This clearly shows that the proposal is based on the “supply-demand” philosophy.

Such departure from the current transfer pricing rules would require significant technical details to ensure the formula works consistently with the current rules and does not lead to an increase of tax disputes and double taxation. The Drafting Group thus decided to add substance to the para. 3 of Art. 12B and for instance to specify that the use of segmented accounts is mandatory, but if the MNE does not segment its accounts, the profitability ratio of the beneficial owner will be applied. It appears that the new Art. 12B would respect the type of segmentation, geographical or product-wise for instance, used by the MNE. This would also mean that small MNEs that do not segment are worse off than big MNE who can segment or do so as a rule.

There are several issues here. One is determining the PBT of the selling enterprise. Second is determining PBT of a selling enterprise when it is a part of a MNE Group. Third is determining the PBT ratio. No detailed guidance is provided on these matters except in Para 28 which states “the profit to be used for calculating profitability would be profit before tax as per accounts of beneficial owner, or the consolidated accounts of the MNE group, as the case may be, with adjustments such as exclusion of income tax expenses, exclusion of dividend income, and gains or losses in connection with shares, adding back expenses not deductible for corporate income tax purpose due to public policy reasons, etc.” Compared to the Pillar I proposal this part of the UN commentary is underdeveloped.

Also, there is no mention to the treatment of losses and whether they can be carried forward and for how long. The OECD Pillar 1 on the other hand addresses the question of the treatment of losses (both pre regime and in regime losses).

5. Revenue Sourcing Rules

The revenue sourcing rule is laid down in paragraph 6 which states: “income from automated digital services shall be deemed to arise in a Contracting State if the payer is a resident of that State or if the person paying the income, whether that person is a resident of a Contracting State or not, has in a Contracting State a permanent establishment or a fixed base in connection with which the obligation to make the payment was incurred, and such payments are borne by the permanent establishment or fixed base.”[23]

Therefore, the income from ADS will be sourced to the payer’s residence country or to a PE or fixed base. This sourcing revenue rule would lead to lower revenues for developing countries, especially, in selected triangular cases as explained below (there could be other cases too).

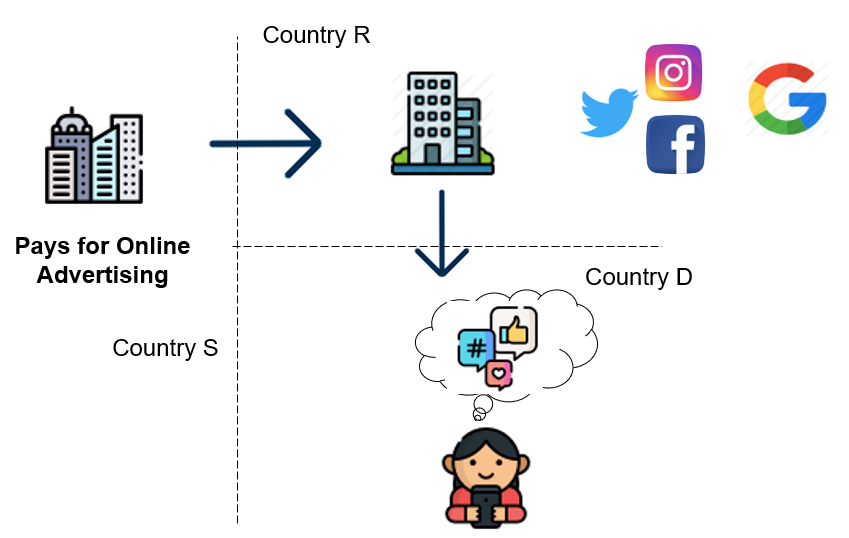

Take the example of online advertising. Let’s assume that a company resident in State S (developed country) pays for online advertising that is provided by another company located in State R (developed country). The advertising is actually seen by users in State D (Developing country). In this case, under Art. 12B, the income from online advertising arises in State S, as it is the payer’s country of residence. On the other hand, under the OECD Pillar 1 proposal, the online advertising services is sourced to the jurisdiction of the real-time location of the viewer of the advertisement, State D (developing country). Given the population sizes of some developing countries, it seems that they would be losing out in these situations.

A similar outcome arises in a case where there is a sale of user data. If we assume that a company in State S (developed country) buys the data of users located in State D (developing country) from a company located in State R (developed country). Under the UN new Art. 12B, the income would be sourced to the country of residence of the company which pays for the data, in this case, State S. On the other hand, under the OECD Pillar 1 proposal, the revenue from the sale of data of the users located in State D would be sourced to the jurisdiction of the real-time location of the user that is the subject of the data being transmitted, at the time the data was collected, in this case, State D.

