Following up on Jonathan Schwarz’s latest blog contributing to the debate on taxation and value creation, I wanted to attempt adding some further critical points. The OECD’s stated goal of the second pillar (“Substance”) of its BEPS action plan is to align taxation with value creation. It has already been observed that this is a highly ambitious project as the place of value creation is very difficult to discern. In its latest Interim Report on the Challenges of Digitalisation, the OECD makes a valiant effort to understand different models of value creation. But more fundamental questions remain unanswered.

To start, it is questionable whether the international tax system’s focus on the allocation of income taxing rights can be reconciled with the idea of taxation where value is created. Does income even entail value creation?

The intuitive answer is yes: income arises where someone captures value in a market transaction by transforming a good’s (or service’s) use value into exchange value, as long as the latter exceeds the input costs for the creation.

One problem with this equation that has long been recognized in tax law is that income will then only reflect additionally created value if the measure of inputs depends on the same (market) logic. Seen in this light, transfer-pricing rules ensure that inputs are valued correctly in order to allow a close alignment of value and income.

Another more fundamental and not commonly recognized issue is that value capture is not the same thing as value creation. Income measures the former, and not the latter, which means that income can be attributed to someone who did not in any real sense “create” any value. Consider the following example: If A buys shares in a US company and resells them with profit after a year, A earns “income”. But it is difficult to see what “value” A created there, let alone on what theory her Residence State ought to tax any value so created. In reality, as the provider of capital, A may have simply been able to capture a portion of the value created by the firm due to the fact that capital is a limited resource. Note that the “provision of capital” here is entirely indirect — no capital flows from A to the company, and the sale of the shares in a secondary market does not in any way affect the capital available to the company (leaving aside the marginal effect on the company’s valuation); it is therefore not any risk-bearing on the part of the capital provider that justifies calling her a “value creator”.

Where is value created?

At its most fundamental, a firm’s value creation has two elements:

- First, the firm needs to add something to existing inputs it acquired in the market; this can be conceivably assigned to the place where the firm exercises its value-creating functions, uses assets and, arguably, assumes risks

- Second, the value assigned by customer to the output must exceed sum of those inputs; logically, it would seem that this happens wherever the customer makes her decision as regards the value of the product. In most cases, the country of residence of the customer will do as a proxy.

As recently observed by Englisch and Becker in their blog entry, the latter is a necessary step to really speak of added value. International tax law, however, entirely ignores the second step and focusses purely on the first one, thus sidestepping the unsolvable issue of objective vs subjective value.[1] But even with this simplification, locating where (a presumed objective) value has been added to pre-existing inputs (acquired in free market transactions) is fraught with difficulty.

Under the prevailing paradigm, a firm creates value via the functions it exercises, with the assets its uses, and related to the risks it assumes. The pre-BEPS world relied considerably on contractual relationships as proxies to allow a determination of the territories where these three components are located. By contrast, the post-BEPS approach aims to move beyond such arbitrariness to the “real economic activity” — increasingly looking to the place where “real people”, i.e. (traditionally!) employees, are located.

This is particularly important as a consequence of the increased importance of intangibles over recent decades as the leading force behind the generation of income. But do intangibles also generate value? A key realization of the BEPS project may be that they do not — by themselves — generate any value at all. Whatever value is stored in the intangible has been generated by its creation; thus the mere ownership of an intangible asset does not “entitle” a taxpayer to any return. Rather, it is the use of an intangible that may be said to produce additional value. It is therefore appropriate to attribute income to taxpayers who develop, enhance, maintain, protect or exploit an existing intangible (the (in)famous DEMPE-functions).

The “Digital Challenge”

How does the new typology of digital business models identified by the OECD — value networks and value shops as alternatives to value chains as applied to “platforms” fit into this new paradigm? The OECD primarily focusses on the ability of digital platforms to create “size without mass” (i.e. business extracted from a territory without any physical connection in the form of a PE) and the exploitation of data as a key component of their activity. The consequence, according to the OECD Report, may be that users can be said to create value for the platform businesses they are using, which may justify taxation in the location where users are located.

How does the allocation of income to the country where users are located fit into a functional model of value creation? Petruzzi and Buriak have recently proposed as a solution to consider users as “unconscious employees”, thereby attributing their actions as “functions” to the firm.[2] Yet this raises two further questions:

First, how can the input of the user be valued? The “free provision” of the user’s services are no obstacle to a fair-market evaluation, of course: it is merely a practical difficulty to discern the user’s willingness to pay for a service that is in effect a barter transaction (“free” use of a platform against “free” provision of services for the firm).

