Random thoughts on presumptions on accuracy

It is a fact that most in-house tax professionals know very little about their group’s financial systems. E.g. very few know whether their companies deduct discounts from gross sales or from net sales; likewise very few know whether there are any employee expenses included in cost of goods sold (“COGS”), or whether all employee expenses are treated as operational expenses (“OPEX”).

These things matter e.g. when it comes to comparability; and the default TP approach to reach for databases and start searching for comparables (I have written before that I do not think this is a good approach and that it gives a false sense of security). For things to be comparable, they must be similar or the differences must be known.

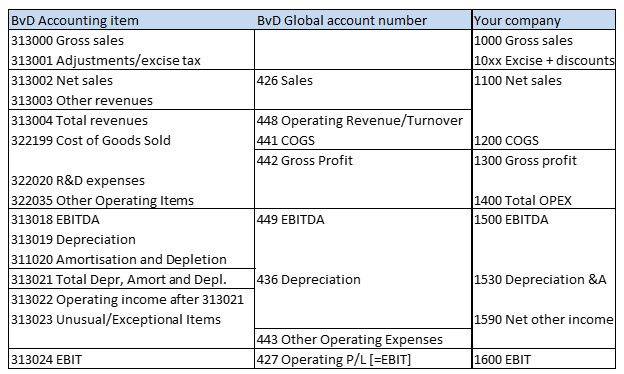

When one works, for instance with Bureau van Dijk’s (“BvD”) databases, their Profit and loss account breakdown compared to your company’s may look something like this (Picture 1):

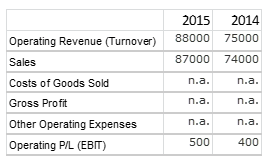

and the company details for a particular company in BvD’s database like this (Picture 2):

The available documentation does not seem to indicate whether BvD includes discounts as a part of Global account 426 or as part of 441. Hence if your group deducts discounts from your Gross sales (your account 1000) to calculate your net sales (your account 1100, BvD’s account 426), you do not know whether your net sales (1100) looks more like BvD’s account 426 or 442.

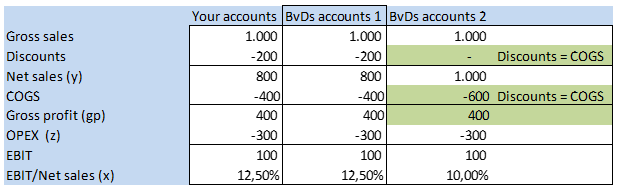

A simple illustration (Picture 3).

Clearly when comparing your company to BvD 1, the results seem comparable, whilst in comparison to BvD 2, your profit margin is 2,5% higher. However, it will be wrong to adjust your profit margin down to that of BvD 2 as actually there is no real economic difference, just a difference in allocating discounts.

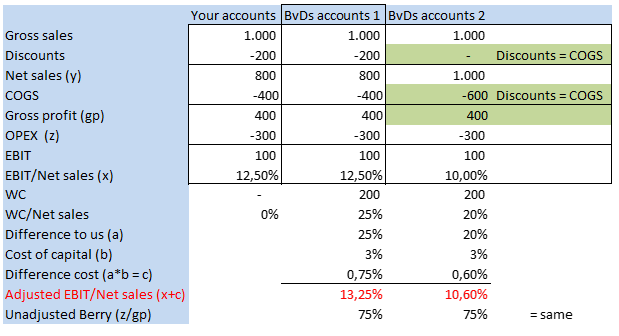

This differentiation can also create further havoc in working capital adjustments. Let us assume your company’s working capital (Inventory + trade receivables – trade payables) is 200 less than that of the BvD comparable and a fair cost of capital (interest) is 3%. Your chosen profit level indicator is EBIT (427)/Net Sales (426) or the Berry Ratio (Gross profit (442)/OPEX (443) 443 being the difference between Gross Profit 442 and Operating Profit 427).

If we do not know where discounts are booked there can also be differences in the working capital adjustments for EBIT/Net Sales ratios, but not for the Berry ratio adjustments as the denominator lies below the COGS line (gp). See the following examples (Picture 4).

The above complications can be elevated at least twice without any significant effort:

- by having your group’s TP adjustments made on the basis of your group GAAP (IFRS or US GAAP) to reach an arm’s length range under Group Gaap numbers, whilst your local TP documentation and tax return is reported under local GAAP; and

- to generate comparables like those in Picture 2, where COGS and the Gross profit are not available.

Re. 1. The difference between Group GAAP and local GAAP can still be solved with laborious reconciliation exercises. In fact, in view of BEPS action 13, the rise of importance of the Master file, and the introduction of country by country reporting, I am a very strong advocate of preparing the local file on the basis of group GAAP numbers rather than local GAAP.

- I believe it will further simplicity, transparency and comparability. Bearing in mind that in many groups transfer pricing documentation is coordinated centrally, it can also enable the standardization of documentation at the centralized level resulting in more consistency without losing traceability.

- In addition, any request to reconcile a country by country report based on group GAAP with a local files based on local GAAP will produce a gargantuan task.

Re. 2. The lack of data on the comparable’s COGS and Gross profits makes even a Net Sales based TNMM calculation and working capital adjustment unreliable and unreliably adjustable.

The above is not so much a plea against the use of databases, as it is a plea for:

- in-house tax professionals to be aware of what is in their group accounts and how;

- being aware what data is in databases and how that is presented;

- giving serious consideration for preparing local files under group GAAP, or clear legislation (and motivation) why it should be under local GAAP; and

- safe harbours. The goal of transfer pricing is to leave income in source countries (see OECD 2010 TPG, paragraph 1.13), not to generate administrative nightmares. It is time to turn the annexes of the adopted amendments to the Safe Harbour chapter into standard practices, like the OECD did with low value-adding intra-group services in the new Chapter 7.D. No one has time for this level of complexity for simple routine functions such as manufacturing and distribution (and maybe contract manufacturing).

________________________

To make sure you do not miss out on regular updates from the Kluwer International Tax Blog, please subscribe here.

Kluwer International Tax Law

The 2022 Future Ready Lawyer survey showed that 78% of lawyers think that the emphasis for 2023 needs to be on improved efficiency and productivity. Kluwer International Tax Law is an intuitive research platform for Tax Professionals leveraging Wolters Kluwer’s top international content and practical tools to provide answers. You can easily access the tool from every preferred location. Are you, as a Tax professional, ready for the future?

Learn how Kluwer International Tax Law can support you.