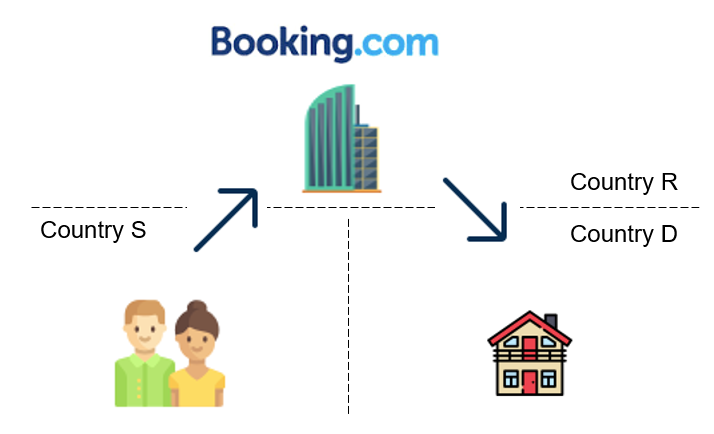

Consider another example of an online marketplace which connects accommodation seekers and accommodation service providers. Imagine Mr. X, who lives in Country S (developed country) books an accommodation in Country D (developing country) through a Country R (developed country) platform provider (Company B). Once again, in this case, under Art. 12B, the income would be sourced to the country of residence of the payer, State S. On the other hand, under the OECD Pillar 1 proposal, the revenue is sourced 50-50 in the sense that Company B will be subject to tax in Country D.

Also, the OECD Pillar 1 proposal has strong revenue sourcing rules. Each category of revenue from ADS and CFB has its own sourcing rule with indicators. These rules could indeed allocate additional revenues to developing countries.

6. Dispute Prevention framework

Concerning dispute prevention, the UN proposal would stay within the existing framework (and possibly not provide any mechanism to prevent disputes). Meanwhile the OECD Pillar 1 proposal develops a new framework for dispute prevention for Amount A and beyond Amount A to foster tax certainty.

A new dispute prevention mechanism is necessary for Amount A because it departs from the current transfer pricing rules by relying on a pre-determined formula. Paragraph 3 of the new UN Art. 12B offering the option for net taxation also departs from the current transfer pricing rules nonetheless, the dispute prevention mechanisms would be the same as the one used in the current context (eg. Unilateral or bilateral APAs). This situation could create inconsistency and discrepancies. As reminded by the OECD, “Securing tax certainty is an essential element of Pillar One. Providing and enhancing tax certainty across all possible areas of dispute brings benefits for taxpayers and tax administrations alike and is key in promoting investment, jobs and growth”[24].

7. Implementation

Finally, the UN prefers to implement the new Art. 12B through bilateral negotiations (it does not seem possible to introduce this provision in the existing MLI as it is a tool developed and controlled by the OECD). Meanwhile, the OECD would prefer to implement Pillar 1 through a new multilateral instrument.

Some members of the UN Committee raised concerns regarding the possibility that the implementation of a bilateral provision could lead to excessive taxation and double taxation compared to the multilateral implementation of OECD Pillar 1. To this consideration, the Committee responded that “a multilateral approach also raises concerns, complexity for instance being one and less than fair share of allocation of revenue being other besides complex multilateral dispute settlement mechanism as well as complex process for elimination of double taxation. As per the DG, a bilateral solution will work in the same way as it has worked for existing physical presence rules.”[25] In a response made to a comment brought by the USCIB, the Committee advocates that “We feel that the multilateral approach is complex and difficult to implement for and does not result in fair or reasonable share for developing countries.” [26]

Some members of the Committee nonetheless commented that “It is unlikely that many countries (especially those in which major digital companies are resident) will accept this provision in their treaties as the issue at stake is a multilateral issue and requires a global solution.”[27] Moreover the residence countries could be reluctant in face of the possible double taxation brought by a gross basis withholding tax.

Two main issues emerge concerning the choice of a bilateralism. First, developing countries and smaller economies usually have more limited double tax treaties networks, meaning that they would have to negotiate new tax treaties, or they could be tempted to adopt a domestic Digital Services Tax (DST). The second concern relates to the fact that existing double tax treaties would need to be renegotiated and this process could be time-consuming. Also, the tax rate provided in paragraph 2 has to be negotiated bilaterally. Although it provides greater flexibility it will lead to a non-uniform practice.

8. Conclusion

Based on the above we would like to argue that from a tax policy standpoint, the UN proposal is “less” neutral, inefficient, simple on the face of it but complex when you get into the details, ineffective to collect taxes in several situations (weak sourcing rules as well as non-applicability of withholding taxes in a B2C scenario) as well as non-flexible due to its narrow scope. Moreover, by staying within the existing international tax framework, it creates room for tax uncertainty. Thus, it ranks “low” from the perspective of the tax policy principles discussed in the Ottawa Framework[28].