Second, how can one justify attributing the activity to the firm if it has no control over the user’s action on its digital platform? Ronald Coase’s theory of the firm can be instructive here: under that approach, an employee creates value for the firm (the reason of its existence) because it acts under a certain control of the company that leads to reduced transaction costs so that a smooth and continuous exchange of value takes place between the firm and its employees. From that perspective, in the absence of any control of the firm over the user, it is difficult to attribute the user’s functions to the platform so as to tax its income. Yet, control may be said to exist in the form of the user agreement any user of a digital platform accepts, and which determines the amount of data that is shared and its use. Although it is true that the level of control over a user is much reduced relative to that of a traditional employee, there is certain control in this. There is also typically a direct link between the user’s “remuneration” — the free use of a platform — and the value provided by that user, since the extent of the use will strongly correlate with the data that is being shared and the value created to other users.

Substance and the right to tax digital businesses

How does the proposed paradigm-shift to taxation without physical presence of assets or employees fit with the idea that substance is an important element to justify taxation? In the context of post-BEPS allocation of tax jurisdiction, the term “substance” is directly linked to the above-mentioned functional analysis of value creation. An entity has (sufficient) substance if its legal existence is backed by “physical presence”, in particular, the (continuous) presence of personnel that acts on behalf of that legal entity. Substance under this new paradigm is not a backstop to prevent abuse in exceptional cases (as in traditional “substance over form” doctrine), but the key element to allocate profits.

This is closely related to classic concepts of public international law and the theory of justifying taxation: the “genuine link” principle and the “benefits principle”. Physical substance in a territory easily leads to fulfil the genuine link condition; physical substance also typically means that a firm’s activity is supported by local public goods provided by the State.

How can these conditions be fulfilled in the digital era? Can there be substance without presence? Substance without control? In a world where countries assume taxing rights with no more connection to a business than the presence of users who benefit from a business’s services without paying for it, the genuine link to tax profits made by such business becomes strained. Wolfgang Schön has anyway argued that the wide scope of the genuine link condition covers (even) taxation on a destination basis: in his view, the “existence of a customer base in a territory, leading to the transfer of financial means from the customers to the taxpayer, forms a strong economic allegiance”[3] that is the basis for taxation. Yet in the case of “free” digital platforms, the transfer of financial means is questionable: data given to a platform would have no use value for users, and little, if any, independent exchange value. Their transfer certainly does not in any way reduce the user’s ability to pay. A justification for their State of residence to tax a non-resident and merely digitally present firm thus remains elusive — even more so than true “destination-based” taxation, whereby destination denotes the place of sales.

Conclusion and outlook

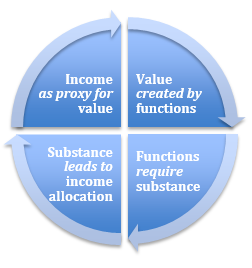

International tax law reform following the BEPS project and digital challenges identified by the OECD is attempting to align “taxation with value creation”. It does so in an effective circle, by

- declaring income (or other subject of taxation, e.g. revenue) a proxy for “value”

- explaining value-creation by identifying related functions,

- locating functions where substance can be identified and

- allocating taxing rights in line with substance in a territory.

In doing so, it creates an internally coherent system with respect to the allocation of taxing rights, although the fundaments of this system are somewhat shaky. Even beyond such criticism as made above, it is uncertain whether this approach can serve as a solution for the future, as it is built around a rather traditional, but even higher weighted functional analysis. As digitalisation progresses further to give intelligent software (“artificial intelligence”) ever-more significance — eventually handing over decisional control over key aspects of a company’s functions — the question whether such functional analysis can continue to form the basis of income allocation will have to be posed anew. If artificial intelligence exercises functions, it will hardly be sufficient to reflect on any tenuous link to a physical presence (such as a computer where the software runs or the place where human software developers once worked to bring it into existence) in order to solve the question which country ought to tax the value it “creates”.

**********

[1] As a side note, the focus on objective values may help explain BEPS-project’s rejection of marketing intangibles as value/substance-related IP in BEPS 5, as it seems based on the same counterfactual assumption that value is independent of consumer-valuation, which may strongly depend on marketing measures. This reflects a well-known challenge that the prevalence of marketing measures poses to economic theories that assume fixed consumer preferences.

[2] Raffaele Petruzzi and Svitlana Buriak, Addressing the Tax Challenges of the Digitalization of the Economy – A Possible Answer in the Proper Application of Transfer Pricing Rules? 72 Bulletin for International Taxation 4a (2018).

[3] Wolfgang Schön, International Tax Coordination for a Second-Best World (Part I), 1 World Tax Journal 4 (2009) at p. 92.

______________________________________________________________________________

To make sure you do not miss out on posts from the Kluwer International Tax Blog, please subscribe to the blog here.

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.

Kluwer International Tax Law

The 2022 Future Ready Lawyer survey showed that 78% of lawyers think that the emphasis for 2023 needs to be on improved efficiency and productivity. Kluwer International Tax Law is an intuitive research platform for Tax Professionals leveraging Wolters Kluwer’s top international content and practical tools to provide answers. You can easily access the tool from every preferred location. Are you, as a Tax professional, ready for the future?

Learn how Kluwer International Tax Law can support you.