At the same time, it seems that the proposal is not really in the interest of developing countries because i) in many situations developing countries will not be able to collect the much-needed revenues from the digital economy; ii) it relies on bilateral negotiations which could be time consuming and perhaps not leading to the desired outcome; and iii) it is clearly not in the interest of OECD Member States who will surely be reluctant to introduce this provision in their tax treaties due to the various issues surrounding it. It is really surprising that prestigious organizations such as the IMF[29] and World Bank[30] show support for this proposal from a developing countries standpoint. In fact, the IMF seems to have its own agenda and seems to favor proposals that are politically not feasible (e.g.; destination based corporate taxation)[31].

Overall, while the UN has always been defending the interest of the developing countries, unfortunately this proposal could actually not be in their best interest. The updated version of the new Art. 12B and its Commentary indeed still needs detailed technical work on gross basis taxation (especially, collection of taxes), the net basis taxation option, revenue sourcing rules and rules to implement the provision. Apart from the technical work, the question is how much revenues will this proposal really raise for developing countries? Surely not a lot given its current formulation (as discussed above).

At this stage, the best proposal, in our opinion, is the Pillar I proposal which is based on a net approach and seeks to establish multilateral cooperation in international corporate tax matters. In fact, the finance ministers of several countries have picked up on the work of the OECD and have expressed commitment to reach a consensus (probably by Mid 2021). The recent letter of the US treasury (written by Secretary Yellen) adds to the optimism. We would thus urge developing countries to participate actively in the Pillar I proposal.

All views expressed are personal. The authors would like to thank Stefaan De Baets and Alessandro Turina for their comments on the draft version.

[1] UN Committee of Experts on International Cooperation in Tax Matters, Twentieth session, Update on work on taxation issues related to the digitalization of the economy (UN, E/C.18/2020/CRP41, October 2020) available here https://www.un.org/development/desa/financing/sites/www.un.org.development.desa.financing/files/2020-10/CITCM%2021%20CRP.41_Digitalization%2010102020%20Final%20A.pdf

[2] OECD, Tax Challenges Arising from Digitalisation – Report on Pillar One Blueprint: Inclusive Framework on BEPS (OECD Publishing 2020)

[3] UN, supra n.1, p. 44

[4] UN, supra n. 1, p. 19

[5] UN, supra n. 1, p. 22

[6] UN, supra n.1, p. 34

[7] UN, supra n.1, p. 65

[8] UN, supra n. 1, p. 11

[9] UN, supra n. 1, p. 11

[10] UN, supra n. 1, p. 35

[11] UN, supra n. 1, p. 35. FTS stands for Fees for Technical Services laid in Art. 12A UN Model

[12] https://www.theguardian.com/technology/2020/oct/14/amazon-to-escape-uk-digital-services-tax-that-will-hit-smaller-traders

[13] https://economictimes.indiatimes.com/industry/cons-products/electronics/apple-passes-on-2-per-cent-equalisation-levy-to-indian-consumers/articleshow/78962608.cms?from=mdr

[14] https://economictimes.indiatimes.com/industry/media/entertainment/netflix-to-absorb-equalisation-levy-not-passing-the-charge-on-consumers/articleshow/79011418.cms

[15] UN, supra n. 1, Commentary para 4 and 15, p. 11 and 13

[16] UN, supra n. 1, p. 13-14

[17] UN, supra n.1, Commentary para. 44, p. 24

[18] UN, supra n.1, Commentary para. 45, p. 24

[19] UN, supra n.1, p. 58

[20] UN, supra n.1, Commentary para. 26, p. 16

[21] UN, supra n.1, p. 9

[22] UN, supra n.1, Commentary para 30, p. 17

[23] UN, supra n.1, p. 10

[24] OECD, supra n.2, p. 174.

[25] UN, supra n.1, p. 7

[26] UN, supra n. 1, p. 66.

[27] UN, supra n. 1, p.7

[28] The principles laid down by the Ottawa Framework in 1998 were: neutrality; efficiency; certainty and simplicity; effectiveness and fairness; flexibility.

[29] See https://www.un.org/development/desa/financing/sites/www.un.org.development.desa.financing/files/2021-02/IMF%20staff%20observations%20on%20proposed%20UN%20Art%2012B_0.pdf

[30] See https://www.un.org/development/desa/financing/sites/www.un.org.development.desa.financing/files/2021-02/2020_1_19_WB%20staff%20comments%20on%20UN%20Article%2012B_FINAL.pdf

[31] See for instance, https://www.imf.org/en/Publications/Policy-Papers/Issues/2019/03/08/Corporate-Taxation-in-the-Global-Economy-46650

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.